Cloud vendors will need to do more to disrupt the fast-growing managed security software market

Cloud vendors such as Google, AWS and Microsoft are increasingly focused on security solutions, and on delivering them via managed security services providers (MSSPs). This is a growth market, which has generated investment from new and legacy providers.

While the cloud vendors have compelling offers, strong brand recognition, and the funds to invest, the MSSP market is not a straightforward win for them. This market is characterised by intense competition, entrenched providers and investments in partnerships by MSSPs. Cloud vendors will need to prove to MSSPs that they are worth the switching costs.

Cloud vendors have invested in security and managed service provider offerings

Over the last few years, the major cloud vendors have increased their efforts to serve MSSPs. Google announced the launch of the Chronicle MSSP programme in 2022. The programme aims to boost MSSPs’ adoption of Google’s Chronicle SIEM, Mandiant Advantage, Virus Total and Autonomic Security Operation. Google is investing heavily in the security stack; it acquired the threat intelligence and cyber-security services firm Mandiant for USD5.4 billion and cyber-security start-up Simplify for USD500 million in 2022.

AWS launched a Security Competency Program for MSSP partners in 2021. AWS solutions for MSSP partners include vulnerability management, monitoring for AWS service configuration, managed detection and response (MDR), managed web application firewall (WAF) services, and event monitoring and response.

Microsoft Azure launched Microsoft Defender in 2022 after the Microsoft Sentenial launch in 2019.

This is a growth market, making it an attractive investment for cloud vendors

Several factors point to growth in MSSP engagement among small and medium-sized businesses (SMBs). SMBs have become major targets of cyber attacks. According to Verizon’s Data Breach Investigations Report of 2022, more than 75% of cyber-security incidents occurred at SMBs, which is up 55% from the previous year’s report. One reason that SMBs represent a high share of total breaches is that they are vulnerable to attacks from malware, ransomware and phishing because their systems are not as securely managed as those at large businesses.

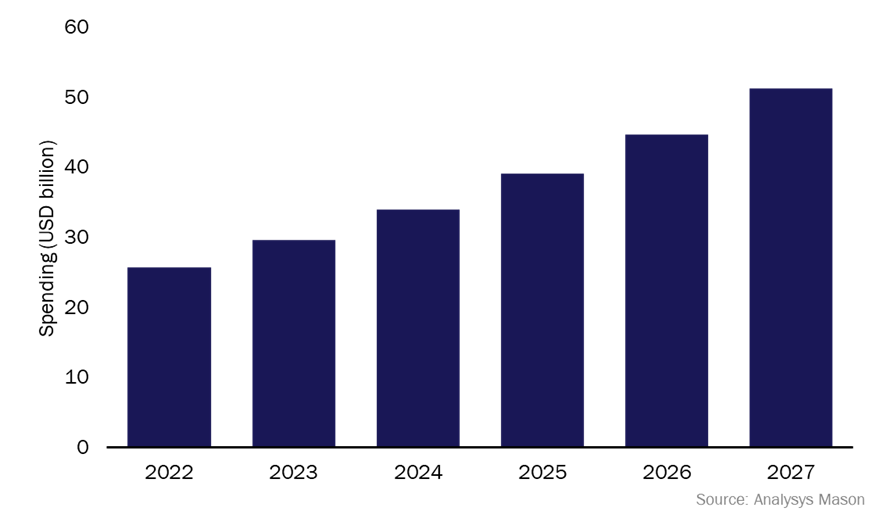

SMBs are increasingly aware of the risk of cyber attacks and are ready to allocate budgets to solutions. However, they will not be building teams in-house. They will look to MSPs and MSSPs for help in managing the security of IT environments. According to our SMB Technology Forecaster, SMBs will spend USD51 billion by 2027 on remotely managed security, an amount that will grow at a 15% CAGR between 2022 and 2027.

Figure 1: SMB spending on remotely managed security, worldwide, 2022–2027

Many SMBs are accustomed to working with MSPs that deliver foundational IT services. This will lower barriers to entry for MSSPs (or MSPs that are adding security services to their offers) as they seek to onboard SMB customers. Our recent SMB technology survey showed that most SMBs subscribe to at least one managed IT service, and that they plan to expand investments into managed services.

Cloud vendors have advantages, but this market is competitive

Cloud vendors can offer MSSPs some compelling benefits. For one, they own the cloud stack, putting them in a better position than many outsiders to offer security solutions for it. Additionally, they may be able to accept lower margins than competitors; this offer will be successful if it drives consumption of cloud services and encourages MSSPs to standardise on, or recommend, their cloud services over those of competitors.

However, cloud vendors will not automatically succeed in this space. For now, incumbent MSSP-focused software providers, such as BeyondTrust, Checkpoint and CrowdStrike, have some distinct advantages, including established reputations and partner rosters, which include MSSPs of all sizes. These partners are likely to have invested in training, practice development and even in proprietary tools to deliver services with the incumbent providers’ software. The costs associated with standardising on a new platform are high. Providers such as Connectwise and Kaseya will also bundle software that enables MSPs to deliver security as well as other managed services, creating a unique value proposition.

To successfully compete in the MSSP software market, cloud vendors should consider taking the following actions.

- Target newly established MSSPs as well as small and medium-sized MSSPs. Our research shows that the number of MSSPs will grow significantly in the next 5 years. Some of these MSSPs will be newly formed entities, but many will be MSPs or value-added resellers (VARs) that want to expand their service offerings and do more for customers. They may not have the same barriers to adoption as established MSSPs.

- Implement pricing structures that are both clear and straightforward. In an increasingly competitive MSSP market, newly established or small and medium-sized MSSPs are likely to be price-sensitive. Most incumbent software providers offer complex pricing models depending on the specific solutions and deployment models. Simple and transparent pricing models will enable MSSPs to provide better offers to clients and efficiently manage their profit margins.

- Provide the flexibility to work with different cloud vendors. Providing support for multi-cloud has become a critical offering for MSSPs, allowing businesses to choose suitable security solutions while reducing their dependence on a single cloud vendor and mitigating potential risks. Furthermore, cloud vendors that offer multi-cloud solutions will create opportunities to work with more businesses and encourage these businesses to move from their current service providers.

- Assist MSSPs in becoming true security partners for SMBs. The evolving cyber-security landscape, characterised by increasingly sophisticated cyber attacks, has resulted in changing security needs among SMBs. As a result, SMBs are seeking strategic partnerships with MSSPs that can effectively address their unique security concerns. To this end, cloud vendors can provide invaluable support to MSSPs, helping them to comprehend the evolving security risks and market changes while offering guidance on future plans and focus. This will enable MSSPs to transform themselves into trusted security partners for SMBs.

Article (PDF)

DownloadAuthor