Operator revenue from digital advertising will grow to USD37 billion worldwide in 2027

Listen to or download the associated podcast

Recent structural changes to the digital advertising market have put operators in a stronger position to capitalise on their first-party user data assets and share in the growth of the market.

Approaches will vary among operators; those in many low- and middle-income regions (particularly in emerging Asia–Pacific) will pursue the opportunity more assertively than their counterparts in higher-income regions such as North America and Western Europe.

This article accompanies Analysys Mason’s Digital advertising worldwide: trends and forecasts 2022–2027.

The digital advertising market continues to grow, and the changes to its structural dynamics favour operators

The digital advertising market worldwide is worth just under USD500 billion as of 2022. We forecast that it will grow at a CAGR of 5% between 2022 and 2027 to reach USD640 billion. Key growth drivers include increasing internet penetration, consumers’ growing adoption of digital devices and services and businesses’ shifting spend from traditional to digital advertising formats.

However, these growth drivers are balanced against barriers such as stricter data regulation, a lack of clear regulation, lower market competition due to an increased dominance of platform players and reduced ad spend due to inflation and/or recession.

The digital advertising opportunity for operators is shaped by the following factors.

- Growth in value of first-party data (such as telecoms consumer data). The value of such data is growing due to the diminishing supply of third-party data (that is, data collected by third parties) for advertising because of pro-privacy measures taken by platform players Apple and Google. Operators will benefit from this.

- Increased market dominance of Google, Meta, Amazon and Apple, particularly in middle- and high-income countries. These players increased their share of revenue during the COVID-19 pandemic because of their high visibility and strong capabilities.

- Operators’ growing (or diminishing) role as content providers and ad inventory owners.

- Regulatory scrutiny over operators’ handling of user data.

Trends in operator digital advertising revenue in lower-income countries will differ from those in higher-income countries

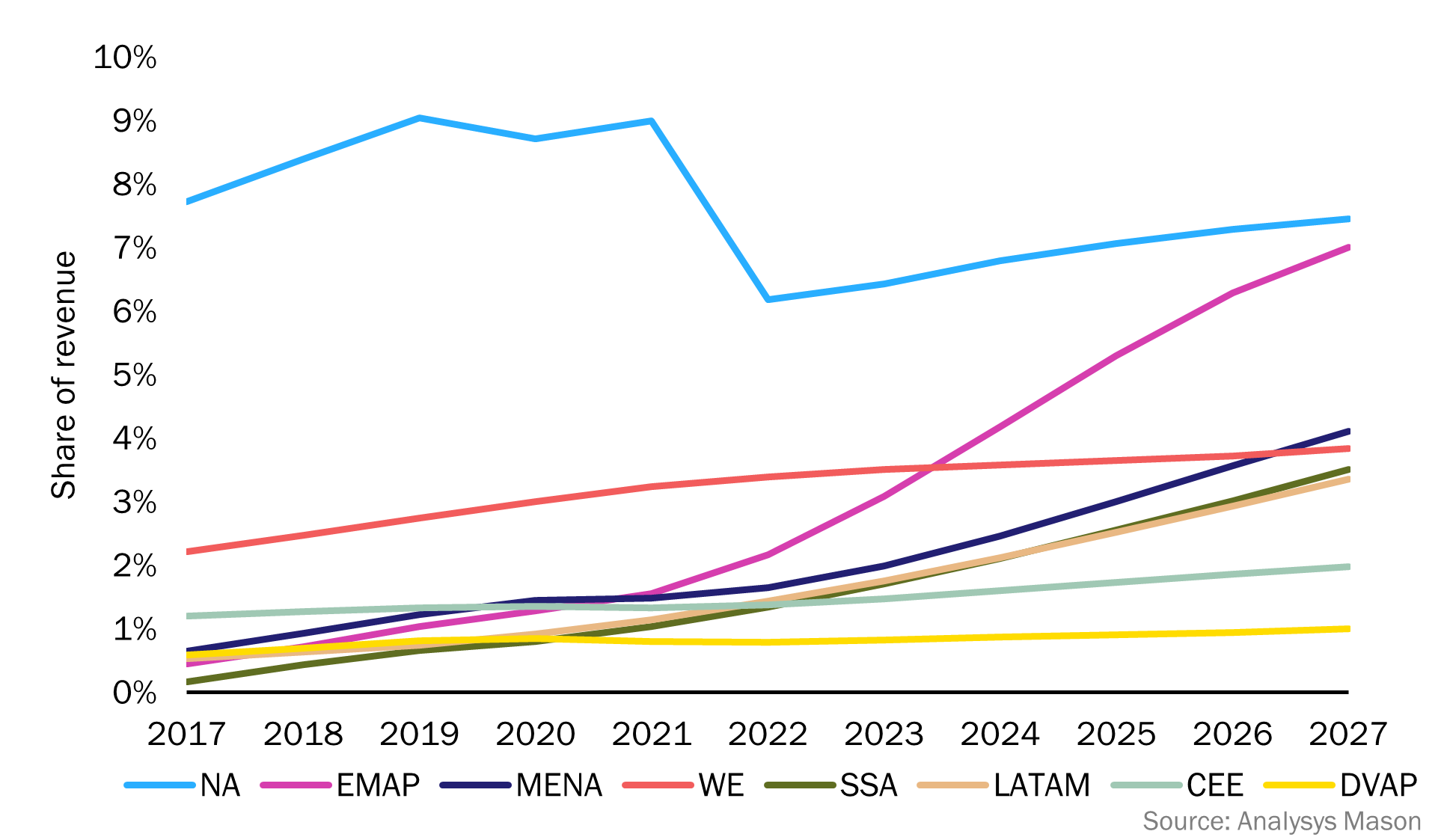

The digital advertising business for operators is worth USD19.4 billion (2.1% of total mobile service revenue) as of 2022. We expect this to grow at a CAGR of 13.7% between 2022 and 2027 to reach USD37.0 billion. However, this growth will vary considerably between higher-income countries and lower-income countries due to the differences in attitudes, experiences and regulation (Figure 1).

Figure 1: Operators’ share of the total digital advertising revenue by region, worldwide, 2017–2027

Operators in high-income countries will be selective about advertising opportunities due to past failures, high competition and privacy concerns

Operators in most middle- and high-income countries will take a generally cautious attitude to digital advertising. Most of the opportunities (beyond monetising ad space on media platforms for those with media businesses such as Comcast) consist of building demand-side tools for brands. Operators will need to balance their desire to monetise their first-party data with a reluctance to repeat past failures of competing with Google and Meta and a fear of regulatory pushback. We expect that many operators will form joint ventures to pool data assets and capabilities in order to build tools. For example, Comcast and Charter in the USA have already taken this approach.

North America will remain the largest digital advertising market for operators throughout the period in terms of revenue (USD20.2 billion in 2027) and revenue market share (7.5% in 2027), largely due to the presence of cablecos with large media businesses such as Comcast.

Operators in Japan and South Korea will be more bullish about digital advertising than their counterparts elsewhere in developed Asia–Pacific because the Japanese and South Korean markets are more insulated from Google and Meta.

Operators in low-income markets are generally new to advertising and will capitalise on their strong positions in the digital economy

Operators in lower-income markets, particularly those in emerging Asia–Pacific, Latin America and Sub-Saharan Africa, will grow their market shares. We expect the highest growth in emerging Asia–Pacific; here, operator digital advertising revenue will grow at a CAGR of 36.2% between 2022 and 2027 to reach USD11.1 billion.

Operators in large countries such as India, Indonesia and the Philippines will capitalise on their large in-market scale and their stronger competitive position relative to Google and Meta compared to operators elsewhere. Key players include Jio Platforms (India), Telkomsel (Indonesia) and Globe Telecom (Philippines), all of which have digital economy credentials and ambitions. Digital advertising presents them with an opportunity to build on their existing businesses in mobile financial services, media and healthcare (sources of ad inventory and user data). These and other local players will be well-positioned to identify local partners (including brands and publishers to onboard onto advertising platforms) and work effectively with local regulators.

The demand side will be the main area of focus for operators

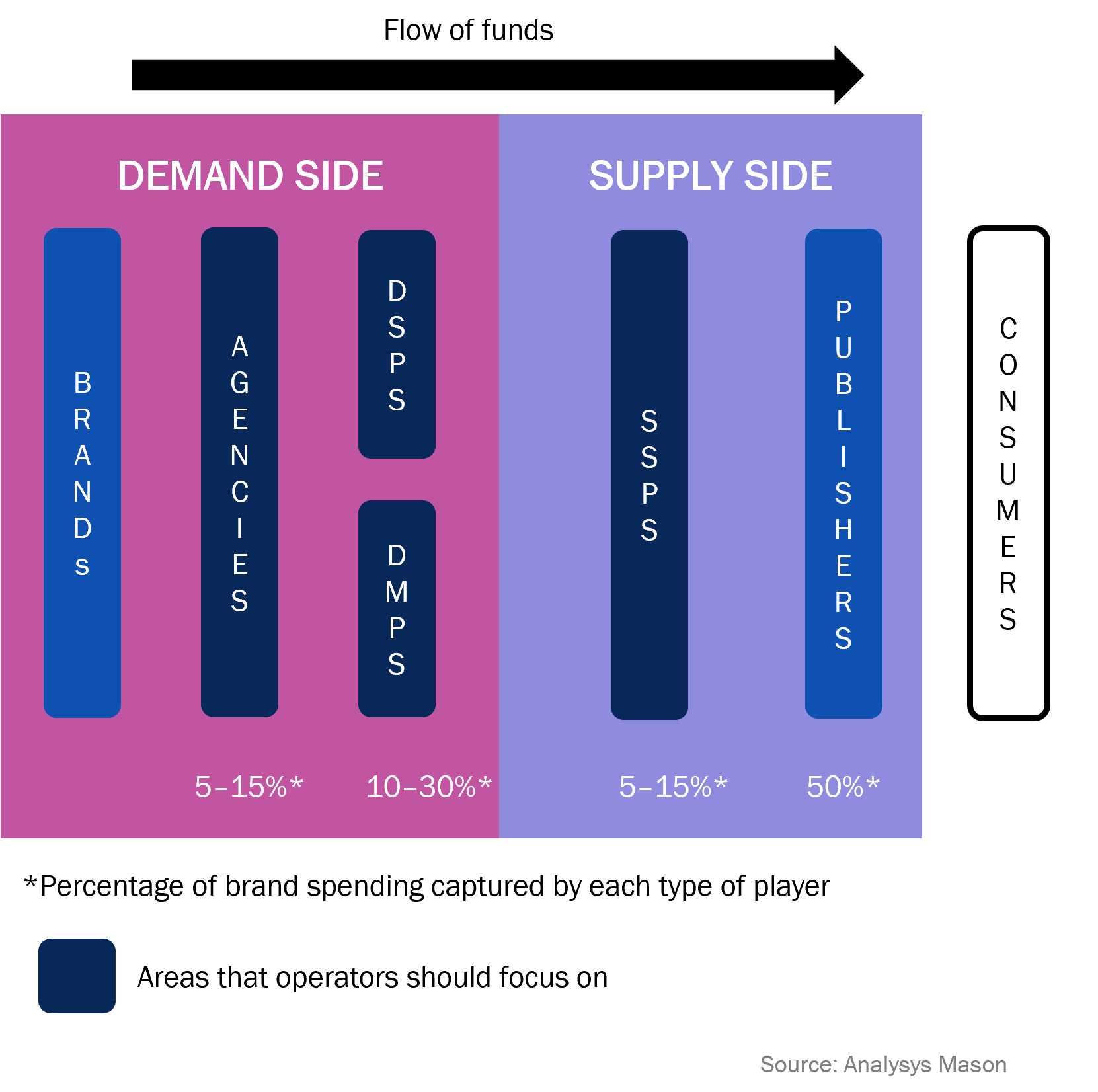

The digital advertising value chain consists of the demand side (encompassing brands that buy ad space and entities that serve their interests) and the supply side (encompassing publishers that sell ad space and entities that serve their interests), as illustrated in Figure 2. Funds flow from brands through the demand side and then the supply side; publishers ultimately receive about half of brand spend.

Figure 2: Digital advertising value chain

Operators with media businesses, such as Comcast, will continue to act as publishers, particularly in the USA, but overall, operators should compete on the demand side. This enables them to monetise high-value user data and target the 15–45% of spend demand-side players. Operating a supply-side platform (SSP) offers more-limited rewards than operating on the demand side; monetising the opportunity as a publisher entails higher risk due to the competitiveness of media and the significant capex associated with content.

What kinds of demand-side services operators seek involvement in will depend on their ambition and capabilities. The most ambitious will build tools themselves (as done by Telkomsel, for example), and those with the most-advanced capabilities will focus on valuable tools such as data clean rooms (as done by Comcast). These approaches can position operators as more-credible digital economy competitors.

Fundamentally, all operators will benefit from the increasing value of first-party data, but whether they have the appetite to proceed in the digital advertising space will depend on their past experiences and local factors such as competition and regulation.

Article (PDF)

Download