Facebook’s investment in Jio Platforms is likely to pave the way for a super app in the mould of WeChat

Listen to or download the associated podcast

In late April 2020, Facebook announced its intention to invest INR435.74 billion (USD5.7 billion) for a 9.99% stake in Jio Platforms (the parent company to Reliance Jio, India's leading mobile operator) and, in a related move, to link up WhatsApp and JioMart (Reliance Industries’s click-and-collect e-grocery platform). This tie-up presents the two players with a joint opportunity to launch a super app (as reported by insider sources)1 that can help to mobilise India’s growing digital economy. The effects of this deal on other Indian telecoms operators and the broader digital sector in India are likely to be significant. In this comment, we review the drivers of this deal and the potential impact on telecoms players and others.

Facebook’s investment in Jio Platforms will make it possible for both parties to launch a super app together

Facebook’s investment in Jio Platforms in April 2020 coincided with the launch of a partnership that links Reliance Industries’s JioMart and Facebook’s WhatsApp. This partnership allows WhatsApp users to access the JioMart app via a dedicated WhatsApp number. After making a purchase on the JioMart app, WhatsApp users will receive an invoice and the seller’s location via WhatsApp before collecting their order.

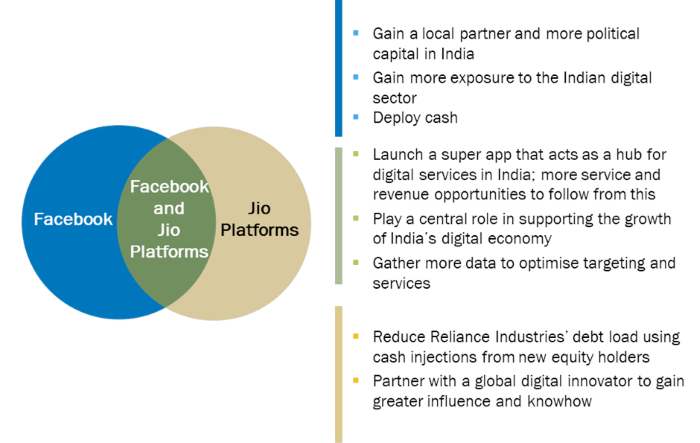

There are various reasons behind Facebook’s tie-up with Jio Platforms (Figure 1).

- Facebook’s investment in Jio Platforms and the JioMart–WhatsApp partnership mark a step towards Facebook and Reliance Jio pooling their user bases (388 million Jio subscribers and 400 million WhatsApp users in India) and resources to launch a super app on a scale comparable to Tencent’s WeChat. In their respective press releases announcing the investment, both Facebook2 and Reliance Industries3 stated their intention to focus on digitalising India’s substantial small and medium-sized enterprise (SME) sector. Reliance Industries’s CEO Mukesh Ambani has also identified healthcare and education as future areas of collaboration with Facebook.4 Integrating SME sellers into an app and scaling up the app’s service portfolio to include services beyond communications and e-commerce can, if successful, allow Facebook and Reliance Jio to gain a substantial share of consumer attention, which will create further service and revenue opportunities in the future.

- Facebook’s acquisition of a stake in Jio Platforms represents an opportunity for Facebook to gain more exposure to a fast-growing emerging market and, in particular, to India’s digital sector in which Reliance Jio plays a key role. It is also an opportunity for Facebook to deploy capital from its large cash pool (USD54.9 billion as of 2019). Most importantly, Facebook’s investment may give it an easier way into the Indian market. Facebook has had limited success in India; its most prominent venture, Free Basics (which offered free access to certain websites) was banned by the regulator in 2016 for violating net neutrality rules. Investing directly in India (especially at a time of COVID-19-driven economic hardship) suggests a firm commitment and can help win Facebook political capital to aid its business activities.

- For Reliance Industries, selling a stake to Facebook is part of a drive to raise equity and deleverage. Reliance Industries intends to eliminate net debt by March 2021, and since Facebook’s stake acquisition it has also sold equity stakes in Jio Platforms to investment funds Silver Lake, Vista Equity Partners, General Atlantic and KKR to raise cash. Facebook’s investment also enables Reliance Industries to welcome a global digital innovator as a partner.

Figure 1: The individual and collective drivers behind the deal between Jio-Platforms and Facebook in April 2020

Source: Analysys Mason, 2020

Reliance Jio and Facebook can together attract a substantial share of consumer attention

The impact on the telecoms market in India and the broader digital sector is potentially significant. For Reliance Jio, opening up its services to new customers may lead to revenue gains. Increasing its service range – or ultimately operating a super app – can help Reliance Jio to reduce mobile churn and to further build mobile ARPU, which stood at INR127.01 (USD1.83) as of 2019 – 10.1% above the market average. The tie-up with Facebook is also a boost to Reliance Jio’s ambitions as a B2B digital enabler and a digital lifestyle company. This move is likely to put pressure on Jio’s competitors, but it is not clear what impact it will have on the level of mobile market competition as a whole in India, which is increasingly an area of concern given Vodafone–Idea’s financial troubles.5

This deal may enable Facebook to realise its ambitions to have a stronger presence in India, but it remains unclear what relationship it will have with local authorities. The forthcoming Personal Data Protection Bill in India may impose high compliance costs relating to data localisation among other things. Furthermore, local sources report that the government in India is mulling new taxes for big tech companies.6 At the same time, in addition to gaining a useful local partner in Reliance Industries, Facebook will have won some goodwill from local authorities given the timing of its investment and the way that its aims correspond with the government’s ‘Digital India’ vision. The key, as-yet unanswered question is whether these new advantages will be sufficient to enable Facebook to operate its business with limited regulatory obstacles.

The benefits of this move will take time to materialise, but other operators in India and elsewhere may seek to partner with big tech

Facebook’s investment in Jio Platforms provides an interesting example of a big tech company investing in a telecoms company. Elsewhere, big tech companies typically compete with telecoms operators. India is a relatively unusual case because of the significant growth opportunities for the digital economy as well as the role that telecoms operators such as Reliance Jio play as central enablers of the digital economy. Operators in other countries are likely to view partnerships with tech companies as attractive, but the opportunities to form such partnerships are potentially more limited. It is not yet clear how Reliance Jio’s competitors will respond. To compete more effectively, a similar tie-up with a technology company is likely to now be higher on the agenda of Indian telecoms operator Bharti Airtel (Airtel), which has clear ambitions in both the financial services and digital services sectors, and Vodafone Idea. At the time this was published, Google was reportedly considering buying a 5% stake in Vodafone Idea.7 Given the size of the digital economy opportunity, there is likely to be room for more than one operator to succeed, even if the benefits of the deal between Reliance Jio and Facebook are yet to materialise.

1 The Economic Times (April 2020), Reliance Industries, Facebook weigh creating a super-app. Available at: https://economictimes.indiatimes.com/tech/software/ril-facebook-weigh-creating-a-super-app/articleshow/75169476.cms.

2 Facebook (April 2020), Facebook Invests $5.7 Billion in India’s Jio Platforms. Available at: https://about.fb.com/news/2020/04/facebook-invests-in-jio/.

3 Reliance Jio (April 2020), Facebook to invest ₹ 43,574 crore in Jio Platforms for a 9.99% stake largest FDI for minority investment in India. Available at: https://www.ril.com/getattachment/f8f5c090-6286-42f0-96e5-db05b1ded9f4/FACEBOOK-TO-INVEST-%E2%82%B9-43,574-CRORE-IN-JIO-PLATFORMS.aspx

4 The Economic Times (April 2020), Jio-Facebook deal looks at local level e-commerce; to cover education, health gradually: Mukesh Ambani. Available at: https://economictimes.indiatimes.com/industry/telecom/telecom-news/jio-facebook-deal-looks-at-local-level-e-commerce-to-cover-education-health-gradually-mukesh-ambani/articleshow/75287438.cms?from=mdr.

5 Bloomberg (February 2020), Vodafone Idea Says Unable to Pay $3.5 Billion to the Government. Available at: https://www.bloomberg.com/news/articles/2020-02-27/vodafone-idea-says-unable-to-pay-3-5-billion-to-the-government.

6 The Economic Times (February 2020), Government weaves tax net for internet’s global biggies. Available at: https://economictimes.indiatimes.com/news/economy/policy/government-weaves-tax-net-for-internets-global-biggies/articleshow/73996836.cms?from=mdr.

7 Tech Crunch (May 2020), Google and Microsoft reportedly considering stakes in telecom firms in India after Facebook deal. Available at: https://techcrunch.com/2020/05/28/google-vodafone-idea-microsoft-reliance-jio-platforms-facebook-deal/.

Download

Article (PDF)Related items

Article

Operators cannot rely on price rises to boost revenue in 2024 but digital services could help

Tracker

Mobile services quarterly metrics 1Q 2024

Article

Digi and Iliad grew their revenue far more quickly than the established competition in 2023