Consumers care about the environment and operators’ sustainability initiatives should reflect these concerns

30 November 2021 | Research

Article | PDF (4 pages) | Fixed Services| Mobile Services| Video, Gaming and Entertainment| Fixed–Mobile Convergence

Operators have started to focus on green issues and sustainability as part of their environmental, social and governance (ESG) strategies to satisfy the expectations of investors, regulators and consumers.1 Consumers’ concern for the environment is moving from a niche priority to a mainstream demand that affects their buying behaviour. This article explores how and why operators should cater for, and help to grow, consumer demand for environmentally-friendly telecoms products and services.

Operators are increasingly focusing on sustainability to satisfy investors, regulators and consumers

Four main factors influence operators’ sustainability policies: investment pressure, regulation, consumer demand and cost control. Rising energy costs (and operators’ desire for energy efficiency), investment and regulation have all gained recent attention, but operators are only now beginning to pay attention to consumer demand for greener solutions. Operators’ ESG reports often focus on the risks associated with increasing energy demands as well as the need for energy efficiency, with operators pointing to the environmental benefits of fibre and 5G deployments. Most operators also use standardised sustainability metrics to report on their greenhouse gas (GHG) emissions and e-waste collection, but these areas of focus are primarily for the benefit of investors.

Operators are trying to gain further consumer recognition by highlighting other sustainability strategies, including the following initiatives.

- Some incumbent operators have launched social media campaigns on the topic of sustainability, such as Deutsche Telekom’s ‘#greenmagenta’ or BT’s ‘#BTBigSofaSummit’.

- Some operators use an ‘eco-index’ rating to help consumers to choose more-sustainable products

- Some are using sustainable packaging, such as Deutsche Telecom’s 100% biodegradable ‘Paper-Foam.’ packaging or Orange’s ‘eco-designed’ branded products.

- Many operators now use half-size SIM cards to reduce plastic waste.

- Many operators promote device collection at stores, such as Vodafone’s buy-back scheme.

However, such consumer-focused operator initiatives are not yet widely in use. One reason for this may be that operators do not wish to draw consumers’ attention to the scale of their environmental impact: energy consumption in the telecoms industry accounts for at least 2 percentage points of global energy demand. In addition, data gathered by Orange about its e-waste collection reveals that only 15.1% of all mobile devices sold in 2020 were collected. This indicates that telecoms operators can do more to minimise their environmental impact.

Operators’ green credentials increasingly influence consumers’ choice of provider

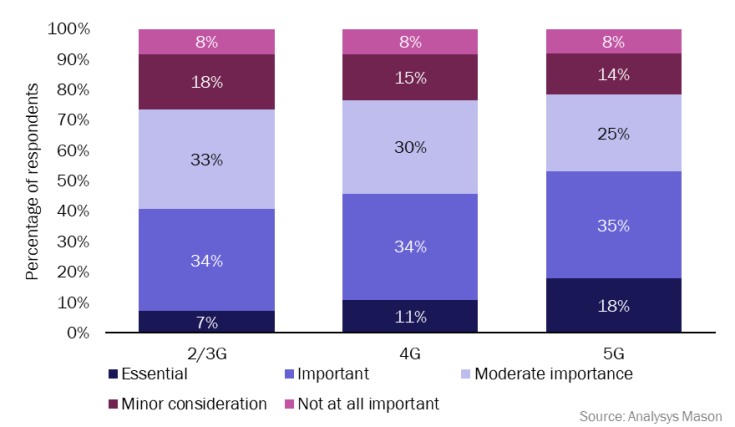

The GSMA’s report The Future of Mobile 20212 states that 73% of consumers adjust their buying behaviours with the environment in mind. This concern is also beginning to make a difference in telecoms buying behaviour. In Analysys Mason’s Connected Consumer Survey 2021,3 46% of respondents in Europe and the USA considered the environmental sustainability goals and green credentials of their telecoms providers to be ‘important’ or ‘essential’ in their choice of provider. We asked mobile customers that intended to churn within the next 6 months which three factors were most important when choosing their next mobile plan: 10% of respondents that intended to churn considered ‘lower environmental impact’ to be a top priority. A further 8% of consumers that did not intend to churn still considered it to be one of the three most-important factors for improving their current service. This niche group of consumers will inevitably increase in size over time as awareness around environmental issues increases. Significantly for operators, this group of consumers that consider green issues to be a priority also tend to spend more on telecoms products and services. For example, buyers of newer, more-expensive 5G handsets were much more likely to consider green issues ‘important’ or ‘essential’ than consumers using lower-specification handsets, as shown in Figure 1.

Figure 1: The importance of green credentials to consumers by handset generation, 2021

Operators should cater to consumers’ increasing demand for sustainable services

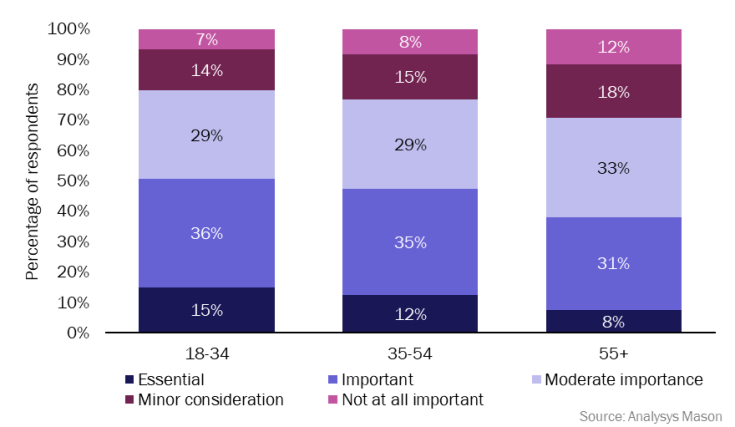

Consumers’ awareness of industrial energy consumption– including by the telecoms sector– is increasing. Furthermore, operators will soon be obliged to disclose their energy consumption and green credentials. Operators are already taking steps towards making their operations greener because of investor pressure, regulatory intervention, and a desire for (energy) efficiency. It therefore makes sense to make these actions more visible to consumers for marketing purposes: this may help operators to stand out from competitors. Indeed, the share of consumers that make buying decisions based on environmental concerns is likely to shift over time: twice as many consumers aged 18–34 considered operators’ green credentials to be ‘essential’ compared with those aged 55 or over. By advocating clear ESG credentials, consumers, employees and others will have more confidence in operators’ corporate responsibility to the environment and this will have a compounding effect on the reputation of the company.

Figure 2: The importance of green credentials to consumers according to different age groups, 2021

Operators should highlight their current ESG initiatives to appeal to consumers’ concerns for the environment

Operators can improve their marketing collateral by highlighting the work that they have already undertaken to environmentally transform their businesses. This includes:

- increasing the visibility of existing sustainability practices and more-closely tying these efforts to marketing aims (for example, communicating carbon-neutrality targets and championing handset recycling schemes such as those offered by Apple, Deutsche Telekom and Orange).

- building active fundraising and charity links for closer brand association with environmental responsibility. For example, AT&T launched a branded smartphone game in 2019, for which AT&T matched users’ gaming achievements with donations to a tree restoration charity. In addition, Deutsche Telecom recently donated EUR10 000 (USD 11 300) to biodiversity conservation efforts and TIM Group donated USD1.3 million donated to disaster relief.

- accelerating environmentally friendly cost-control initiatives and ensuring that press coverage highlights these priorities. For example, network function virtualisation and the migration of functions to ‘as a service’ solutions improve energy efficiency, though this can be harder to communicate to consumers.

Operators need to focus more on how they articulate such efforts to consumers so that they are seen by consumers as positive players effecting important environmental change. By reminding consumers that the telecoms industry is playing an active role in sustainable thinking, operators can capture the momentum of consumers’ own interests and care towards sustainable issues.

1 Most operators’ ESG strategies are informed by standardised sustainability metrics such as those outlined by the Task Force on Climate-Related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB) For more information, please see Analysys Mason’s forthcoming report 'ESG initiatives: how operators can benefit'.

2 GSMA (March 2020), Future of Mobile. Available at: https://www.gsma.com/betterfuture/wp-content/uploads/2020/03/GSMA_TheFutureofMobile-1.pdf.

3 Analysys Mason’s annual Connected Consumer Survey tracks and measures the changing telecoms and media habits of users in 24 countries around the world. For more information, please see Analysys Mason’s Connected Consumer Survey information page, available at : https://www.analysysmason.com/what-we-do/practices/research/consumer-services/connected-consumer-survey/.

Article (PDF)

DownloadAuthors

Martin Scott

Research DirectorRelated items

Article

M&As such as the recent XL–smartfren merger are reshaping Indonesia’s telecoms market

Article

TV services remain essential for many operators, even if media asset sales mark a change in ambition

Tracker

5G coverage tracker 1H 2025