Hatch’s cloud-gaming service offers Sprint a way to differentiate on the real-world 5G consumer experience

Gaming is already a popular activity on smartphones, and cloud gaming has the potential to open up new experiences to consumers, such as higher-performance multi-player games and subscription streaming of top titles. The demand for higher performance from the network makes cloud gaming a strong fit for 5G, with cloud-gaming experiences forming part of many operators' go-to-market strategies for 5G mobile. Operators have a number of options including offering an own-branded service, partnering with a third-party service or simply offering 'gaming passes' to allow customers access to their preferred services. This comment looks at Sprint's relationship with Rovio's Hatch cloud-gaming service and the role that this has played in the launch of Sprint's consumer 5G services in nine cities.1

Sprint is using cloud gaming to support its 'True Mobile 5G' proposition

Sprint includes a range of features to differentiate its unlimited data plans, with content from providers such as Hulu, Tidal and Amazon Prime. For the launch of its 5G services, Sprint collaborated with Hatch to offer its 5G smartphone customers a mobile gaming service. Sprint first offered Hatch with its 5G service launches in Los Angeles, New York, Phoenix and Washington DC (enabled by Nokia infrastructure). These cities were considered to be among the most-challenging locations for 5G deployments because of their large and dense geographical areas. At the time of writing, Sprint is still the only mobile network operator (MNO) in the USA to offer a mobile cloud-gaming service.

The Hatch add-on2 offers unlimited access to more than 100 mobile games for USD7.99 per month, with the first 3 months free for customers with a 5G phone. The service offers a premium mobile gaming experience, with the following benefits.

- The offer includes selected, high-end games that are not available for free as standalone.

- There is no advertising or in-game purchases.

- Some games have multi-player capabilities that are not available in standalone native versions.

- Additional features include message boards, leader boards and tournament-style competitions.

The Hatch service is available to all subscribers, whether on 4G or 5G networks, but it is clearly designed to showcase the 5G experience. Users on 5G can expect high-resolution native gameplay at 60 frames per second. Performance requirements vary by game: a standard game title will offer a 'very good' experience with download speeds of 10Mbit/s with a latency of 100ms, which is well within the capabilities of an LTE-A network, albeit with caveats around congestion at peak times and busy locations. Racing games are more demanding, requiring lower latency of 50ms. In the future, more-demanding PC adaptations will have still higher performance requirements.

In its 5G marketing messages, Sprint is focusing on 'True Mobile 5G', emphasising consistent mobility in its coverage areas, contrasting with Verizon's '5G Ultra Wideband' and its foregrounding of power and speed. Sprint is the only US operator currently using mid-band spectrum for 5G. Its deployment uses 2.5GHz spectrum and Massive-MIMO antennas offering a balance between performance and coverage. At October 2019 Sprint announced coverage of approximately 16 million people in the metro areas of nine cities for its 5G service. Existing services on offer from Verizon and AT&T use mmWave spectrum, which offers very high speeds but with relatively limited reach (both Verizon and AT&T have been reticent about coverage, but this is changing as operators in the USA roll out services on sub-1GHz spectrum). The Hatch service offers Sprint a means to demonstrate sufficiently high performance for one of the main consumer 5G use cases while also making the case for the importance of coverage for everyday mobile experience. Mobile gamers play while moving in public or private means of transport and in different locations during the day and they expect a consistent user experience in the multiple locations where they play, regardless of the title that they are playing. It is a shrewd marketing move for Sprint.

Mobile cloud gaming aims to address the needs of an attractive market segment

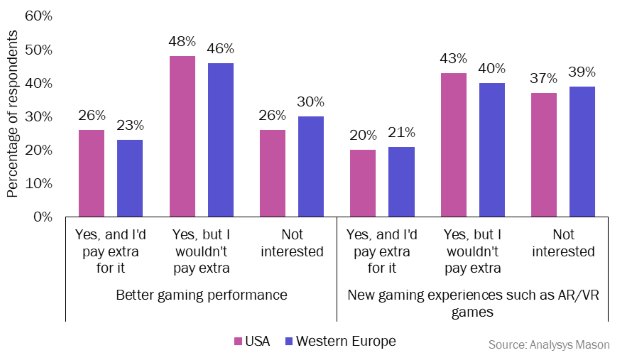

The Sprint–Hatch relationship leverages the latent demand for a new and better mobile gaming experience to showcase the potential of 5G to as many consumers as possible. According to Analysys Mason's Connected Consumer Survey 2019,3 63% of mobile users in the USA play games on their mobile phones, 44% of whom play every day and 31% at least once a week. Figure 1 shows that a large proportion of mobile gamers in the USA and Europe are interested in trying a new gaming experience or benefiting from the improved gaming performance provided by 5G: between 43% and 48% would try but are not prepared to pay extra while between 20% and 26% stated that they would be prepared to pay extra for it. Paying extra could mean potentially paying for content or for the connectivity that supports the user experience.

Figure 1: Willingness to pay for 5G-enabled services among mobile gamers in selected developed markets, 2019

Most of the mobile users that are interested in a better gaming experience powered by 5G are young, 'tech-forwards' individuals who are likely to be the first adopters of 5G. Offering a service such as Hatch may help to grow Sprint's brand equity within this segment. To reach as many users as possible, the operator pre-installs Hatch in the 5G handsets that it sells and gives 3 months free of charge to ease the onboarding process and to make the service as easy to discover as possible.

Challenges still remain in monetising mobile cloud gaming

Despite the broad penetration of mobile gaming currently and consumer interest in improving the mobile gaming experience, there are longer-term challenges around monetisation that become clear when we look at the target market segments for mobile cloud gaming.

- Persuading casual gamers to buy in to a subscription model. The mass market of casual smartphone gamers currently accounts for the majority of gaming revenue, though average individual spend levels are very low. Cloud-gaming services such as Hatch aim to convince casual gamers to convert infrequent spend to a subscription model. Gaming services are commonly associated with mobile 5G launches and are often included as promotions to help stimulate interest, as with the Sprint–Hatch relationship. It will be interesting to see conversion rates when the promotional periods end.

- Providing the performance required for 'hardcore' gamers to adopt mobile cloud gaming. Willingness to spend is well established for avid gamers and subscription models are already gaining traction. Spend is also expected to migrate from hardware (PC gaming rigs and/or consoles) towards cloud-based services. The challenge for mobile cloud services is providing a consistent performance on cellular networks, particularly as more-demanding AAA PC titles are adapted. Sprint is interested in supporting this move in the longer term.

There are risks and rewards here. The requirement for responsive gameplay, both for casual and hardcore gamers, means that new architectures will ultimately be required to support cloud gaming. In contrast with many other content types, such as video, where mobile operators are often just the carriers of 'OTT' services, gaming offers an opportunity for operators to create value for gaming providers through a service enablement platform.

The relationship between Sprint and Hatch provides a good example of how mobile cloud gaming offers an efficient tool to educate the consumer market on the potential of 5G mobile currently. However, operators and their partners still have work to do in order to realise the longer-term potential of consumers' apparent willingness to pay for more and better gaming services.

1 Analysys Mason interviewed Bryan Fries, Vice President of 5G Strategy at Sprint for this comment.

2 For more information about Sprint’s plans, see www.sprint.com/en/shop/services.html?INTNAV=TopNav:Shop:AddOnServices.

3 Analysys Mason’s Connected Consumer Survey is an annual survey of respondents in 23 countries covering customer experience, content consumption and digital services among other topics. The results are based on a sample of 1000 users per country ( Western Europe aggregates the results of France, Germany, Italy, Spain and the UK).

Downloads

Article (PDF)Authors

Tom Rebbeck

Partner, expert in TMT consumer and business servicesLatest Publications

AI series: Microsoft's Aileen Hannah on how AI can offer SMBs an edge over larger companies

Podcast

Mobile customer satisfaction: consumer survey

Survey report

AI series: who will be the GenAI winners and losers in the TMT industry?