How can telecoms operators conquer the mobile gaming industry?

Listen to or download the associated podcast

Two thirds of all adults worldwide play digital games; of those, 73% play mobile games. Operators can take a number of key roles in the mobile gaming industry in order to capture growth. 5G is an intrinsic part of this opportunity. This article provides an analysis of the size and future prospects of the mobile gaming industry and the role that operators can play within it.

How big is the mobile gaming industry?

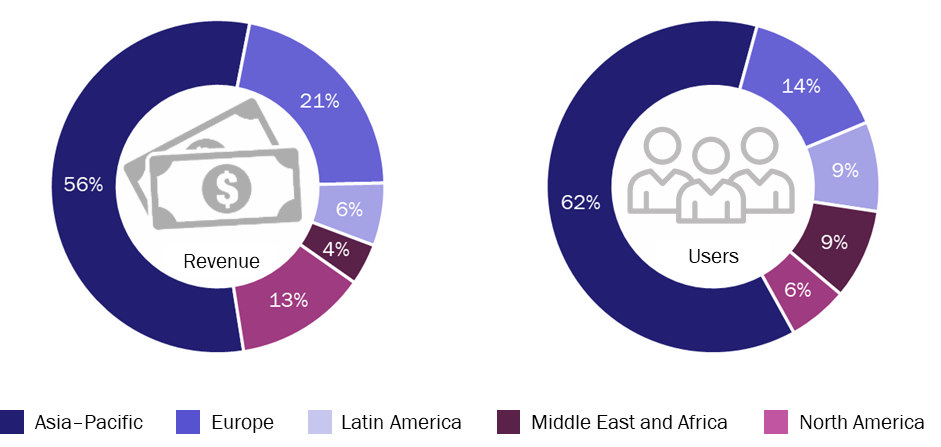

The mobile gaming industry generated revenue of USD75 billion in 2020, which accounted for 51% of total digital gaming market revenue worldwide. Mobile gaming revenue grew by 19% between 2019 and 2020, and the number of people who play mobile games grew from 3.2 billion to over 3.5 billion (or 46% of the world’s population) in the same period. Most mobile gaming industry trends are driven by activity in Asia: the Asia–Pacific region accounted for 62% of the world’s mobile gamers and 56% of revenue in 2020 (see Figure 1).

Figure 1: Mobile gaming industry revenue and users by region, 2020

Source: Analysys Mason

The largest players in the mobile gaming industry are also some of the largest players in the wider digital gaming space, such as Activision Blizzard, Microsoft, Nintendo, Sony and Tencent. Most of the hyperscalers have launched, or are developing, a cloud-gaming proposition of which mobile gaming is a key part:

- Google launched Stadia

- Tencent launched START

- Microsoft developed xCloud

- Amazon launched Luna

- Facebook has announced a mobile cloud gaming service on its Play portal.

How important is 5G to mobile gaming?

5G will drive spending on mobile gaming from USD75 billion in 2020 to USD138 billion in 2025, when 30% of the smartphones worldwide will be 5G-enabled. 5G will strengthen the growth of mobile gaming services, giving gamers access to higher-value content. 5G will also enable the next generation of cloud-based gaming services to disrupt the market, because they will be available to new segments of consumers and will facilitate new gaming experiences, such as mixed reality (MR).

We estimate that 5G will create up to USD12.5 billion of retail revenue in 2025 that operators can target in these segments:

- mobile cloud gaming revenue will grow from USD140 million in 2020 to USD6.4 billion in 2025

- mobile XR gaming revenue will grow from USD1.4 billion in 2020 to USD6.1 billion in 2025.

5G offers a unique chance for operators to capture revenue growth in the mobile gaming value chain. Mobile gaming is one of the most likely solutions that operators can use to address the challenges of migrating customers from 4G. 5G will boost the growth potential of gaming, particularly mobile gaming, and will create the conditions for the next generation of services – and operators’ assets will be fundamental to the success of these services, enabling them to reach all consumers.

How to capture mobile gaming industry growth?

So far, operators have only been adjacent to gaming, mostly benefiting indirectly from upselling connectivity to gamers. A few operators have tried to build game portals and become gaming service providers, but with limited success because of competition from app stores, consoles and online distributors, and the role of operators was confined to that of connectivity provider, mainly relevant for downloading titles, updates and online multiplayer gaming.

The next generation of gaming services enabled by 5G relies on cloud-based content delivery and consumption, which unlike traditional (or local) video gaming, focuses a significant share of service user experience and QoS optimisation on connectivity. Operators’ assets are central to the success of cloud-based gaming because the activity requires consistent high-speed and low-latency assurance for the duration of the service provision. High-performance broadband, both fixed and mobile, and cloud gaming services complement each other, but also edge cloud and network management capabilities will be key to their success.

This technology allows consumers to access the gaming experience without needing expensive hardware and titles; it reduces the price barrier to entry by enabling subscription-based and on-demand consumption rather than requiring an expensive pay-upfront-to-play distribution model. In addition, it enables the development of complex games that can be played on devices with scarce computational resources, such as smart glasses and the new generation of mobile connected handsets and wearables. Indeed, mobile XR gaming will rely on cloud resources to handle all or most of the software heavy-lifting.

In the mobile gaming market, operators should focus on cloud gaming and XR gaming because their assets are central to these services and because they are well positioned to be cloud-based gaming-on-demand service providers to their subscriber base (and consumers in general) in the same way they are with subscription and transactional video and music services.

What role can telecoms operators play in mobile gaming?

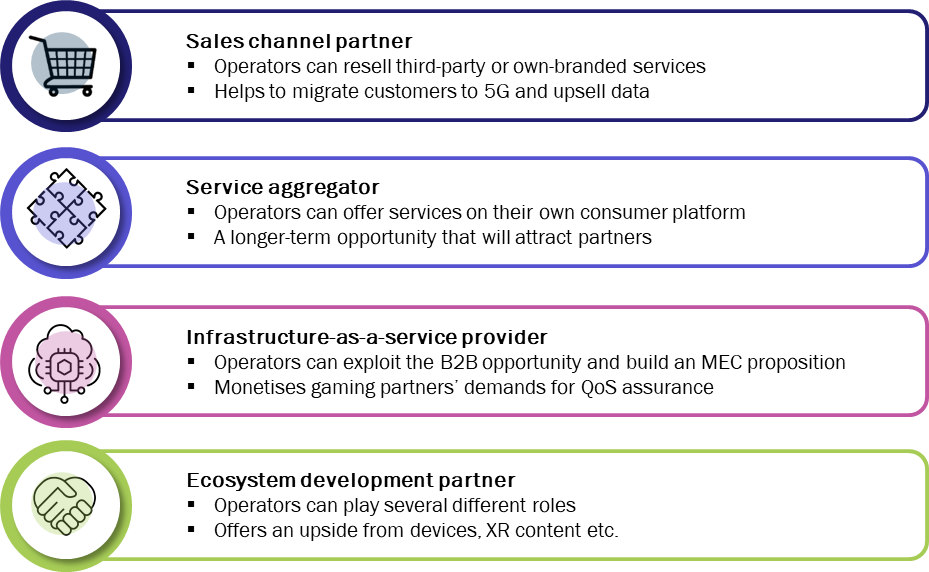

Operators should proactively decide their role in gaming before the next-generation gaming ecosystem matures in order to maximise the value that they can extract from it. Operators can play a variety of roles in the mobile cloud value chain, unlocking B2C and B2B revenue opportunities (see Figure 2).

Figure 2: Roles that operators can play in mobile gaming

Source: Analysys Mason

- Sales channel partner. Operators will add value to their core consumer proposition by offering gaming as a value-added service, or reselling third-party or own-branded services. Operators’ direct relationship with consumers and control of the network could enable them to become gaming service providers, offering own-branded consumer products or reselling third-party services and devices. In the next 2 to 3 years, they can use those services to educate consumers about, and encourage them to migrate to, 5G services.

- Service aggregator. In the longer-term, operators could offer services via their own consumer platform and infrastructure via a service aggregator play. Operators have a long experience of aggregating and distributing content, particularly video, and of selling services through a subscription model. This is something that third-party gaming service providers value and will look for in a partnership.

- Infrastructure-as-a-service (IaaS) provider. Operators should use the growth of 5G-enabled gaming to target the B2B opportunity and to build a mobile edge computing (MEC) proposition, which they can do in partnership with other operators and/or public cloud providers. As next-generation gaming ecosystems mature, operators should use their MEC, end-to-end network management capabilities to monetise the gaming service providers’ demand for QoS assurance, strengthening the go-to-market partner role. Operators can use gaming as the first large-scale application to build MEC capabilities.

- Ecosystem development partner. Operators can partner with gaming service providers to accelerate the development of the next-generation gaming ecosystem, new devices, XR content and supporting infrastructure as well as offering them a go-to-market partner that can educate consumers on the value of 5G and the gaming experience that it can offer. Operators can choose one or more roles in this segment, depending on their profile, long-term strategy and appetite for risk.

Martin Scott is a Principal Analyst with Analysys Mason and heads Analysys Mason’s research initiatives related to gaming and TV. He manages the Video, Gaming and Entertainment research programme. Martin has held numerous positions within Analysys Mason during the last 16 years, including heading the company’s Consumer Services, Data and Regional Markets practices. He also launched Analysys Mason’s Connected Consumer Survey series of research.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Article

TV services remain essential for many operators, even if media asset sales mark a change in ambition

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Forecast report

France: pay-TV and streaming video forecast 2024–2030