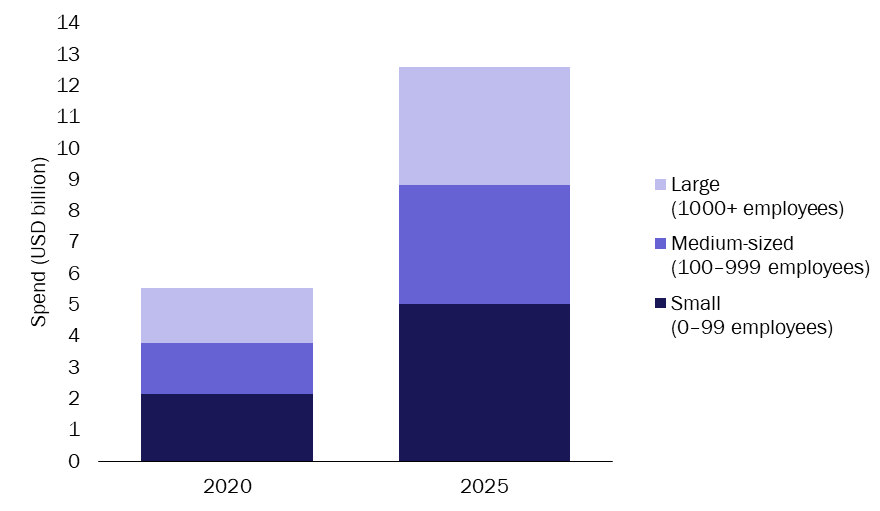

SMB spend on securing mobile devices will increase at a CAGR of 18% to almost USD9 billion in 2025

Analysys Mason’s SMB Technology Forecaster estimates that small businesses (0–99 employees), medium-sized businesses (100–999 employees) and large enterprises (1000+ employees) spent USD5.5 billion on mobile security solutions in 2020 and this spending is projected to reach USD12.6 billion by 2025. Small and medium-sized businesses (SMBs) have accounted, and will continue to account, for almost 70% of that spending.

Growth in mobile security spending is being driven by the following factors:

- the increasing number of SMBs that are providing their employees with mobile communication solutions to enable remote working

- the prevalence of attacks on mobile devices, such as malware and smishing

- the increasing frequency with which telecoms operators offer mobile phone contracts with bundled security solutions.

Figure 1: Mobile security spending by business size, worldwide, 2020 and 2025

Source: Analysys Mason

This article is based on our recently published reports: SMB mobile security spending worldwide: trends and forecasts 2020–2025 and Rethinking your 2021 SMB strategy: COVID-19 survey insights for IT vendors.

COVID-19 is a driver of dramatic growth in mobile security spending

The number of SMBs that provide their employees with mobile communication solutions increased dramatically in 2020. COVID-19 lockdown restrictions forced many employees to work from home. In Analysys Mason’s recent survey of 1870 SMBs worldwide, 68% of businesses reported that their employees were working from home due to the pandemic. Of these businesses, a quarter purchased mobile phones or increased mobile data allowances for company-provided mobile plans. The installed base of mobile handsets among SBs, particularly among those with fewer than 20 employees, is expected to continue to increase, even more quickly than among MBs.

Mobile connectivity has become vital in enabling many SMBs to continue operating. Two-thirds of SMBs in our survey reported providing mobile connectivity to their employees. Over half of businesses specified that they either started using it for the first time, or increased their usage of mobile connectivity since the pandemic started. SMBs are prioritising security for these mobile devices; 87% expect to spend at least as much or more in 2021 on mobile security solutions as they did in 2020.

Businesses are becoming more concerned about the prevalence of mobile device attacks. Employees who use mobile devices are causing some of those security breaches, by installing unapproved apps or connecting to non-secure public Wi-Fi hotspots, and are vulnerable to malware and smishing attacks. SMBs are deploying mobile endpoint security (MES) and mobile application management (MAM) solutions to protect their mobile devices against such attacks. SMBs’ projected spending on MES and MAM solutions is expected to increase dramatically at a CAGR of 22% and 18%, respectively.

We asked businesses that provide their employees with mobile telephony, which aspect of their mobile service is most important. Almost half (43% of SBs and 46% of MBs) rank bundled mobile security as ‘very important’. Many telecoms operators are offering businesses a variety of mobile security products often partnering with mobile security vendors to do so. Most operators, such as AT&T, Orange, Telefónica and Verizon, are partnering with leading mobile security players, MobileIron, Lookout, and McAfee among others, while other operators (such as Vodafone) offer bundles of in-house mobile solutions plus security vendors’ apps with devices and connectivity plans.

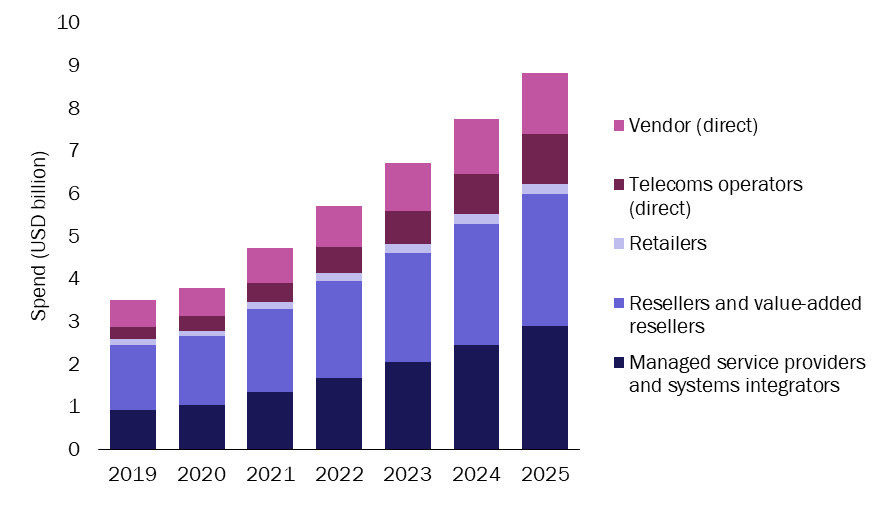

Telecoms operators will increase their share of SMB spend on mobile security solutions

Resellers and local value-added resellers (VARs) accounted for the largest share of SMB mobile security spending (43%) in 2020, but this will decrease to 35% in 2025 (see Figure 2). SMB spending on mobile security, like many other IT services, is gradually moving from the reseller channel to the managed service provider (MSP) and operator channels. Telecoms operators will play a greater role in providing mobile security offering packages that combine connectivity, devices and security, and we expect that this channel will increase revenue more quickly than the other channels during the forecast period (at a CAGR of 28%). We note that although operators direct sales to SMBs accounted for 9% in 2020, a much greater share goes through the operator channel and is then sold by resellers or by MSPs.1

Figure 2: SMB mobile security spending by channel, worldwide, 2019–2025

Source: Analysys Mason

One-third of SMBs in our survey reported that they are looking to vendors and service providers to suggest solutions to help them during the crisis. SMBs are looking to their channel partners and telecoms operators to help them to easily deploy secure mobile connectivity for their employees working from home.

SMBs are looking for security-related support from vendors and operators

SMBs will continue to want to securely support remote workers. A growing number of SMBs report that they plan to have more of their staff work from home when lockdown restrictions are lifted, compared to the number that worked from home before the pandemic began. SMBs are looking to their security vendors and telecoms operators to accomplish this. Three-quarters of SMBs in our survey report that it would help them to have vendors upgrade their security to cover new problems, such as working from home, collaboration, and BYOD, and 33% of SMBs are prioritising improving mobile connectivity for their employees who are working from home.

Vendors and operators have tended to neglect mobile security. However, this previously small fraction of the security market is now growing, driven by an increasingly mobile workforce, a growing number of threats and a rise in SMBs’ awareness of those threats.

1 The figures shown represent end-user purchases of security solutions, so only direct sales from a telecoms operator directly to the end user are included in the ‘Telecoms operators’ category. If sales are from an operator, but through a reseller, then the spend is attributed to ‘Resellers and VARs’.

Article (PDF)

DownloadRelated items

Podcast

SMBs’ IT priorities have shifted following a change to a 'technology-first' mindset

Report

Operator business services profiles: Western Europe 2025

Forecast report

Singapore: telecoms operator business and IT services forecast 2024–2029