COVID-19 will accelerate the shift of SMB IT spending to managed service providers and systems integrators

The COVID-19 outbreak has encouraged small and medium-sized businesses (SMBs) to shift their IT-related spending to the IT service and equipment providers that are best-placed to support digital transformation and cloud strategies. Channel players such as managed service providers (MSPs) and systems integrators (SIs) that are helping businesses to rapidly respond to the disruption caused by COVID-19 are increasing their share of SMB IT spending more quickly than previously forecast. We expect these players to continue to increase their share of the market in the next 5 years. Meanwhile, channel players such as resellers, retailers and value-added resellers (VARs) that deal with customers on a transactional basis, and are less involved in supporting operational changes at customer organisations, are losing share.

This comment draws on insights from Analysys Mason’s SMB Technology Forecaster and our recent survey of small and medium-sized businesses (SMBs) in the USA to assess the impact of the COVID-19 pandemic on the channel ecosystem.

Channel players that help clients to adopt and manage new technologies will increase their share of SMB IT spending

The COVID-19 pandemic has forced many SMBs to adopt new technologies to serve customers and support employees. However, they will need help with implementing and optimising these technologies, which will require ongoing investment.

Our recent survey in the USA shows that a significant number of SMBs started using, or increased their use of, an IT service provider as a result of challenges stemming from the COVID-19 pandemic. For example, 28% of SMBs started using collaboration tools in response to the effects of the pandemic, and 46% of established users increased their use of these tools. More than half of SMBs also plan to increase their usage of newly adopted IT solutions even after the effects of the pandemic subside.

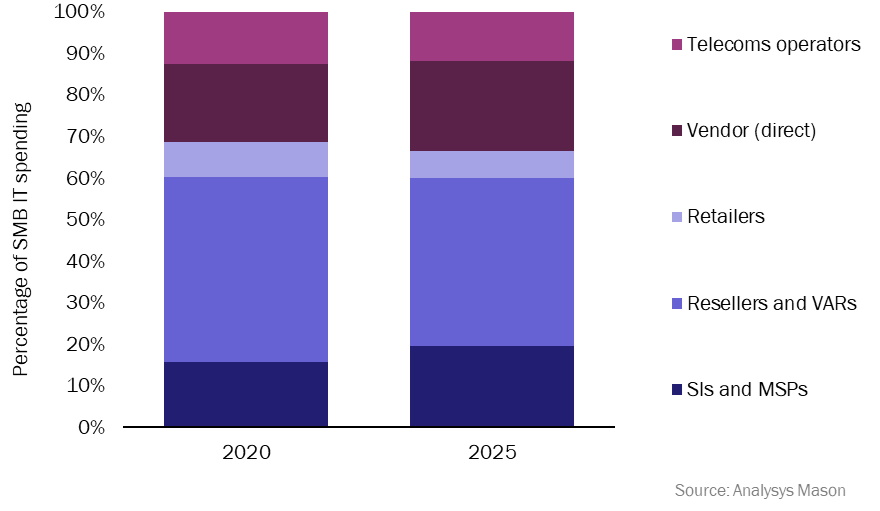

The players that are best-positioned to assist SMBs with their digital transformation efforts – namely MSPs and SIs – will continue to increase their share of revenue in the market, despite a challenging economic environment. We attribute this growth to the high levels of engagement that these players have with SMB customers. SIs and MSPs assist SMBs with new technology implementations, and provide ongoing support, which is important for businesses that typically lack skilled IT resources. However, players with transactional business models, such as resellers and VARs, may struggle. Retailers will suffer most; their share of SMB IT spending will decline by 6% between 2020 and 2025, owing in part to the mobility restrictions imposed by governments in many countries.

MSPs will account for 17% of SMB IT spending by 2025

When businesses adopt new technologies, they need help putting these solutions to work and getting the most out of their investments. Many SMBs lack the sophisticated IT resources that are available to large enterprises. In addition to reselling, developing and integrating solutions, MSPs provide SMBs with services for network monitoring, hosting and managing servers, endpoint protection, and help desk support. They help SMBs to deal with complex IT-related issues on an ongoing basis. These services, offered as part of annual or multi-year contracts, are often more cost-effective for SMBs than hiring in-house IT professionals across a range of specialities.

MSPs are increasingly important partners for SMBs, especially given the pressure to transform in response to COVID-19 business disruptions. Indeed, 51% of medium-sized businesses (100–1000 employees) and 36% of small businesses (0–99 employees) in the USA started or increased their use of managed services in response to the pandemic. We expect that SMB spending on MSPs in 2020 will reach USD144 billion, growing 7% year-on-year. By 2025, the market will reach USD240 billion, growing at a CAGR of 11% between 2020 and 2025. In the coming years, MSPs will gain share while that of resellers and VARs will decline. By 2025, 17% of SMB technology spending will accrue to MSPs, as SMBs continue to investment in cloud and digitalisation solutions (see Figure 1).

Figure 1: SMB IT spending by channel, worldwide, 2020 and 2025

The growing importance of MSPs is reflected in the success of key enablers of managed services business models. SolarWinds, one of the largest MSP-focused IT management software vendors, recently reported that total revenue grew 7% year-over-year for the second quarter of 2020 to USD247 million. It expects similar growth in the third quarter of 2020.1

The growing importance of MSPs is reflected in the success of key enablers of managed services business models. SolarWinds, one of the largest MSP-focused IT management software vendors, recently reported that total revenue grew 7% year-over-year for the second quarter of 2020 to USD247 million. It expects similar growth in the third quarter of 2020.1

Vendors are also seeking to enable MSPs to increase their ability to manage their solutions. For example, Microsoft recently partnered with SolarWinds to integrate Microsoft 365 capabilities with the company’s remote monitoring and management tools, citing the importance of these services to SMB customers. Nathalie Irvine, General Manager, Microsoft 365, said “In these challenging times, small and medium-size businesses need, more than ever, to empower all their employees to work from anywhere and on any device in a secure way.”2

IT vendors should improve their programmes to support partners in effectively delivering services at scale to SMBs

The channel players that will succeed are the ones that are positioning themselves to assist SMBs with their digital transformation efforts. Disruptions caused by the COVID-19 pandemic have forced SMBs to adapt to new ways of working and have catalysed demand for technology implementation and support services. Demand for these services will only increase. As SMBs adopt increasingly complex IT solutions, they will expect partners to provide advanced infrastructure, management and cyber-security solutions. However, delivering these services to SMBs at scale comes with inherent challenges. IT vendors should assist their partners in delivering robust service programmes to SMB customers, but must first identify the training, tools and marketing support that they need to succeed in today’s challenging environment.

1 SolarWinds (2020), Earnings Release FY20 Q2. Available at: https://investors.solarwinds.com/financials/quarterly-results/default.aspx.

2 SolarWinds announces collaboration with Microsoft to enhance monitoring and management for MSPs. Available at: https://techcommunity.microsoft.com/t5/small-and-medium-business-blog/solarwinds-announces-collaboration-with-microsoft-to-enhance/ba-p/1534160.

Download

Article (PDF)

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Receive the latest news and research on SMB IT buying behaviour and forecasts

Author

Youngeun Shin

Senior AnalystRelated items

Report

SMB IT spending forecast report: driving business growth and increasing efficiency

Report

SMB IT spending forecast report: a new beginning

Article

SMBs in manufacturing and professional service industries are making big investments in CRM solutions