CRM vendors have an opportunity to attract SMBs as business leaders plan their 2023 budgets

28 November 2022 | SMB IT

Article | PDF (4 pages) | Business Applications| Cyber Security| Devices and Peripherals| IT and Managed Services| IT Infrastructure| UC and Digital Services

Small and medium-sized businesses (SMBs) are re-examining their IT services budgets and are likely to increase their spending on customer relationship management (CRM) solutions to strengthen their connections with customers and find opportunities for revenue growth. CRM vendors can maximise this opportunity by advertising easy-to-use software and security assurance and by explaining how CRM tools can be used to cope with inflation.

CRM is becoming an increasingly important part of SMBs’ digital transformations

SMBs are seeking ways in which to increase engagement with their customers. As such, CRM is becoming an ever more important component of SMBs’ digital marketing strategies. CRM is especially beneficial due to the rise of omnichannel marketing, which has led to more-complex customer journeys.

For example, a potential customer may discover a product while browsing on their desktop, and then visit a brick-and-mortar store to see the product in person. They may later order the product from their mobile device. CRM software helps businesses to engage with customers at each step of the process.

SMBs’ spending on CRM platforms is likely to increase as the tools’ segmentation and targeting improves. These capabilities are especially useful for influencing customers’ preferences during an economic downturn. Advances in AI have resulted in the ability to provide more-targeted content and to send optimally timed messages via email and chatbots that are hard to distinguish from those sent from humans. For example, HubSpot’s Insights and Adaptive Testing tools include AI-powered content optimisation that can identify key targets and personalise customer interactions.

These developments mean that SMBs’ total spending on cloud CRM applications worldwide is expected to increase at a CAGR of 10.6% from USD45.3 billion in 2021 to USD73.2 billion in 2026. The SMB share of the total market will increase from 49.8% in 2021 to 54.1% in 2026.

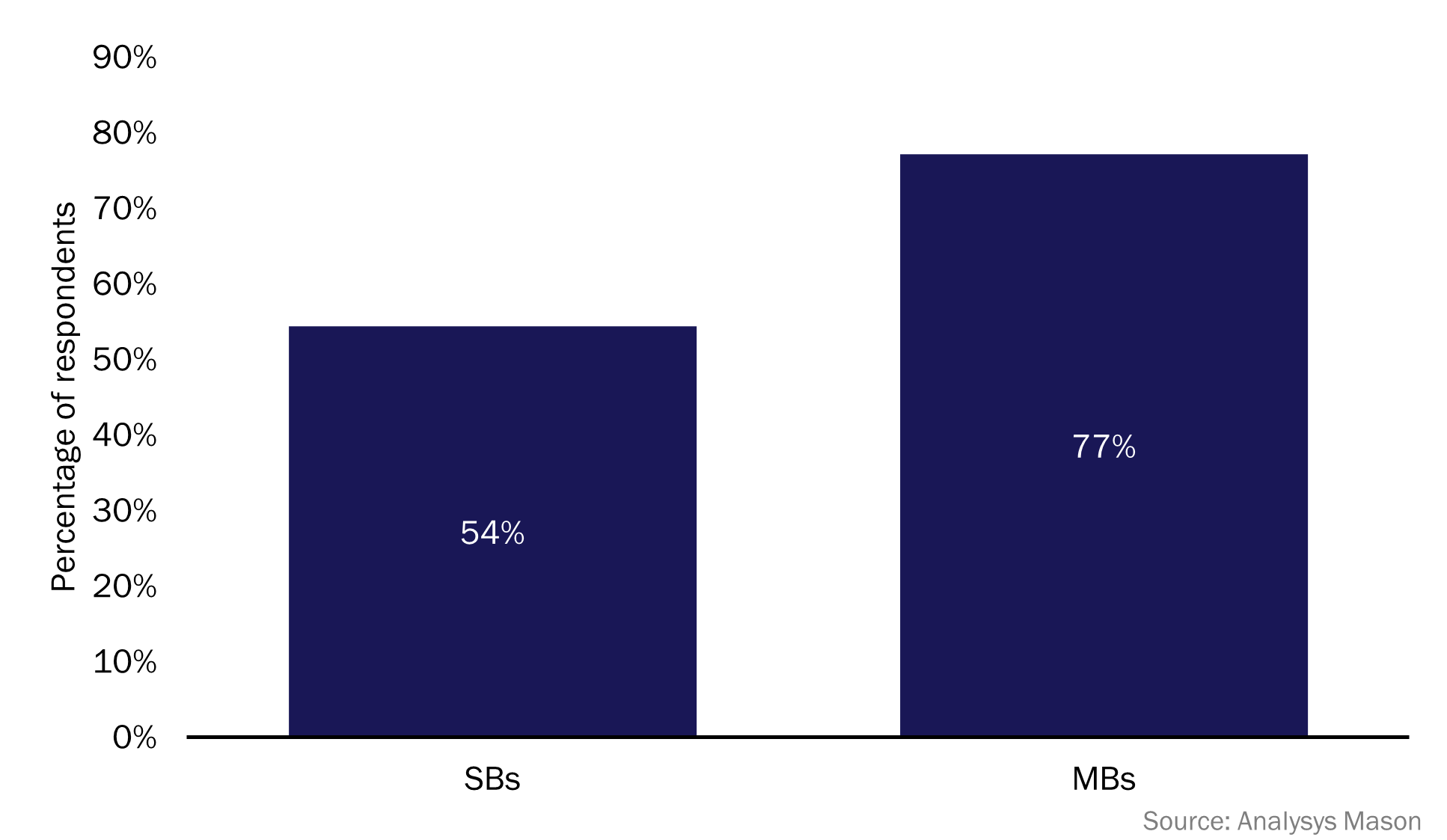

Our recent SMB IT spending study shows that there is strong demand for CRM solutions among SMBs. The findings suggest that the use of CRM software will be similar across all verticals, but that the take-up of such solutions among medium-sized businesses (MBs) will be much higher than that among small businesses (SBs) (Figure 1).

Figure 1: Percentage of SMBs that currently use CRM software applications (cloud/SaaS and on-premises), by business size, Germany, Singapore, UK and USA, 1Q 20221

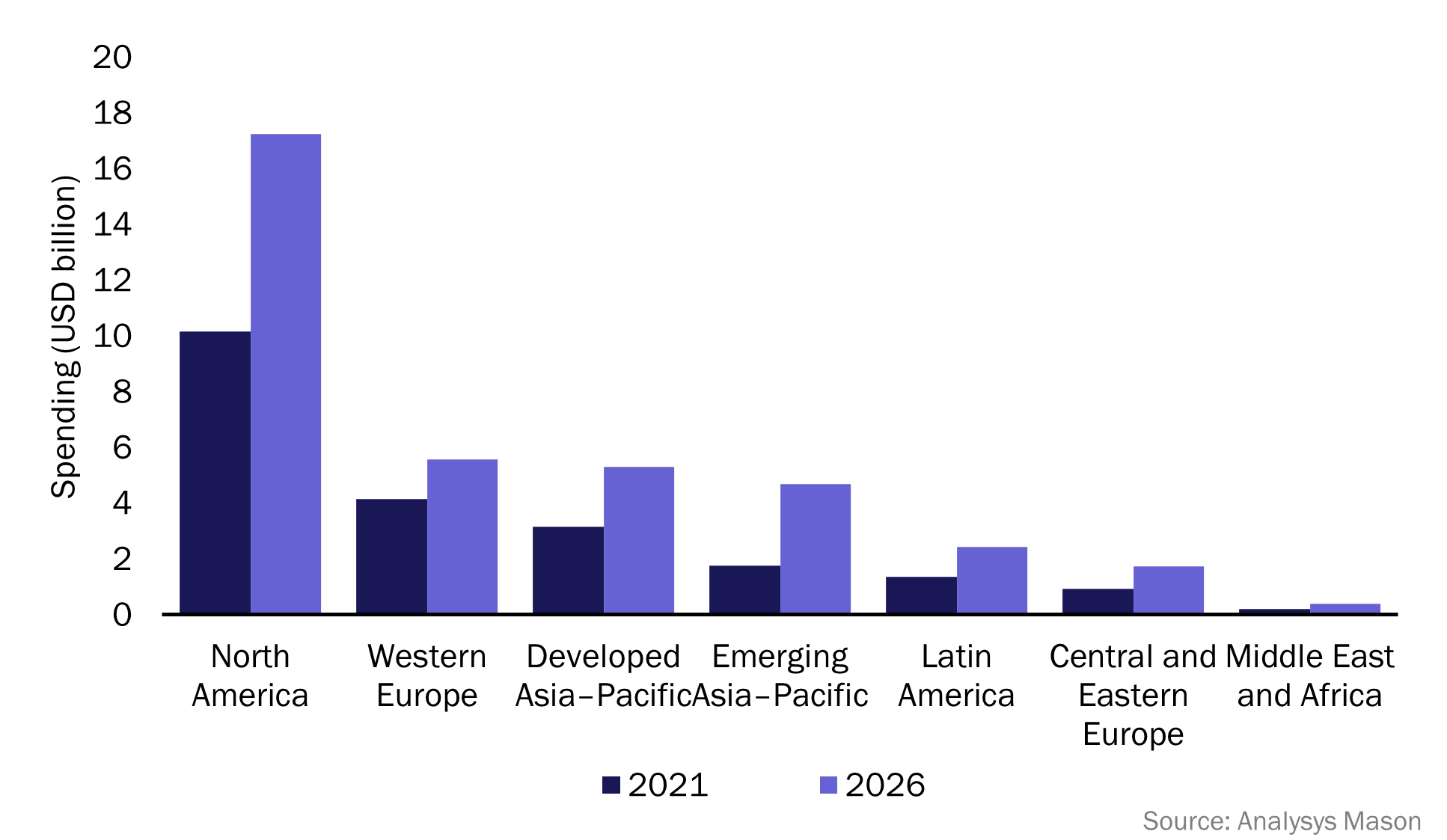

Our SMB Technology Forecaster shows that there are significant differences in spending magnitude and growth across regions. Indeed, Figure 2 shows that SMBs in North America will spend the most on CRM solutions. Spending in this region will grow at a CAGR of 11.2% from USD10.2 billion in 2021 to USD17.2 billion in 2026. This will be driven by the presence of leading CRM vendors in the region and the high adoption of cloud-based solutions. Spending on CRM in emerging Asia–Pacific will grow the fastest between 2021 and 2026 (at a CAGR of 22%) due to MBs’ rapid digitisation in the region.

Figure 2: SMBs’ spending on cloud CRM solutions, by region, worldwide, 2021 and 2026

CRM market leaders may not be doing enough to target SMBs

Macroeconomic factors such as inflation, rising energy costs and slowing economic outputs will have an effect on SMBs’ IT budgets. Business expenditure will increase in some areas, such as energy costs and salaries, so SMBs will look to reduce costs elsewhere. These financial pressures alongside the will to embrace digital transformation will encourage SMBs to invest in cost-saving technology, such as CRM software.

Analysys Mason predicts that the year-on-year growth in SMBs’ spending on CRM cloud software worldwide will decrease only slightly from 11.7% in 2022 to 10.8% in 2023. Growth is then expected to decrease again in 2024 to 10.4%, before picking up in 2025 and growing steadily during 2026. However, spending on CRM software will not be immune to the broader macroeconomic effects and any growth will depend on the actions taken by CRM vendors. Industry leaders will therefore need to work hard to maximise the SMB opportunity and protect their existing market share.

CRM software providers should include SMB-specific selling points in their marketing material

Vendors should take steps to communicate the importance of a comprehensive CRM solution to SMBs. These steps might include the following.

- Promoting how CRM can help SMBs to optimise sales in inflationary environments. CRM software provides readily available data to enable SMBs to analyse prices and margins in order to efficiently target and communicate price increases to certain customers. Vendors should demonstrate that their CRM solutions can help SMBs to gain insights into their customers’ pricing sensitivities. These insights will provide better direction on how much of their rising costs SMBs can pass on to customers without affecting loyalty.

- Improving low-code development technologies. Salesforce has made the “world’s first real-time CRM platform”, Genie, with lake house architecture. This system permits the storage of very large volumes of data and is able to adapt to new data as it is received to optimise the timing of messages and create more-personalised connections. This development suggests a move towards composable architecture and API-first resources, but smaller businesses are currently unable to afford either the platform or the staff required to implement workflows. Salesforce and other CRM vendors should therefore continue to build low-code technology that is more accessible and affordable for SMBs.

- Advertising security assurance. Data security is increasingly important due to advances in data regulation, current geopolitical issues and the increased number of connected devices. Emails, contact details, names, job titles, addresses, passwords and transaction sums are valuable and sensitive pieces of information that SMBs are keen to protect. The ability to protect customer data is also increasingly important for corporate social responsibility (CSR) and environmental, social and governance (ESG) goals, especially for SMBs that store sensitive customer information, such as those in the healthcare or finance sectors. CRM vendors should promote the ways in which their platforms keep data secure.

CRM industry leaders that continue to focus their attention on developments that are relevant to SMBs are likely to increase their opportunity in the SMB space. SMBs will be a critical segment for overall revenue growth as the adoption of CRM solutions by large businesses reaches saturation.

1 Analysys Mason conducted a survey of 1149 SMBs in Germany, Singapore, the UK and the USA between December 2021 and January 2022. Question: “Which of the following front office-related applications does your firm currently use or plan to use/upgrade in the next 12 months? If upgrading a product now in use, be sure to check both “use” and “upgrade” columns.” n = 1149.

Article (PDF)

DownloadAuthor