Ericsson’s acquisition of Vonage raises questions, but creating an API platform for 5G is a good idea

Listen to or download the associated podcast

Ericsson announced its planned USD6.2 billion acquisition of Vonage on 22 November 2021. Vonage was known to be exploring strategic options and so the sale is not a surprise, although the identity of the buyer was a shock for many, including Ericsson’s investors. Ericsson’s share price fell around 7% after the deal was announced, taking around USD2.5 billion from its market capitalisation.

Ericsson wants to provide more support for developers to use 5G-based APIs, and the intention is that Vonage will, in time, provide the platform to do this. Revenue generated by Vonage for providing API access will directly help Ericsson and should also help Ericsson’s customers, the telecoms operators.

The move is a positive step for the sector – operators and vendors have long talked about the opportunity of monetising the advanced features of 5G networks, but little action has been taken. The acquisition of Vonage is a step in the right direction.

However, the acquisition raises several questions, especially around whether Ericsson is well placed to develop a neutral platform for 5G-based APIs (that is, a platform that will work whether or not the operator uses Ericsson’s 5G infrastructure) and whether Vonage is the best starting point for such a platform.

Vonage has moved away from consumer services to CPaaS

Vonage’s operations were built over the years through organic development and at least eight acquisitions (most notably Nexmo for CPaaS and NewVoiceMedia for contact centre solutions). The three parts of its operations are as follows.

- A consumer voice service. Once Vonage’s core business, but now in rapid decline as part of a deliberate strategy to focus on business services. It generated USD70 million in 3Q 2021, down –15% year-on-year.

- Unified communications and contact centre solutions, which generated USD119 million (+8% year-on-year) in 3Q 2021. The rate of growth is lower for this division than for competitors 8x8 (+17%), RingCentral (+36%) and Zoom (+35%) during the same period.

- A CPaaS platform, selling communications APIs. This is the growth engine for Vonage, generating USD155 million (+43% year-on-year) in 3Q 2021. It is the main reason for Ericsson’s interest.

The challenges facing the existing business lines, many arguably subscale, and the healthy premium offered by Ericsson (the offer is 28% above the prevailing share price) explain why Vonage’s shareholders opted to sell.

Vonage will support Ericsson’s vision of an API platform for 5G

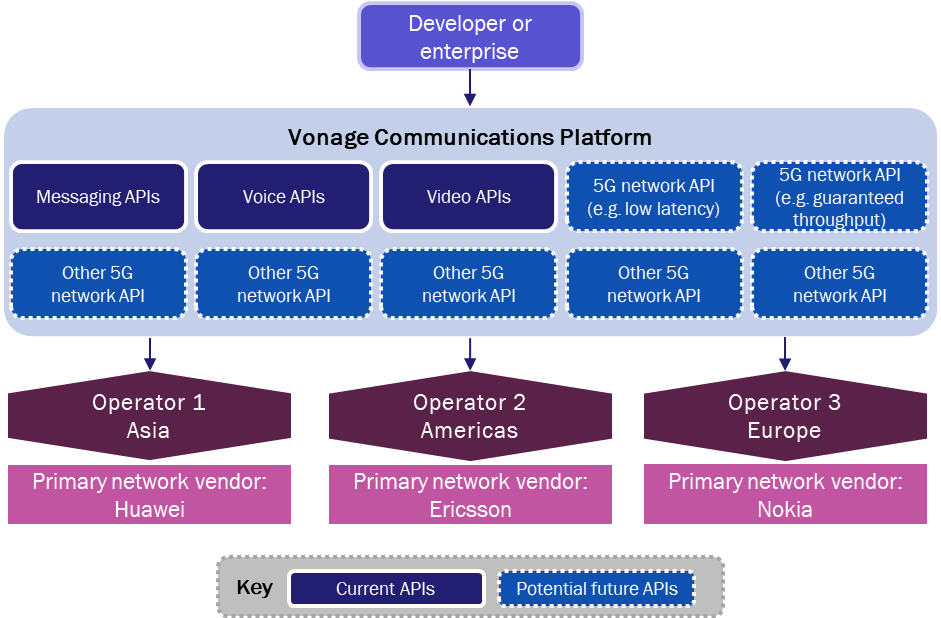

Ericsson’s reasons for buying Vonage are complex and best understood in the broader context of Ericsson’s ambitions to create a platform for developers to exploit the capabilities of 5G (see Figure 1 for what we believe this vision looks like).

Consider a developer building an application that needs a high-quality connection (for example, for a high-quality voice service, or to control an industrial machine). The connection needs guaranteed low latency and throughput, and to work across multiple mobile networks (either within one country or, as shown, across different countries or regions).

Ericsson’s vision is to have a platform that exposes the 5G network APIs across these different operators, regardless of the underlying network vendor. Vonage’s Communications Platform already does something similar to this for messaging (typically SMS), voice and video services. Ericsson would like to expand this to include 5G network capabilities too. In Ericsson’s words it wants to put “the power of the network at the fingertips of developers”.

Figure 1: Analysys Mason’s summary of Ericsson’s vision for the Vonage Communications Platform

Source: Analysys Mason

The capabilities of 5G are much discussed but operators and vendors have given less attention to how these services will be brought to market, priced and packaged. Ericsson is trying to help advance the market through its acquisition of Vonage.

The vision is good, but the execution will be challenging

The logic of the deal makes sense but the details raise questions. Firstly, Ericsson was clear that its platform would need to work across different operators and networks. “The APIs need to be global and open” and the platform “will have to be multivendor”, Ericsson’s CEO told the investor call. Nokia, Huawei and other network vendors may not feel that Ericsson is the ideal partner to generate value from network APIs. They have little incentive to cooperate in assisting Vonage–Ericsson in its plans.

The operators themselves may be more favourable. They need someone to develop these sorts of cross-vendor, cross-operator capabilities, and Ericsson may be viewed as a better partner than, say, Twilio.

It is also unclear how well placed Vonage is to exploit these network APIs. It has a developer community already (of over 1 million developers), but these are used to including a few lines of Vonage code to enable an app to use voice services or send an SMS, quite different services to those enabled by 5G. Vonage will also need assistance from Ericsson in developing new APIs that depend on deeper network expertise.

Ericsson will also have the distraction of dealing with Vonage’s existing businesses. The consumer service is already in a managed decline. The unified communications and contact centre business also does not look strategic.

Despite the questions facing this acquisition, we view it as a positive step by Ericsson. A large driver behind Ericsson’s acquisition of Cradlepoint was the need to give the 5G ecosystem (in that case, hardware) a stronger push. The Vonage deal is similar in that it is a sign that Ericsson is trying to accelerate another area of the 5G ecosystem; one that is probably of greater importance and also one that needs more assistance. Like all deals, the execution will be challenging but the vision is good.

Article (PDF)

DownloadAuthor