Operators’ reporting shows signs of business revenue growth and highlights effective growth strategies

Operators are now reporting revenue growth after a difficult year in 2020. In fact, more operators achieved revenue growth in 2Q 2021 than in 2Q 2019 before the initial breakout of the COVID-19 pandemic (see Analysys Mason’s Business revenue tracker). Operators have taken various approaches to dealing with the crisis and the associated business closures and declines in mobile roaming revenue, and have been putting themselves in the position to compete as global economies begin to recover. Many have been focusing their efforts and investments on growing the IT services side of their enterprise businesses and on building stronger relationships with their business customers. Others have been forced to engage in restructuring or cost-cutting programmes.

Operators are reporting year-on-year growth in their business revenue

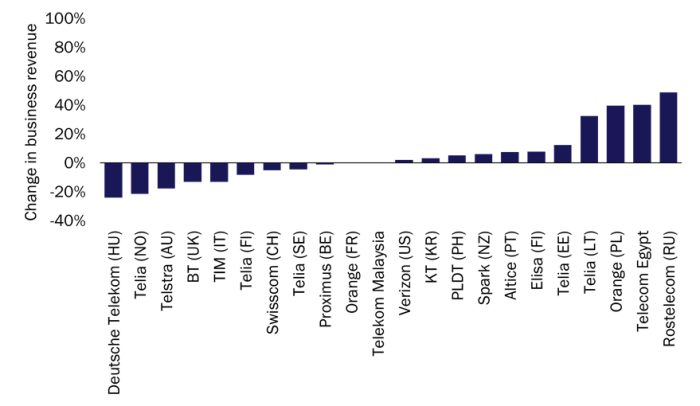

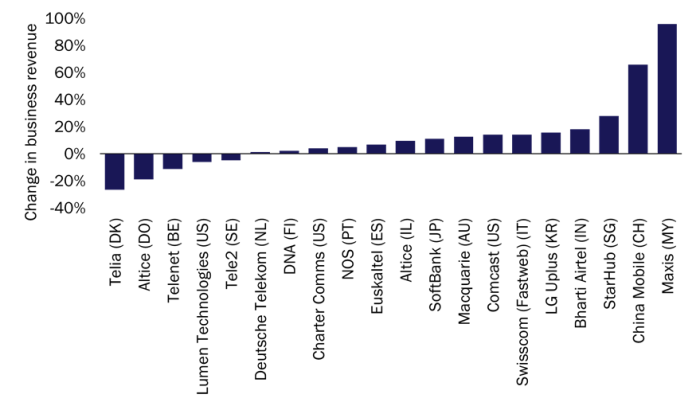

We have analysed the reported business revenue of 42 operators and have compared their quarterly earnings from 2Q 2019 with those from 2Q 2021(Figures 1 and 2). The trend is positive; 64% of these operators are reporting either flat or positive business revenue growth.

Figure 1: Business revenue growth between 2Q 2019 and 2Q 2021, selected incumbent operators, worldwide1

Source: Analysys Mason, 2021

Figure 2: Business revenue growth between 2Q 2019 and 2Q 2021, selected challenger operators, worldwide1

Source: Analysys Mason, 2021

There is a relatively even mix of incumbent operators and challengers in terms of revenue losses and gains. The incumbents that reported the greatest losses in revenue between 2Q 2019 and 2Q 2021 were Deutsche Telekom (Hungary), Telia (Norway) and Telstra (Australia); Telia (Denmark), Altice (Dominican Republic) and Telenet (Belgium) were their challenger counterparts. All of these operators (and others) are planning to employ various strategies to address their falling revenue.

- Telstra Enterprise is focused on improving its performance by simplifying its product offerings and business structure, implementing cost reduction strategies and improving customer experience.

- Telia’s CEO stated that the company plans to “reinvent a better Telia”, partly by continuing the push of convergence and IoT products to their enterprise customers and by expediting network upgrades and the 5G roll-out.

- BT (UK) has been focusing on reducing customer churn and improving NPS performance. It has also created its Small Business Support Scheme, which is aimed at boosting small and medium-sized enterprises’ (SMEs’) connectivity and digital transformation progress, while also addressing digital skills deficiencies and financial concerns.2

Some of the most resilient challengers (that is, those reporting business revenue growth of at least 20% between 2Q 2019 and 2Q 2021) are Maxis, StarHub and China Mobile. These operators cite a range of reasons for their strong performance.

- Maxis’s enterprise revenue grew rapidly during 2020, though from a low base. Its enterprise service revenue, which includes revenue from fibre connections and IT services, accounted for 7% of its total revenue in 4Q 2020, compared to just 3% in 1Q 2019. Note that Maxis’s enterprise revenue figure does not include mobile revenue.

- China Mobile increased its number of corporate customers by over 1.7 million in the first half of 2021, and focused on IT solutions and commercial use cases for 5G.

- StarHub reported that increased revenue from cyber security and IT services (Strateq) played an important role in its overall business revenue growth.

From a regional perspective, some of the largest declines in revenue were reported by operators in Western Europe (for example, Telia, Deutsche Telecom and BT).

Operators have a range of strategies for revenue generation

Operators have been taking a wide variety of actions to help them to increase the revenue from their business customers.

Some have chosen to expand, either by investing in infrastructure or IT solutions (for example, BT has invested in future platforms and Macquarie has funded a data centre capacity expansion), acquiring/merging to obtain key skill sets (such as KDDI’s digital transformation-focused joint venture with OPTiM (DXGoGo)) or partnering with leading IT vendors and providers (such as AWS and Microsoft).

Other operators have introduced plans for restructuring (for example, Singtel plans to reorganise its business structure to drive growth in its 5G Enterprise unit and Rostelecom has implemented a new business model that is organised by segments to enable it to focus on growing its ‘digital clusters’) or cost reduction (for example, TDS plans to “operate lean” and reinvest any savings into growth opportunities). These actions have yielded varying degrees of success.

Many operators are putting more resources into IT services and solutions to help them to offset revenue declines from their legacy telecoms businesses. Many successful operators (such as StarHub and NOS) now offer a broad range of IT, data, networks and cloud solutions and services to help them build ‘trusted partner’ relationships with their SME and large enterprise customers.

5G has been the focus of operators’ investments, but as we have explained in our article, Most SMEs consider 5G services to be a low priority as COVID-19 restrictions begin to ease, 5G is of much less importance to SMEs than many other aspects of their mobile services.3 Business customers are much more concerned with their mobile network coverage and quality than pricing, even. Operators need to demonstrate to their business customers that 5G networks are more reliable, not just faster, than their 4G counterparts. Some of the most successful operators (such as China Mobile and Proximus) are also creating 5G use cases to demonstrate the 5G value proposition to their business customers.

The most successful operators are an integral part of their business customers’ IT organisations

Operators are still contending with the effects of economic downturns, pandemic-related business closures and aging legacy technologies, but many have deployed effective strategies to support and grow their enterprise businesses. The most successful of these revolve around operators’ broadening the scope of their services beyond telecoms to include IT-related services.

Operators can invest in growing these skill sets in-house, but many have seen better results by acquiring existing players or partnering with IT services companies. Operators have a large, existing base of business customers, with which they can position themselves as trusted advisers and into which they can sell these value-added services and solutions.

Numerous operators had already been employing many of these strategies prior to the pandemic to help them cope with declining fixed services revenue, and the crisis has only reinforced these stratagems. Operators that had already been focused on supporting business customers’ digital transformation, enablement of remote working and cloud migration are ahead of the curve and are now investing even more resources into these programmes.

1 The definition of business revenue varies by operator. Some include only certain categories of products (such as fixed services) or customer segments (such as large enterprises) in their reporting.

2 For more information, see Analysys Mason’s Operator programmes for helping SMEs with IT: case studies and analysis.

3 For more information, see Analysys Mason’s Rethinking your 2021 SMB strategy: COVID-19 survey insights for IT vendors.

Article (PDF)

Download