Cisco can help SMBs to navigate uncertainty, but it will need to overcome hurdles to gain market share

17 May 2021 | SMB IT

Article | PDF (3 pages) | SME Services| Cyber Security| IT Infrastructure| UC and Digital Services

Cisco is increasing its efforts to appeal to small and medium-sized businesses (SMBs) and is positioning itself as a provider that can help businesses to navigate the uncertain future of the workplace. Cisco believes that hybrid work environments will persist for the long term. Indeed, its SMB homepage leads with the statement, “The future of work is remote.”

Analysys Mason’s survey of SMBs in Australia, Canada, the UK and the USA provides some support for this idea; nearly 45% of SMBs expect that at least 25% of their employees will work remotely once pandemic-related restrictions have been lifted. As such, there is a strong need for secure solutions that will enable workers to stay connected. Cisco is well-positioned to help SMBs to navigate the future of work thanks to its role as a well-established vendor of collaboration, networking and security solutions.

Analysys Mason expects that Cisco’s total addressable SMB market will grow strongly

Cisco’s financial performance suffered in 2020 and early 2021 due to the COVID-19 pandemic. Full year revenue declined from USD51 billion in 2019 to USD49 billion in FY2020. Revenue for 2Q FY2021 (period ending 23 January 2021) was flat year-on-year. However, Cisco expects 3.5–5.5% year-on-year revenue growth for 3Q FY2021 (period ending April 2021). There is a strong opportunity for Cisco to grow its revenue even further if it can convince SMBs that it is the right provider for collaboration, cyber security and networking solutions.

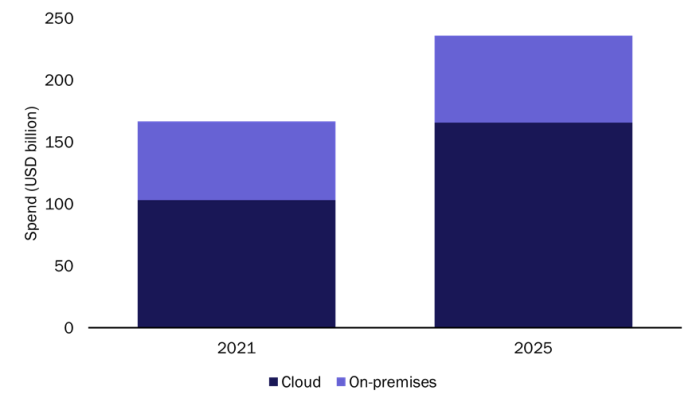

We forecast that SMBs’ spend on collaboration, cyber security and networking worldwide will grow from USD167 billion in 2021 to USD236 billion by 2025 at a combined 4-year CAGR of 9% (Figure 1). The majority of this growth will be driven by cloud-based solutions, the spend on which will increase at a combined 4-year CAGR of 13%.

Figure 1: SMB spend on collaboration, networking and security solutions, by solution type, worldwide, 2021 and 2025

Source: Analysys Mason, 2021

The strong growth in spending on services in these categories is largely due to the rapid shift to remote working in 2020. The results of our survey show that 36% of SMBs started using collaboration solutions as a result of the pandemic. An additional 37% increased their use of collaboration tools in 2020, while 36% of SMBs increased their use of cyber-security solutions. Many SMBs’ requirements for networking solutions also increased during the pandemic; 20% of firms increased their use of networking equipment. Solutions in all three of these categories were critical to enable employees to stay connected. Most of the firms surveyed expect to continue to spend at the same or higher levels throughout 2021.

Cisco is making a push into the SMB space by improving its collaboration offerings

Cisco has taken steps to gain lost ground in the collaboration space by making Webex more attractive to SMBs. Cisco introduced Webex Work in May 2020; it targets businesses with 1000 or fewer licences and includes cloud-based video conferencing and collaboration. Prices start at USD19.95 per licence per month. Cisco also offers a free, scaled-down version of Webex, which provides meetings with 100 participants, HD video, screen sharing and a personal room with no set expiration date.

Cisco has significantly bolstered its Webex offering by adding many new features in the past 18 months. It has used the upgrades to simplify the Webex purchasing process and improve the user experience. The recently added features include personalised backgrounds, colours and interfaces, background noise removal and automated note-taking and transcripts. The product will soon include a “real-time translation” feature for 15 languages.

Cisco is also using acquisitions to further improve its collaboration offering. It announced, on 3 May 2021, that it closed a deal to acquire Slido, a Q&A and polling app that allows meeting participants to more easily interact during video meetings. The goal of the acquisition is to make Webex meetings more inclusive for remote employees. Cisco believes that this is particularly important if there is a mix of remote and on-site employees. Cisco also recently announced plans to acquire Socio Labs, a private Indiana-based firm that delivers an events platform that facilitates virtual and in-person events. Adding this solution to Webex will enable businesses to plan their conferences and seminars around a mix of in-person and virtual attendees. This acquisition is in line with Cisco’s expectations of a hybrid future.

Cisco will need to demonstrate cost-effectiveness and value to regain share from competitors and succeed with SMBs

Cisco lost mind share to firms such as Zoom and Microsoft Teams during the early phase of the COVID-19 pandemic. Decision makers that had used Zoom as consumers found it easy to adopt the solution thanks to its free offerings and simplicity. Similarly, Microsoft Teams was an obvious addition for many SMBs because it is offered as part of Office 365 for no extra cost. After more than a year of uncertainty, business decision makers may be hesitant to make a sudden shift away from products that have worked well enough in the past year.

However, some SMBs may be ready for a change. SMBs are increasingly concerned with cyber security and it is a key consideration for many IT decisions. Cisco may be able to regain share of the collaboration market by demonstrating the value of its integrated security, which companies such as Zoom lack. Cisco’s Secure Remote Work offer bundles Webex, Secure Access, Umbrella cloud security and Cisco Secure Email Cloud Mailbox from USD29.95 per licence per month. However, the security angle may not be as successful with users of Teams because Microsoft also boasts strong built-in security.

Cisco will need to convey the benefits of its unified offerings to small businesses that are often price-sensitive and that pick solutions from different vendors to save money. The key is to demonstrate the lifetime value and high quality of a bundled solution, as well as the simplicity of working with a single vendor. Cisco will also need to demonstrate that it is not simply a vendor for large enterprises. It has begun to do this by offering transparent pricing for Webex and lower-priced solutions and financing options for SMBs. If it continues down this path of innovation, simplicity and price flexibility, it may be able to grow its footprint in the sizeable SMB market.

Article (PDF)

DownloadRelated items

Podcast

SMBs’ IT priorities have shifted following a change to a 'technology-first' mindset

Report

Operator business services profiles: Western Europe 2025

Forecast report

Singapore: telecoms operator business and IT services forecast 2024–2029