Operators are more trusted with user data than global tech rivals and should capitalise on their position

Listen to or download the associated podcast

Consumers’ willingness to entrust their data to operators is a critical indicator for operators that are seeking greater involvement in the digital economy because key digital economy services such as mobile financial services and digital advertising rely on operators acting as custodians of consumer data. Consumers in many countries worldwide are more likely to trust operators with their data than tech innovators, but numerous operators have failed to exploit digital economy opportunities. This article provides findings from our 2020 Connected Consumer Survey that suggest that operators can capitalise on their trust premium over others to better diversify their businesses, but they should be selective and opportunistic in their approach.

Operators are well-trusted relative to tech companies and their trust scores increased in 2020

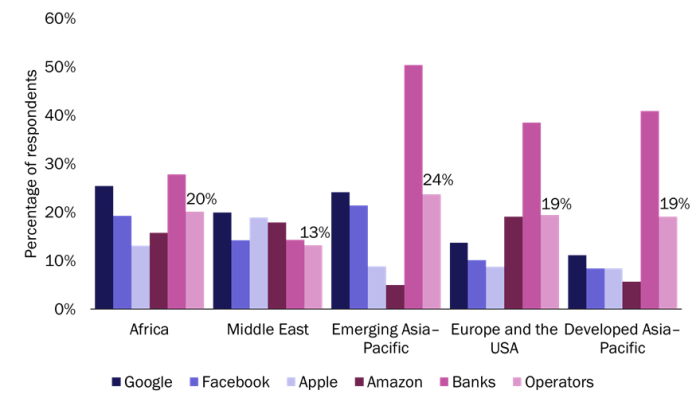

We ask respondents of our annual Connected Consumer Survey whether they are willing to entrust their data to various organisations in return for a discount or service benefit (Figure 1). The organisations specified include mobile operators, global tech companies (whose business models involve harnessing user data) and traditional data custodians such as banks, governments, health insurers and advertisers. We are able to use the responses to this question to see how operators fare over time and compared to their rivals. For example, consumer trust in operators rose in many countries between 2019 and 2020, which reflects the generally strong response from telecoms players to the COVID-19 crisis. Their brands have strengthened as consumer connectivity needs have become more critical; operators have also rolled out extras (free data or content) to help customers through lockdowns. Consumer trust in operators increased particularly significantly in emerging Asia–Pacific (from 13% in 2019 to 24% in 2020); operators in this region (such as Globe and Celcom) have well-developed mobile financial services portfolios and the adoption of these services received a significant boost during the pandemic in 2020.

Figure 1: Percentage of respondents that are willing to share personal data for a benefit, by type of organisation and region, worldwide, 2020

Source: Analysys Mason, 2021

Figure 1 shows how consumer trust in operators in 2020 compared to that in global tech companies and banks. Consumer trust scores should be seen as a function of both companies’ business models1 and the perceived value (according to consumers) of the benefit from allowing these companies to store or harness user data. Players that require consumers to hand over data and then provide a valued service on the back of this should command higher trust scores than players that do not, all other things being equal. When players use a good deal of personal data but consumers perceive there to be minimal value associated with having their data used by the service provider, they will have low trust scores. Put a different way, involvement in user-data-driven services can have a significant impact on trust scores. Handling customer data can potentially drive higher trust scores and yield access to more user data, but only if there is a strong perceived benefit to consumers.

Operators with significant exposure to the digital economy do well in terms of consumer trust

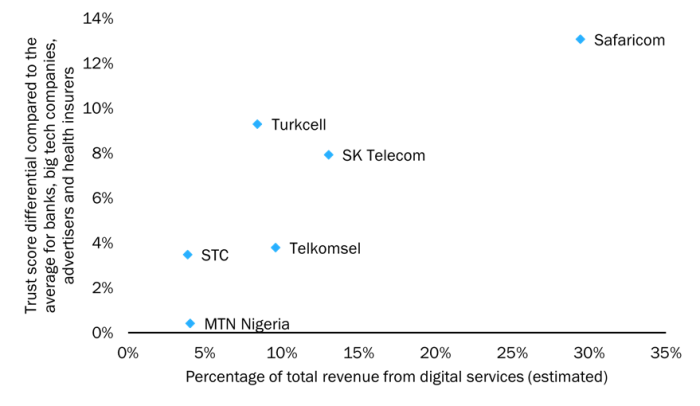

Operators with greater involvement in digital services tend to enjoy stronger trust premiums over rivals such as banks, global tech companies, advertisers and health insurers. We can demonstrate this by considering operators’ trust premiums over others in their (main) country of operation and the digital services share of their revenue (Figure 2).

Figure 2: Operators’ trust score premiums over other players and share of operator revenue from digital services2

Source: Analysys Mason, 2021

Figure 2 shows that some of the operators that have the largest leads over rivals in terms of consumer trust also have the largest exposure to digital services.

- Safaricom’s digital services business consists primarily of M-Pesa, though it also has e-commerce, agritech and health finance businesses. Safaricom’s M-Pesa mobile wallet is well-established; it started as a money transfer service and now provides a range of services such as banking. M-Pesa dominates the payments market in Kenya; indeed, 77% of Kenyan panellists reported using M-Pesa in our 2020 Connected Consumer Survey. The total value of M-Pesa transactions was KES9.044 trillion (USD82.8 billion) in the first 6 months of FY 2021; this is equivalent to around 85% of total GDP in Kenya for 2019.

- Turkcell’s digital services business consists of its fintech business (Paycell and Financell), its media operations (including music streaming, video streaming and gaming) and its data/analytics services provided through its Digital Business Infrastructure division. Turkcell has been positioning itself as a key digital enabler in Turkey and is seeking to grow its digital service revenue by 2.5 times between 2020 and 2023.

Operators should capitalise on trust premiums where possible

Operators’ trust premiums over tech companies present an opportunity for them to seek greater involvement in digital services, especially for those that currently have limited involvement. However, not all operators can or should seek the digital service exposure of Safaricom and Turkcell; the opportunities are determined largely by the conditions in the market(s) in which they operate. Countries with favourable regulatory conditions (for example, progressive telehealth regulation) and limited existing competition offer stronger prospects for operators’ digital services involvement. Having strong digital knowhow is also important; operators with digital service ambitions will need to acquire or develop in-house tech talent to power their service initiatives and compete effectively.

As such, operators should be selective in pursuing opportunities. The failures of previous digital services strategies suggest that operators should be cautious, and that failing to take due care in harnessing data risks eroding trust. Examining the service opportunities on a case-by-case basis is advisable. Building bespoke services with partners can help to address opportunities in a targeted way. Existing examples of this include Telefónica’s Movistar Salud telemedicine service (operated with Teladoc) and Proximus’s forthcoming neobank–telecoms platform (to be operated jointly with Belgian bank Belfius). Operating with partners may be especially important for banking services because banks generally remain more trusted than operators. Operators that wish to explore opportunities in digital advertising should consider developing in-house digital advertising capabilities to cater to first-party ad needs before potentially launching an externally facing service.

1 For example, banks require user data to operate and therefore generally have strong trust scores because consumers are accustomed to entrusting their data to banks.

2 By digital services here, we mean media services, fintech services and data/analytics services (B2C, B2B2C and B2B).

Article (PDF)

Download