A low Net Promoter Score masks a more-promising picture for operators and their IT ambitions

Listen to or download the associated podcast

Telecoms operators have low Net Promoter Scores (NPSs), often in single figures, as we have written about previously. However, the simplicity of the NPS (a single number that is used to judge how well an organisation is serving customers) masks a more positive message. For many customers, the current performance of their operator may indeed be good enough for them to consider purchasing additional services such as security.

Operators should therefore look at the distribution of results of an NPS survey, rather than focus solely on the single NPS figure. This may help them to uncover the best targets for cross-selling other products to.

Most customers are at least neutral towards their service provider

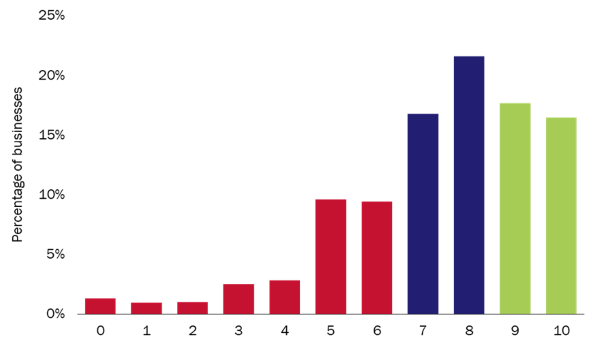

The calculation for NPS is simple. Customers are asked to rate how likely they are to recommend a service provider on a scale of 0–10 (where 0 is not at all likely, and 10 is extremely likely). Customers giving a 6 or less are classed as detractors, and those giving 9 or 10 are promoters. The remaining customers (those who gave 7 or 8) are classed as neutral. The NPS is calculated by taking the percentage of respondents that are promoters, subtracting the percentage of respondents that are detractors and multiplying the result by 100.

A negative NPS therefore tells us that there are more detractors than promoters (conversely, a positive score shows that there are more promoters than detractors). The score tells us little about the ‘neutrals’, despite them giving a score that many would class as reasonably high.

Telecoms operators are not doing as badly as the NPS results suggest

The NPS for fixed services for businesses is just +7 (according to our recent survey), but this result ignores the distribution of ratings given. Figure 1 shows businesses’ likelihood to recommend their fixed service providers. 38% of businesses were ‘neutral’ towards their operator, giving a score of 7 or 8, and a further 34% were positive, giving a score of 9 or 10. 19% of the remaining respondents gave their operator a score of 5 or 6. Operators may therefore only need to make marginal improvements to the service received by their customers to improve their NPS.

Figure 1: Businesses’ likelihood to recommend their fixed service providers, surveyed countries, 2019 (red=detractors, blue=neutrals, green=promoters)1

Source: Analysys Mason, 2019

There is also a strong relationship between a customer’s likelihood to recommend their provider and their intention to churn. 26% of detractors told us that they intend to switch providers in the future, compared to 11% for neutrals and 8% for promoters.

A neutral rating may be good enough

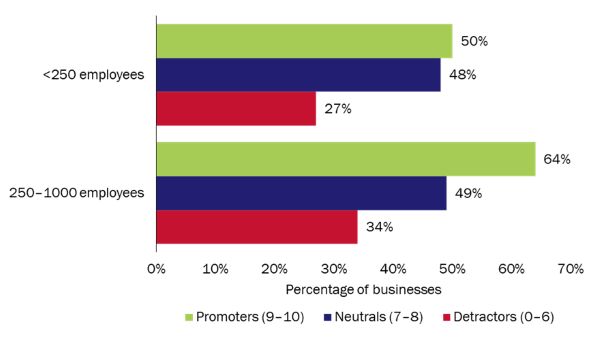

We asked respondents of our survey whether they would consider their fixed services provider as a supplier of various other services. Figure 2 shows the responses for the specific case of security services, for two size categories (up to 250 employees and 250–1000 employees). This demonstrates that the distribution of ratings matters; even neutral customers would at least consider their fixed provider as the supplier of other services.

Figure 2: Percentage of businesses in each category that are willing to consider buying security services from their fixed service provider, by business size, surveyed countries, 2019

Source: Analysys Mason, 2019

For smaller businesses, an almost identical share of neutrals and promoters (48% and 50%, respectively) would consider buying security services from their fixed operator. For larger businesses, there is a bigger difference between neutrals and promoters, but even here. almost half of the neutrals would consider their fixed operator for security services.

We asked the same question for other services such as unified communications and software. The results for each were slightly different, but the main message remained; as long as a customer is at least neutral towards their fixed provider, they may well consider it for other services.

The results are a promising indicator for operators (but not more than that)

The implications of these results are as follows.

- Operators may be better positioned to sell other services than they think, especially as most have not made strong moves in areas beyond connectivity and do not have a reputation for offering other services. It is likely that the share of customers that will consider their operator as a supplier of other services will rise for those operators that promote themselves as such.

- A proportion of customers will never buy other services from a telecoms operator. Slightly over a third of large businesses are not willing to consider fixed operators as suppliers of other services, even if they are promoters of the core service. Individual operators may be able to reduce this figure as described above, but it is likely that there will still be a group of businesses that will not use them regardless, perhaps because they have specialist requirements that they do not trust an operator to manage. A telecoms operator would have to radically shift its position (perhaps to that of a managed service provider (MSP) or systems integrator) to appeal to these customers.

- Operators should look beyond the NPS. Operators that rely on NPSs or other similar measures need to look behind the headline number and explore other findings. The distribution of ratings contains valuable information that they can use to decide who to target with which products.

- Focusing on making customers neutral may be more valuable than trying to increase the number of promoters. Neutral customers are far less likely to churn than detractors, and are highly likely to consider their operator for other services. The difference between neutrals and promoters (in terms of buying other services from their operator) is limited, especially for businesses with under 250 employees. Operators may do better to focus on customers that rate them 5 or 6 in the NPS question (19% in our sample) than investing in gaining more promoters.

1 The countries surveyed were Australia, China, France, Germany, India, Indonesia, Saudi Arabia, South Africa, the UK and the USA.

Downloads

Article (PDF)Authors

Tom Rebbeck

Partner, expert in TMT consumer and business servicesLatest Publications

Article

Operators cannot rely on price rises to boost revenue in 2024 but digital services could help

Article

Cyber-security services will account for almost 20% of operators’ incremental revenue from SMEs

Forecast report

Worldwide operator business services for SMEs: forecast 2023–2028