Operators are well-placed to capitalise on the rapid growth in subscription gaming: consumer survey insights

Listen to or download the associated podcast

Digital gaming is important to operators because gaming is a popular, high-frequency activity and generates significant revenue. Our 2021 consumer survey of 23 500 online adults in 24 countries also shows that subscription gaming is quickly gaining popularity and we believe it to be a good fit for operators. Operators should target hardcore gamers with high-value, high-performance 5G and fibre packages.1 They can also capitalise on the increasing popularity of subscription gaming to generate direct revenue.

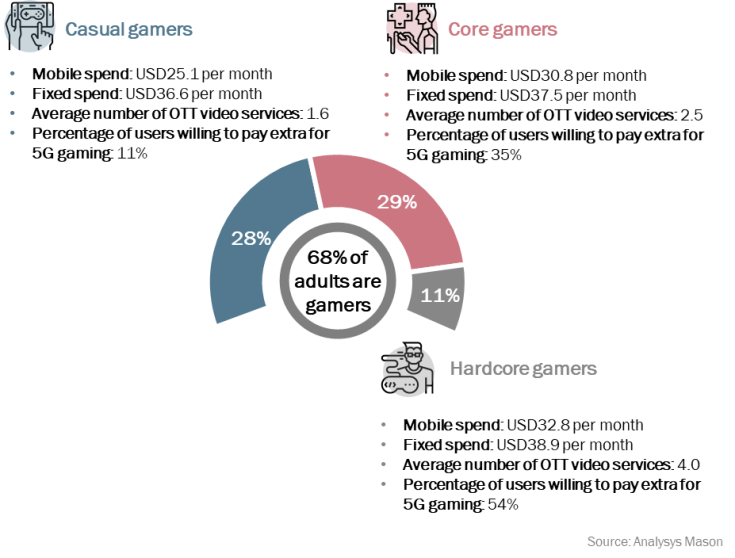

Figure 1: Selected spend metrics for different categories of gamer, 3Q 2021

Digital gaming is important to operators because gaming is popular, high-frequency and generates significant revenue

The worldwide digital gaming market was worth around USD165 billion in 2021.2 As shown in Figure 1, over two thirds of the world’s population play digital games. Gaming is important for telecoms operators because it is high-engagement, drives demand for high-performance connectivity and has high revenue growth potential. Our latest consumer survey covers gaming in Europe, the USA, Asia–Pacific(APAC) and the Middle East and Africa (MENA) in 3Q 2021.

Mobile devices are a vital part of the gaming ecosystem, which means that gaming is particularly relevant to telecoms operators: 89% of gamers in emerging Asia–Pacific (EMAP) play on mobile devices compared to 74% in the USA and 66% of those in developed Asia–Pacific (DVAP). Gaming has been offered as a value-added service (VAS) in EMAP for several years, which has helped to boost the number of gamers on mobile devices, and gaming is now being used to promote 5G in the region (as it has been elsewhere in the world).

Gamers tend to be young and are more likely to frequently change their fixed and mobile providers than non-gamers.3 They spend more on telecoms and media than non-gamers (as shown in Figure 1), so they are valuable to operators.

Subscription gaming is rapidly gaining popularity and is a good fit for operators

Around 60% of gamers in our panel paid for games in 2021. Transactional, upfront purchases are still the most-common way to pay for games, but subscription gaming is starting to replace this in certain countries. For example, only 54% of paying gamers in Italy (where incumbent TIM has a subscription gaming service) bought games upfront, compared to 75% in Sweden. The share of paying gamers that used subscription services increased from 27% to 37% in Europe between 2020 and 2021 and from 32% to 46% in the USA.

Consumers frequently pay the games developer directly for these subscriptions (for instance, in the case of a subscription to a single game such as World of Warcraft) but operators are also increasingly able to act as billing partners for such services, especially for cloud gaming services that aggregate multiple titles. For example, Google Stadia, PlayStation Now, Xbox Cloud Gaming and other providers have embraced such a model alongside more-standard credit/debit and PayPal payment options.

The role of operators as service aggregators is a good match with gamers’ growing willingness to pay for game subscriptions. Gamers that pay for subscription services stack more OTT video services than those that do not. Operators are therefore likely to achieve synergies by aggregating OTT video services and gaming services through the same interface, rather than just the same billing platform as, for example, Telecom Italia has done with TIMGAMES. Operators should consider adding gaming services (cloud gaming services in particular) to flexible bundles of TV channels and OTT video services for a fixed monthly fee.

Operators should target hardcore gamers with high-value, high-performance 5G and fibre packages

Connectivity spend differs significantly between the various types of gamers, as shown in Figure 1 above. The more intensive the gaming, the wider the range of digital services used (such as payments, OTT apps and social media) and the higher the spend on connectivity.

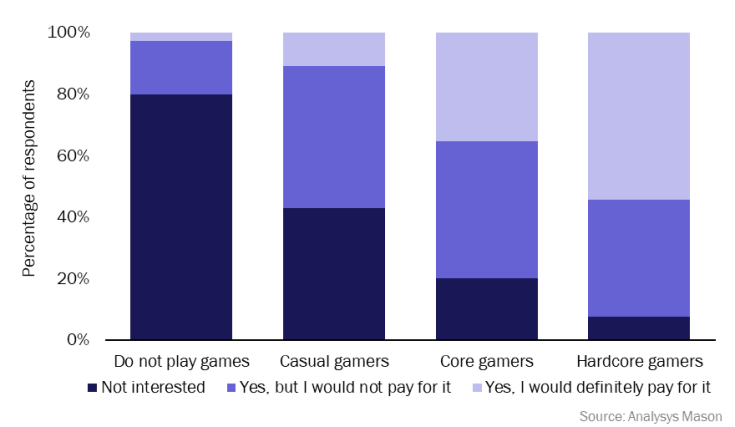

Operators are already using gaming and cloud gaming as part of their go-to-market messaging around 5G and fibre. Many casual gamers, especially in countries such as Malaysia where 5G has only just been launched, are still unaware of how 5G can improve their gaming experience. In these cases, operators will need specific campaigns that aim to inform users of how 5G improves the gaming experience. Core and hardcore gamers, on the other hand, as shown in Figure 2, have well-defined expectations. They are already highly engaged with gaming and are the most likely to pay for an upgrade in performance. They are also receptive to trying new gaming experiences such as XR, which are often greatly enhanced by 5G.

Figure 2: Willingness to pay for 5G to enable an improved gaming experience, by consumer type, worldwide, 2021

High-speed, low-latency connectivity is essential for these high-end consumers. Appropriate 5G and fibre broadband tariffs (specifically those that promise to reduce latency) will appeal to this group, as, indeed, will converged 5G–fibre tariffs. Casual gamers may also be receptive to 5G-enabled gaming services and bundles in the long term.

Operators should therefore target core and hardcore gamers with their high-value, high-performance 5G packages. However, operators must partner with gaming service providers to educate consumers on the value of upgrading their gaming experience to maximise the potential value of next-generation gaming.

1 For more information about these categories of gamers, please see Analysys Mason’s Segmenting the gaming market for telecoms operators.

2 For more information, see Analysys Mason’s How can telecoms operators conquer the mobile gaming industry?

3 For more information, please see Analysys Mason’s regional consumer survey reports related to gaming: Digital gaming in developed Asia–Pacific: consumer survey; Digital gaming in emerging Asia–Pacific: consumer survey; and Digital gaming in Europe and the USA: consumer survey.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Article

TV services remain essential for many operators, even if media asset sales mark a change in ambition

Article

Operators need ways to pre-empt tech players gaining ground in the consumer telecoms market

Forecast report

France: pay-TV and streaming video forecast 2024–2030