Fixed–mobile convergence is becoming increasingly crucial for operators' consumer strategy

It has likely never been easier, or so essential, for operators worldwide to offer fixed–mobile convergence (FMC) services, than now.

The number of operators offering FMC services is growing, as a result of market consolidation (especially between mobile-only and fixed-only operators) and a greater use of fixed wholesale services (the presence of infrastructure operators has created new business models for offering FMC bundles). For example, out of all of the mobile network operators (MNOs) in the five largest Western European countries in terms of mobile connections, Hutchison 3G UK (Three) is the only MNO that does not offer FMC bundles.1

FMC is a proven strategy in customer retention. Although, this strategy carries risks – the strategy depends on large price discounts in order to drive the take-up of FMC plans. Therefore, more operators are exploring new strategies aside from the traditional discounting approach.

This article draws on Analysys Mason’s Fixed –mobile convergence in Asia–Pacific, Europe and North America: trends and forecasts 2023–2028 report. The forecast report examines the main trends and drivers for the adoption of FMC services in 18 countries.2 For each country, the report includes forecast data for 15 KPIs, available in the Analysys Mason DataHub.

The FMC share of fixed connections will increase in every country included in our forecast reports, apart from France and Spain

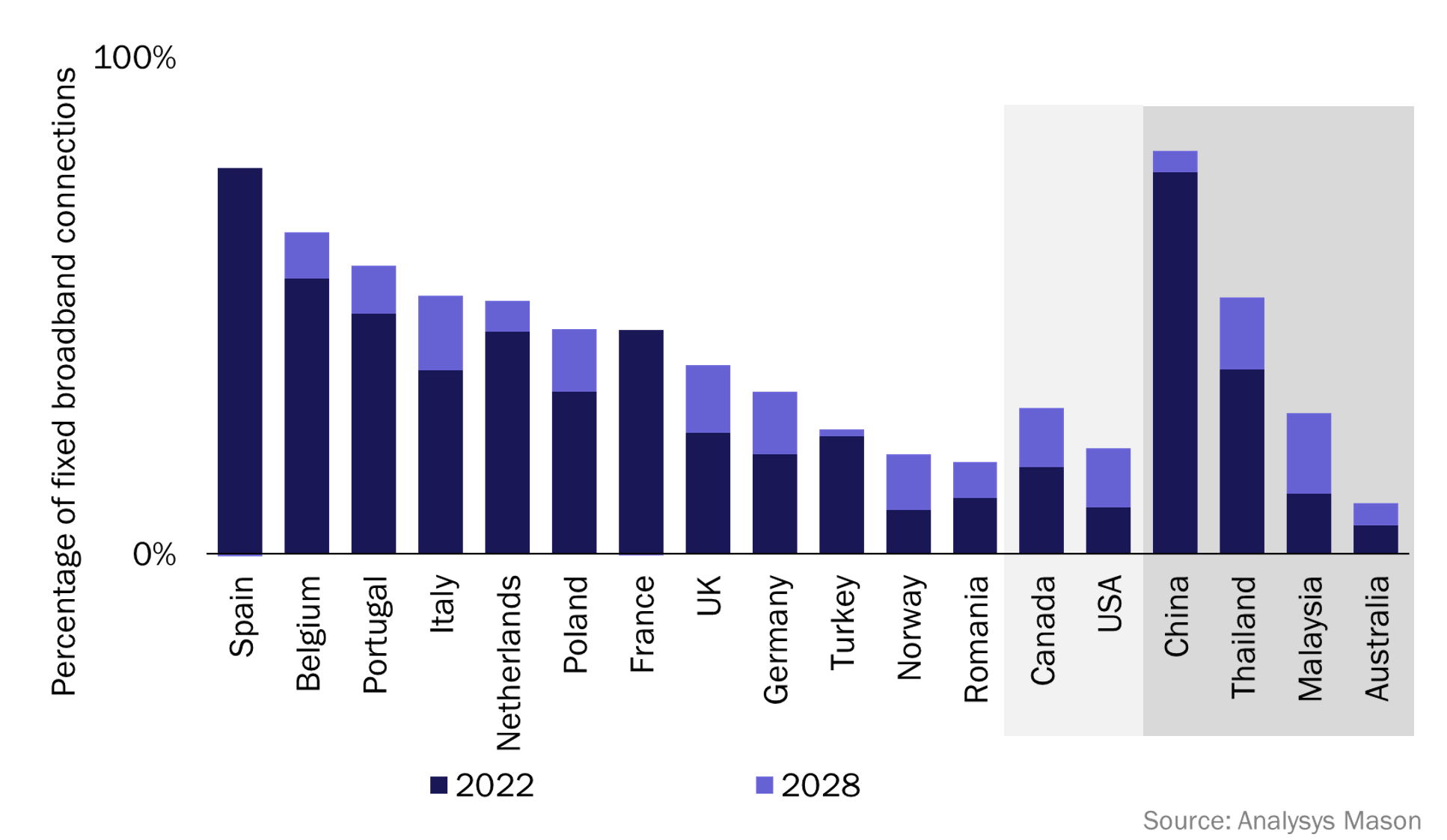

In 16 out of the 18 countries modelled individually, the FMC share of fixed broadband connections will grow over the 5-year period to 2028 (see Figure 1).

Only in France and Spain will the fixed broadband penetration of FMC services decline marginally, mainly because the leading FMC operators have significantly reduced the price discounts granted to FMC customers after years of intense price competition. These two countries show that it can become challenging for operators to drive the adoption of FMC when discounts included in FMC plans are gradually reduced.

Figure 1: FMC share of fixed broadband connections, selected countries in Asia–Pacific, Europe and North America, 2022 and 20283

Fixed–mobile M&A deals, as well as a greater use of wholesale services, are facilitating the increasing take-up of FMC bundles

The general trend of market consolidation in the telecoms industry will help the adoption of FMC bundles in most countries. Recently, there have been several mergers, mainly between fixed-only and mobile-only operators (or between mainly-fixed and mainly-mobile operators), especially in Europe. Examples include Virgin Media and O2 in the UK in 2020 and Orange’s takeover of VOO in Belgium in 2Q 2023.

We expect that similar deals will continue over the forecast period. For example, Timotheus Höttges, Deutsche Telekom’s CEO, believes that ‘over the next years, there will be a consolidation coming because there are 67 mobile operators in Europe, of which 35 are operating with less than… 500 000 customers. So this is highly unprofitable’.4 One of Vodafone’s priorities is ‘very much [market] consolidation’. In Denmark, the utility and fixed internet service provider Norlys has reached an agreement to buy Telia, a mainly-mobile operator – the deal is due to close in 1Q 2024.

The increasing availability of access to third-parties’ networks has also created new business models for promoting FMC bundles. It reduced the barriers to entry to the fixed market. Mobile-only (and predominantly-mobile) operators have been taking advantage of this opportunity to launch fixed and FMC services leasing access from wholesale-only operators’ networks. For instance, the MNO Iliad in Italy launched fixed services in 2022, reselling services over the network of the two national wholesale operators.

Operators will increasingly use a flexible infrastructure strategy for FMC, using a combination of their own networks and third-parties’ networks. For instance, we expect that fixed operators (with a relatively limited coverage) will also rely on wholesale services in order to offer fixed plans in areas outside their network footprint.

The cable operator Telenet in Belgium plans to launch fixed and FMC services in the south of Belgium – where it currently only offers mobile services – over Orange’s network in 2024. In Spain, the MVNO Digi provides nationwide fixed services thanks to a wholesale agreement with Telefónica. It is deploying its own FTTP network in areas with a relatively low penetration of fixed services.5

Operators are exploring new strategies for promoting FMC bundles

Operators are increasingly exploring new options, beyond the traditional discounting approach, for offering FMC bundles and sustaining FMC ARPA growth. Operators such as VirginMedia O2 (UK), Telenet (Belgium) and Telefónica (Spain) have developed a value-based FMC proposition, offering exclusive features and services only to FMC customers. They aim to maintain FMC bundles attractive by leveraging non-monetary benefits (rather than price discounts).

Some operators, especially those with a large FMC customer base, are also increasingly bundling non-telecoms services, with the hope of generating new sources of revenue. The long-term goal is to include a full set of services in FMC bundles that can meet multiple household needs. For example, MÁSMÓVIL (Spain) launched financial, e-health and electricity services in 2021.6

More operators worldwide have included FMC as a key pillar of their strategy. FMC can help them both to retain customers and upsell additional services to their user base.

1 The five largest Western European countries in mobile connections are (in order): Germany, the UK, France, Italy and Spain.

2 North America: Canada and USA; Europe: Belgium, France, Germany, Italy, Netherlands, Poland, Portugal, Romania, Spain, Turkey and the UK; Asia–Pacific: Australia, China, Malaysia and Thailand.

3 The FMC share of fixed broadband connections will decline by less than one percentage point in Spain and France from 2022 to 2028.

4 Deutsche Telekom, 2Q 2023 financial results, 10 August 2023, transcript.

5 DIGI passed over 1 million premises with its FTTP network in 2022 and targets to reach at least 2.5 million premises (around 10% of national premises) in the next few years.

6 In 2022, the operator provided financial services to at least 1 million customers and energy services to around 100 000 customers (it was one of the leading alternative utility service provider in the country).

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Forecast report

USA: fixed–mobile convergence forecast 2025–2030