Enhanced wholesale services will help MNOs in Europe to slow down the wholesale mobile revenue decline

22 May 2020 | Research

Article | PDF (4 pages) | European Country Reports| European Telecoms Market Matrix| European Core Forecasts

The European wholesale mobile market has been heavily regulated at a national and regional level with the underlying aim of increasing competition and improving service availability and affordability for end users. Operators’ revenue prospects in the retail space have already been squeezed by competition, and this has been compounded by the loss of wholesale revenue due to OTT substitution and tight regulation preventing wholesale price increases. Some mobile network operators (MNOs) are trying to protect their wholesale revenue by expanding their wholesale service portfolios. In this comment, we focus on the drivers of and trends in the mobile wholesale market, and briefly analyse the key segments of mobile wholesale revenue: interconnect, international roaming and MVNO hosting.1

Regulatory pressure and competition have led to a significant decline in mobile wholesale revenue

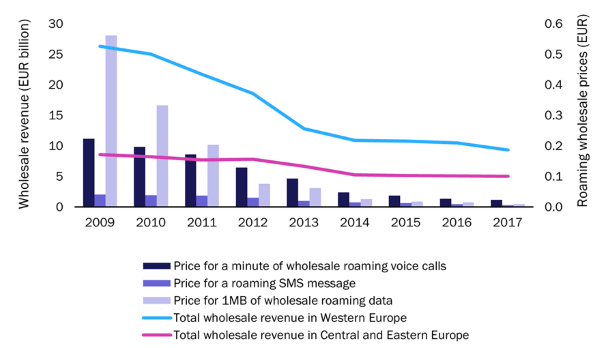

The heavy regulation in the wholesale mobile markets in Europe during the past decade was designed to boost competition and secure access to national and international mobile roaming services for all operators. Regulators outlined a number of requirements for retail and wholesale tariffs for voice, SMS and data roaming. Increased national-level competition led to the implementation of the Roaming Regulation in 2007, and the single market for electronic communications initiative in June 2017 led to the introduction of the Roam Like at Home regulation within the EU (meaning that users are charged the same amount regardless of whether they are roaming or in their home country). The European Commission implemented wholesale roaming price-caps for voice and SMS, as well as 5-year glide paths for mobile data roaming rates. This regulatory pressure, continued competition and changing end-user behaviour (OTT substitution of voice and SMS services) have resulted in a significant decline in mobile wholesale revenue (Figure 1).

Figure 1: Mobile wholesale revenue in Europe and the average international roaming wholesale prices in the EEA, 2009–2017

Source: Analysys Mason and BEREC

MNOs have expanded their range of wholesale services in order to extract revenue from their competitors

The regulation-led decline in retail prices, market saturation and fierce competition have resulted in a slowdown in growth for core mobile service revenue. MNOs have therefore been focusing on monetising network advantages by increasing hosting revenue and optimising interconnection and international roaming agreements. In order to reflect these strategies in our European core forecasts, we have enhanced our methodology to model these wholesale revenue pillars individually.

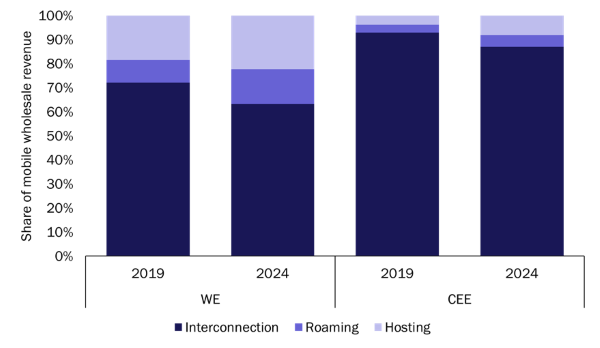

Revenue from traditional voice and SMS interconnection is still vital to MNOs despite the increasing role of IP-based communication, VoLTE and rich communication services (RCS) (that do not have attendant wholesale charges). The termination rates for voice and SMS (MTRs) are usually agreed in bilateral agreements between MNOs and must be below the regulated caps. These termination rates have fallen in recent years, but interconnect still accounted for the majority of MNOs’ total mobile wholesale revenue2 in 2018 (74% in Western Europe (WE) and 94% in Central and Eastern Europe (CEE)).

The Roam Like at Home (RLAH) regulation has decreased international retail roaming revenue within the European telecoms industry and has increased international roaming costs (due to increased data and voice traffic generated by subscribers when travelling abroad). MNOs in countries where retail tariffs are inexpensive and roaming data traffic is unbalanced (Estonia, Finland, Lithuania and Poland) face roaming costs that are higher than their roaming revenue and can therefore apply additional charges to the end user (subject to regulatory approval). The abolition of retail roaming charges as a result of the RLAH regulation in mid-2017 boosted roaming data and voice traffic usage, and thus led to wholesale roaming revenue growth. Indeed, this grew at a CAGR of 16% and 19% in WE and CEE, respectively, between 2016 and 2018, compared to 2.1% and 0.4%, respectively between 2008 and 2015.

Hosting revenue is the fastest-growing mobile wholesale revenue category, albeit from a low starting point. There is significant demand for mobile wholesale access from MVNOs, so MNOs often compete to win business by offering additional services such as mobile value-added services and data analytics. Hosting accounted for 17% of the total mobile wholesale revenue in WE in 2018, up from 2% in 2008 (CAGR of 9%). Wholesale hosting revenue grew at a CAGR of 22% between 2008 and 2018 in CEE, and accounted for 3.4% of the total mobile wholesale revenue in 2018 (compared to 0.2% in 2008).

The decline in mobile wholesale revenue will slow down

Our European Core Forecast programme provides 5-year forecasts for 32 individually modelled countries in Europe, and total mobile wholesale revenue is one of the many metrics included.3 We model the elements of wholesale revenue separately, at the country level, based on the market trends and expected regulations (Figure 2). Prior to our COVID-19 revisions, we expected that the total mobile wholesale revenue would grow at a CAGR of –5% in WE and –4% in CEE between 2019 and 2024, compared to –11% and –8% in WE and CEE, respectively, between 2008 and 2018.

Figure 2: Mobile wholesale revenue by service, WE and CEE, 2019 and 2024

Source: Analysys Mason, 2020

Hosting revenue growth will plateau in WE, but will remain strong in CEE during the forecast period. Operators will continue to expand their hosting offers, and will include more-advanced services such as billing, roaming, mobile value-added services and analytics tools. For example, Orange has launched a carrier grade Wi-Fi roaming service with managed access, session control, core network integration and a flexible billing model. This service will provide end users with uninterrupted data when moving between mobile and Wi-Fi coverage areas and the same level of security and quality of service. Data service continuity while roaming will become even more vital as 5G services and use cases such as 4K streaming or gaming become available.

International roaming revenue will increase in both regions in Europe during the forecast period. This growth will mainly be driven by an increase in the data traffic generated by roaming subscribers. Operators should optimise their international roaming agreements to balance data traffic costs and the total revenue from roaming services. For example, Play (Poland) has managed to reduce its international roaming costs and offers competitive roaming rates to its subscribers due to bilateral discount agreements with foreign MNOs. Its EBITDA increased by 12.8% in 2019 (year-on-year), and the reduction in roaming costs (both international and national) was the second-most important driver of this growth.

Prior to our COVID-19 revisions, we expected that mobile wholesale revenue would account for 6.3% and 8.9% of the total mobile service revenue in WE and CEE, respectively, by 2024. The higher share in WE will mainly be due to greater hosting and roaming revenue. MNOs in both regions should explore the available options to maximise their wholesale revenue opportunities.

However, mobile wholesale revenue will be affected by COVID-19, as changes in travel behaviour will result in substantial losses in roaming revenue. This will probably be a short-lived trend and may partially be offset by an increase in interconnection revenue as a result of the increase in mobile voice traffic that has already been observed during the lockdown period. We currently expect that mobile wholesale revenue in Europe will fall by 11.6–13.0% between 2019 and 2020 (depending on the severity of the impact of COVID-19), compared to our previous forecast of –5.2%. These trends will be fully examined in our next forecast update, which will be published in August 2020.

1 It should be noted that the forecasts discussed here were prepared prior to the COVID-19 outbreak, and the data should be interpreted in light of that timing. We published a top-level core forecast at the regional level for mild, moderate and severe COVID-19 scenarios in May 2020 in our report, COVID-19 scenarios for telecoms operator service revenue: worldwide forecasts 2019–2024. This report also discusses the impact of the pandemic on mobile wholesale revenue.

2 In our models, the total mobile wholesale revenue is the sum of interconnection, roaming-in and hosting revenue.

3 For more information, see Analysys Mason’s Western Europe telecoms market: trends and forecasts and Central and Eastern Europe telecoms market: trends and forecasts.

Download

Article (PDF)Author