COVID-19: SMBs will increase investment in business intelligence solutions

The COVID-19 pandemic has curtailed the IT expenditure of small and medium-sized businesses (SMBs) worldwide. However, our SMB Technology Forecaster shows that SMBs’ spending on business intelligence (BI) solutions is growing at a healthy 5.9% year-on-year from 2019 to 2020. Spending on cloud-based BI solutions is expected to grow at a much faster rate than that of on-premises BI, especially in the emerging Asia–Pacific region.

SMBs will continue to invest in cloud-based BI despite the COVID-19 crisis

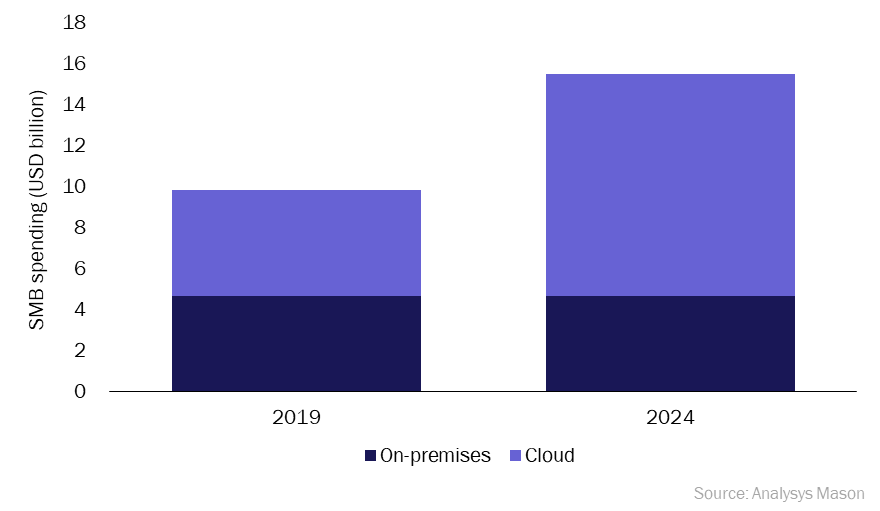

Analysys Mason’s SMB Technology Forecaster predicts that BI spending by SMBs will grow at a CAGR of 9.5% during 2019–2024 to reach USD15.5 billion in 2024 (see Figure 1).

Figure 1: SMB spending on BI solutions, by type, worldwide, 2019–2024

The demand for BI solutions was growing at a steady rate before COVID-19 because an increasing number of SMBs are using this technology to analyse business performance, predict the future and make informed decisions. The pandemic is forcing many businesses to change their investment priorities. Companies are delaying or cancelling IT projects, but not those that relate to BI. SMBs are recognising the need for data analytics to answer many new questions arising from this challenging time and identify business strategies to improve sales and increase resilience.

We predict that SMB spending on cloud-based BI will increase at a CAGR of 15.8% during 2019–2024; while spending on on-premises BI solutions will remain flat. The lockdown and social distancing responses to COVID-19 have pushed businesses to adopt new work-from-home (WFH) policies. Results from our recent COVID-19 survey of over 400 SMBs in the USA show that 63.6% of respondents had started or expanded WFH policies due to COVID-19. Close to three quarters of all respondents stated they intend to change their WFH policy when the crisis is over. We expect most businesses to continue to take a flexible approach to WFH, if they can. In addition, many companies are adopting new online business models to cope with COVID-19 restrictions by using e-commerce platforms for the first time.

An increasingly mobile workforce and the adoption of e-commerce business models increase the demand for cloud-based solutions. On-premises solutions tend to be more capital-intensive, which is another incentive for SMBs to shift to cloud-based solutions.

We expect SMB spending on cloud-based BI to increase most quickly in emerging Asia–Pacific – at a CAGR of 21.5% during 2019–2024. Rapid technology advancement in the region has boosted the demand for cloud-based BI during the last decade, especially in China and India. This trend corresponds with the results from our 2019 survey of 3000 SMBs where emerging Asia–Pacific had the highest percentage of respondents who viewed using cloud-based ‘big data’ databases to manage large data warehouses and analytics as a critical technology strategy for their business growth.

Managed service providers are increasing their share of the BI market

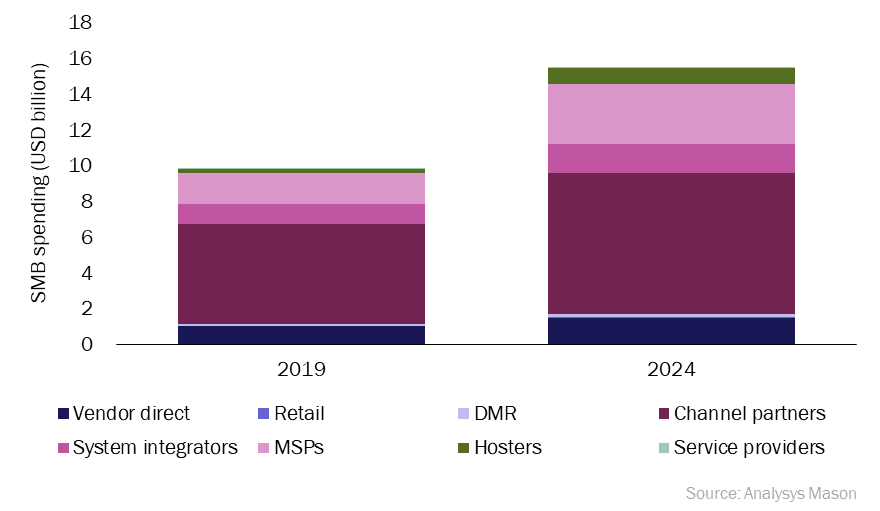

We predict that BI revenue generated by managed service providers (MSPs) will grow at a CAGR of 14.5% during 2019–2024 to reach USD3.4 billion in 2024 (see Figure 2).

Figure 2: SMB spending on BI solutions, by routes to market, worldwide, 2019 and 2024

Traditional channel partners (CPs) such as local value-added resellers (VARs) and independent software vendors (ISVs) continue to be the main players and will generate over half of the total, reaching USD7.9 billion by 2024. However, CPs’ share of the market will decline from 57% in 2019 to 51% by 2024. SMBs will look to MSPs because the adoption of cloud-based solutions will require tailored support and management of integration, cloud platforms and software architecture.

Partnerships between BI vendors and MSPs could provide bundled products and services that appeal to SMBs

SMBs may not have the internal IT expertise and resources to support the complex IT needs required for licensing, installing, hosting and maintaining BI solutions. BI vendor and MSP partnerships can enable them to offer one-stop worry-free packages that are customised to the requirements of SMBs and their individual IT environments. These bundled packages are attractive to SMBs because they can pay for the level of products and services that are suited to them and will have MSP support and expertise to ensure that the BI solutions operate smoothly. MSPs’ other domain expertise in security, infrastructure, supply chain management and enterprise resource planning puts them in a good position to help SMBs to adapt to more-remote operations and new online business models.

Download

Article (PDF)

Receive the latest news and research on SMB IT buying behaviour and forecasts

Author

Li Lin

Senior AnalystRelated items

Report

SMB IT spending forecast report: driving business growth and increasing efficiency

Report

SMB IT spending forecast report: a new beginning

Article

SMBs in manufacturing and professional service industries are making big investments in CRM solutions