Inflationary pressure has yet to lead to operators increasing ARPU for business mobile and fixed services

Operators have found it difficult to increase connectivity ARPU for business customers in line with high rates of inflation. In fact, ARPU has decreased for many operators, especially in the business mobile segment. This may change in the coming months as more price rises come into effect, but it is clear that overall business revenue growth must come from other areas.

IoT connectivity and fixed broadband services will be important revenue drivers for the large enterprise and small and medium-sized enterprise (SME) segments, respectively, over the next 5 years, but ICT services will be the main driver of business revenue growth for both segments. The latest figures show that connectivity alone is unlikely to be enough to sustain a B2B operator.

Much of the data in this article is taken from Analysys Mason’s Business revenue tracker 2Q 2023.

Business mobile ARPU has decreased by an average of just 1% since the start of 2021 despite high inflation in many regions

Inflation peaked at between 12% and 15% in many Western European countries and at between 7% and 9% in North America in 2022. However, telecoms prices, for consumers and businesses, have not increased in line with inflation and in many cases ARPU has declined for business mobile services (Figure 1) and business fixed data services (Figure 2). As a result, business revenue growth has been driven by increased customer volumes or by newer business areas, such as IT services.

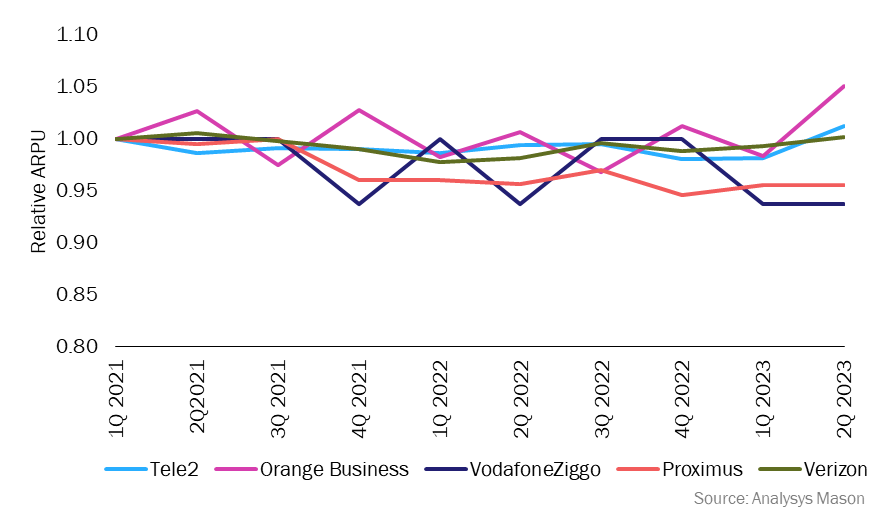

Figure 1: ARPU for business mobile services, rebased to 1Q 2021, selected operators, 1Q 2021–2Q 20231

Only a limited number of operators report data relating to business mobile ARPU, but those that do indicate a broadly similar trend; ARPU, relative to the start of 2021, has decreased slightly. The business mobile services of some operators have performed better than those of other operators; Orange Business’s ARPU increased by 5% between 1Q 2021 and 2Q 2023, mostly because growth was strong during 2Q 2023, while VodafoneZiggo’s ARPU decreased by 6.3% in the same period. Verizon’s ARPU has remained flat, which it stated is consistent with current market pressures and implies that other US-based mobile operators are experiencing a similar trend.

ARPU in the large enterprise and public sectors has remained flat because of long-term contracts that do not allow price rises and competition. VodafoneZiggo explicitly mentioned this in its 1Q 2023 earning release. When some operators (Tele2 and Verizon) have noted strong mobile performance, they attributed it, at least partly, to either an increased proportion of SME mobile customers or strong overall growth in the SME segment.

ARPU for fixed data services has performed better than for mobile, but growth is well below inflation

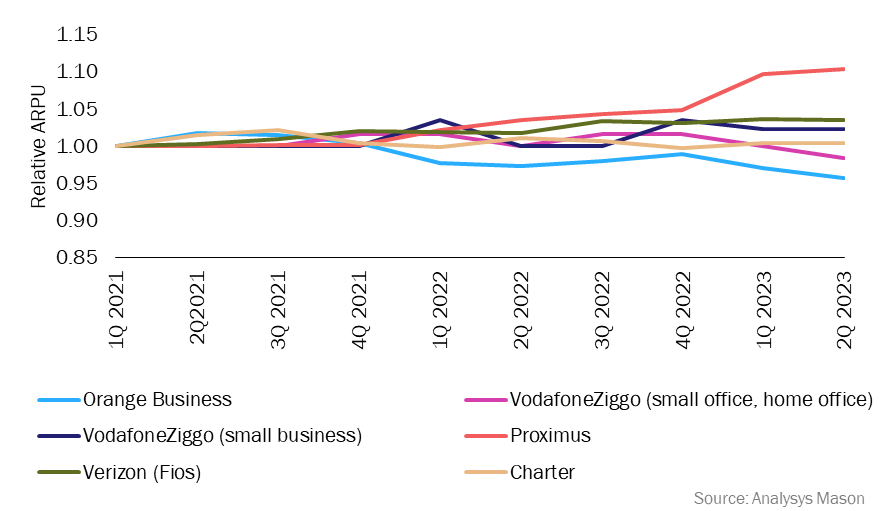

ARPU for business fixed data services2 have held up better since the start of 2021 when compared to business mobile ARPU. Indeed, ARPU for fixed data services for selected operators (Figure 2) has grown, on average, by 1.8% between 1Q 2021 and 2Q 2023. However, this growth is below that of inflation in the countries where these operators are based.

Proximus’s fixed data ARPU increased by 10% between the start of 2021 and 2Q 2023, with ‘internet’ ARPU increasing by 7.5% in 1Q 2023 and 6.6% in 2Q 2023. Proximus attributes this increase to a few factors: price increases, improved price tiering and a growing share of fibre connections – it notes that across consumers and small businesses, ARPU for fibre services is EUR7 higher than that for copper-based connections.

However, none of these increases can be attributed to Proximus’s latest portfolio-wide price changes as they were only introduced on 1 July 2023. For residential and small enterprises, Proximus will implement around a 4% price rise for fixed and mobile services, with an offering that is largely ‘more for more’. For large businesses, price increases will be based on ‘contractual inflation-based indexation’ for products other than mobile voice and data bundles. It should be noted that price rises in the consumer segment have led to some customers dropping and/or downgrading services, which is offsetting the impact of price rises. It is unclear exactly how this has affected the business segment, but we expect smaller businesses to be most likely to follow similar behaviour.

Figure 2: ARPU for business fixed data services, rebased to 1Q 2021, selected operators, 1Q 2021–2Q 20233

Operators have struggled to grow connectivity ARPU and will need to develop value-added propositions to do so

Operators in Western Europe have struggled to grow ARPU for business fixed data and mobile services and the high rates of inflation have depressed ARPU even further in real terms. Some operators have been more successful than others, but growth has still been far below inflation. Recent price changes, such as those announced by Proximus, Tele2 and Vodafone recently, may lead to limited growth in the coming months.

Some of the strongest prospects for revenue growth from connectivity are in broadband services for SMEs and IoT connectivity for enterprises. However, operators will also need to look to new services to support long-term growth. For both segments, ICT services will generate the most incremental revenue out of all service types by 2027.4 Connectivity remains extremely important for operators, but the latest figures show that it is unlikely to be enough to sustain a B2B operator.

1 ARPU is either directly from reporting or calculated as service revenue/connections.

2 Includes fixed broadband and dedicated connection services.

3 Fios is Verizon’s fibre broadband offer. Charter reports overall ARPU from small and medium-sized businesses (SMBs), but this is almost all fixed service revenue.

4 For more information see Analysys Mason’s Operator business services for SMEs: worldwide forecast and Operator business services for large enterprises: worldwide forecast.

Article (PDF)

DownloadAuthor