Datto EDR will help Datto and Kaseya to gain share in the rapidly growing SMB market

Datto, which was acquired by Kaseya in June 2022, announced the roll-out of its endpoint detection and response (EDR) solution, Datto EDR, on 15 November 2022. This is Datto’s latest effort to move into the cyber security space.

The inclusion of EDR places Datto and Kaseya in greater competition with vendors that are focused on managed service providers (MSPs) (such as ConnectWise), as well as cyber security providers (such as Crowdstrike, Field Effect, Huntress and SentinelOne). There are several potential barriers to gaining share in an increasingly crowded EDR market, but Datto’s new solution should benefit its MSP customers and, by extension, small and medium-sized businesses (SMBs) who prefer to work with a limited number of partners.

Datto is in a good position to attract more SMBs following its EDR roll-out

Datto’s acquisition of Infocyte in January 2022 facilitated the release of its EDR solution; Infocyte already offered EDR, managed detection and response (MDR) and threat assessment services. Datto has updated and rebranded the EDR solution and has fully integrated it with Datto Remote Monitoring and Management (RMM) and Kaseya’s IT Complete portfolio.

SMBs are increasingly becoming aware of how EDR can protect them against cyber threats and many are turning to MSPs for their EDR needs. SMBs’ spending on EDR solutions worldwide reached USD517 million in 2022 and is expected to grow to USD935 million by 2027, at a CAGR of 13%. EDR is one of the fastest growing technologies (in terms of revenue) in the cyber security space.

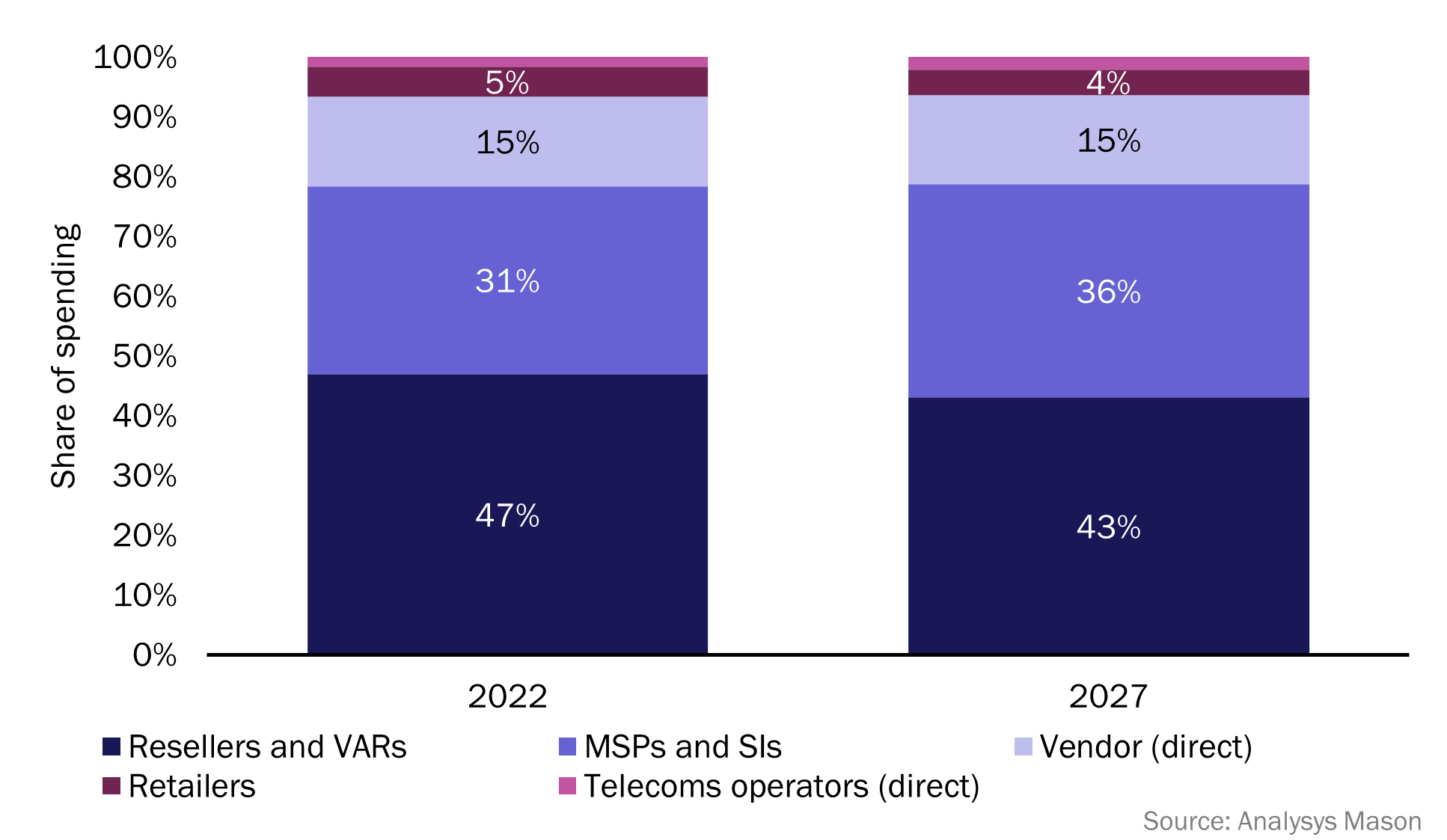

Figure 1 shows that the MSP share of SMBs’ spending on EDR solutions will grow from 31% in 2022 to 36% in 2027. SMB spending via MSPs will grow faster than the overall market. As such, this is a good time for Datto to deliver an EDR solution via its MSP partners.

Figure 1: Share of SMBs’ spending on EDR solutions, by route to market, worldwide, 2022 and 2027

Datto and its customers stand to benefit from the release of Datto EDR

Datto EDR gives Datto an opportunity to grow its market share, increase loyalty among existing customers and increase the revenue per customer thanks to upsell opportunities. It will also make it easier for MSPs to extend their cyber security portfolios, among other benefits.

- EDR will become more accessible to SMBs. EDR has traditionally been a solution for large enterprises due to its complexity and relatively high costs. Larger SMBs are interested in EDR, but have been hesitant to adopt it due to these costs. Datto’s solution will enable these businesses to take advantage of the security benefits of EDR.

- MSPs will have more opportunities for upselling. MSPs that already offer solutions from Datto and Kaseya will have an opportunity to boost their revenue by bundling Datto EDR with other managed services. These upsell opportunities are relatively low-effort provided that the integration with other solutions is seamless and that MSPs can convince their customers of the importance of implementing EDR.

- Datto EDR will enable both MSPs and SMBs to limit their number of vendors. Many MSPs want to limit the number of vendors that they work with. MSPs that already offer EDR solutions and that work with Datto and/or Kaseya can potentially consolidate their partnerships by switching to Datto EDR. SMBs also want to reduce the number of partners they work with and as such, are looking for MSPs that can provide a broad scope of services. 19% of SMBs in our SMB Barometer study in the USA indicated that they switched to a new IT services provider in the last 6 months. Many of these SMBs churned because their previous providers did not meet all of their IT requirements.

Datto will face challenges when selling its EDR solution to and via MSPs, but there are ways to overcome the hurdles

Extending its cyber security portfolio will be beneficial to both Datto and its customers. However, the company will need to prepare to face some challenges.

- Datto will have to compete with cyber security vendors. A growing number of security providers are marketing EDR solutions to SMBs. EDR vendors have, until recently, primarily focused on large enterprises, but they are now placing more emphasis on capturing share in the growing SMB market. Datto will need to highlight how its EDR solution is different to those of its competitors if it is to capitalise on the SMB opportunity. Emphasising the ability to easily integrate the new product with other Datto and Kaseya offerings is one way to do so.

- Many MSPs have limited cyber security capabilities. MSPs typically view general IT management and cyber security as distinct areas of expertise. MSPs that specialise in areas such as managed PCs or managed storage may be hesitant to adopt and sell cyber security solutions to their customers if they are not confident in their ability to manage EDR.

- Smaller SMBs may not see the benefit of EDR. SMBs that are not familiar with EDR might perceive the solution to be an unneeded expense. This could further exacerbate the hesitancy of some MSPs to include EDR in their offerings and thus limit the full market potential for Datto and Kaseya.

- MSPs will need additional support from Datto. Datto will need to support MSPs that wish to add EDR to their portfolios. For example, MSPs will need guidance regarding marketing EDR to SMBs. Datto may also need to help MSPs to teach SMBs about the benefits of EDR and how it differs from legacy security solutions such as anti-virus and email security. This will require additional time and investment from Datto.

Datto has been consistently adding to its cyber security capabilities, and the addition of an EDR solution is an important step in becoming a strong player in the MSP cyber security space. This new addition to its product portfolio will be a net benefit for Datto and Kaseya as long as it can manage the potential challenges.

Article (PDF)

Download