Operators with m-wallet ambitions can learn from Globe Telecom’s Gcash and Celcom’s Boost

The results of our Connected Consumer Survey 2020 show that the adoption of digital payments accelerated during the COVID-19 pandemic, which benefitted operators with mobile money operations.1 Operators in emerging Asia–Pacific (EMAP) made the greatest gains in terms of consumer adoption, particularly Globe Telecom (Gcash) in the Philippines and Celcom (Boost) in Malaysia. In this article, we focus on the drivers of Gcash’s and Celcom’s successes and consider how other operators with m-money ambitions can learn from them.

Gcash and Boost registered double-digit growth in user penetration between 2019 and 2020

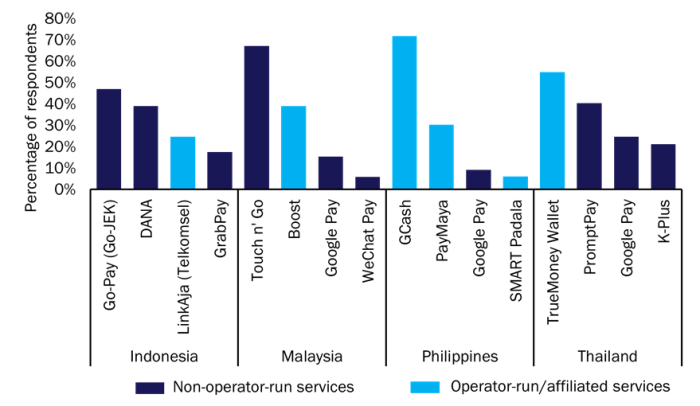

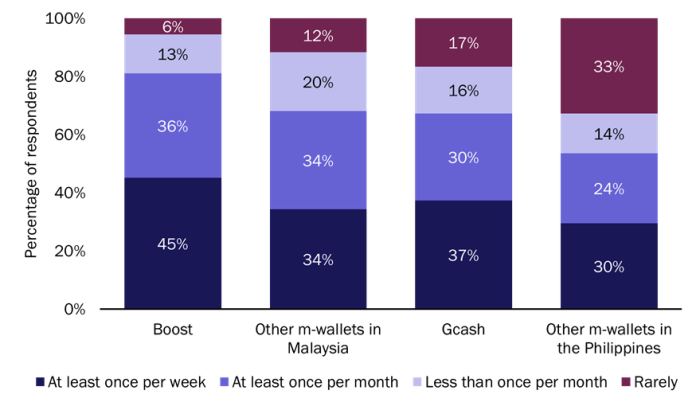

User penetration grew for many operator m-wallets between 2019 and 2020, but Gcash (Globe Telecom) in the Philippines and Celcom (Celcom) in Malaysia were the star performers in our survey. The penetration of Gcash grew by 30 percentage points (pp) between 2019 and 2020 and that of Boost grew by 19pp (Figure 1). Users of these services were also considerably more likely to use them very frequently in physical commerce compared to users of other m-wallets (Figure 2).

Figure 1: Penetration of the four most-popular mobile money services in each country, EMAP, 2020

Source: Analysys Mason, 2021

Figure 2: Frequency of mobile payments in physical commerce, Malaysia and the Philippines, 2020

Source: Analysys Mason, 2021

The key drivers of the strong performance of Gcash and Boost were similar and included the following.

- A strong focus on expanding merchant networks. The COVID-19 pandemic underlined the need to extend digital payments infrastructure in order to support local economies and migrate consumers to safer alternatives to cash-based commerce. Both Gcash and Boost continued to focus on onboarding more merchant partners. Indeed, the size of Boost’s merchant partner network increased by 80% year-on-year in 3Q 2020 to 203 000 merchants. Providing merchants with strong incentives to onboard is also likely to have played a key role in driving merchant network growth. For example, Gcash’s QR partners do not have to pay set-up fees and are able to monitor their own business performance using periodic performance reports.

- An emphasis on growing partner ecosystems to increase service range. Gcash in particular focused on building out its service range to provide more reasons for consumers to use the service. It partnered with UAE-based Denarii Cash in May 2020 to open up the UAE–Philippines remittance corridor to Gcash users, and partnered with life insurer Singlife in September 2020 to make life insurance products available to its customers. Developments of this kind helped to increase both revenue and the penetration of financial services among Gcash’s user base. Gcash reported that its revenue increased by 440% year-on-year in 1Q 2021, and that around a third of its monthly active users were using financial services (such as its savings and credit products).

- The co-opting of the platforms by government authorities to assist in their response to the COVID-19 pandemic. Globe Telecom worked with the Filipino government in 2020 to roll out QR payment functionality in taxis and transportation network vehicle services (TNVS) and to disburse emergency funds to citizens. Indeed, in June 2020, it was reported that Gcash had been used to distribute PHP1.8 billion (USD36.1 million) in emergency aid since the start of the pandemic. Similarly, Boost worked closely with local authorities to assist the Malaysian population; it helped to disburse funds to citizens as part of the government’s MYR450 million (USD103.5 million) e-Tunai Raykat initiative to incentivise the use of e-commerce services. Boost’s co-operation with local authorities also enabled it to expand its service range. For example, the payment of assessment taxes and parking tickets via Boost was enabled in some municipalities in 2020. These positive developments potentially contributed to Boost’s 30% year-on-year increase in weekly gross transaction value to more than MYR400 (USD97), as reported in 4Q 2020.

It is important that operators with m-wallet ambitions build out a solid set of use cases and provide strong reasons for merchants to support digital payments

Having the state as a formal partner is an advantage that is only available to the most important m-wallet players in certain countries; it is out of reach to the more marginal m-wallet players.2 However, there are actions that smaller m-wallet players can take to increase their chances of success.

- M-wallet players should work to extend their partner ecosystems in order to expand their set of use cases beyond money transfer. Such services (for example, digital banking services) come with higher margins than money transfer, and having a larger set of use cases can enable players to address more of consumers’ financial needs, thereby leading to a stickier proposition.

- M-wallet players should also provide merchants with strong incentives to onboard because this is an effective way of growing their merchant partner networks. This, in turn, is likely to drive usage. As discussed, Gcash uses financial incentives as well as value-added services to attract merchant partners. It also recently launched Glife, a service that offers consumers e-commerce deals, which merchants can apply to join to promote their goods. Financial incentives are particularly effective in attracting the long tail of merchants that have typically been less keen to use non-cash payment systems due to the high associated costs. Creating easy-to-use merchant-facing apps is also important. The merchant-facing versions of both Gcash and Boost have simple layouts and a simple registration process. M-wallet services in other regions (such as stc pay in Saudi Arabia and M-Pesa in Kenya) have also acknowledged the need for easy-to-use merchant-facing apps.3

1 For more information, see Analysys Mason’s Connected Consumer Survey 2020: digital services in emerging Asia–Pacific, Connected Consumer Survey 2020: digital services in Europe and the USA, Connected Consumer Survey 2020: digital services in developed Asia–Pacific, Connected Consumer Survey 2020: digital services in the Middle East and Connected Consumer Survey 2020: digital services in Africa.

2 It should be noted that being a leading m-wallet provider in the pandemic also had its disadvantages: M-Pesa in Kenya sustained a 14.5% year-on-year revenue decline in 1H FY2020/2021 because the central bank mandated that it waive fees on transactions below USD10 throughout 2020.

3 For more information, see Analysys Mason’s Connected Consumer Survey 2020: digital services in the Middle East and Connected Consumer Survey 2020: digital services in Africa.

Article (PDF)

Download