Operators in the Middle East should partner with OTT video providers to attract a wider user base

27 April 2020 | Research

Article | PDF (5 pages) | The Middle East and Africa| Video, Gaming and Entertainment

OTT video is gaining popularity in the Middle East, but at the same time, pay-TV providers are struggling to grow their customer bases and maintain margins. This has encouraged a few telecoms operators, such as Etisalat, Ooredoo and STC, to introduce their own OTT services. Operators have previously had mixed success in bundling third-party OTT video services into their core triple-play propositions.

This article shares results from our mobile consumer survey that highlight the importance for operators to establish commercial relationships with different OTT providers so as to capitalise on the growing popularity of OTT video services and appeal to a broader consumer base.

The penetration of paid-for video services among smartphone users in the Middle East has been steadily increasing

Analysys Mason conducted a survey of 4500 smartphone users across Kuwait, Oman, Qatar, Saudi Arabia and the UAE between August and September 2019 as part of the Connected Consumer Survey. Consumers’ use and preferences for TV and video services was assessed.

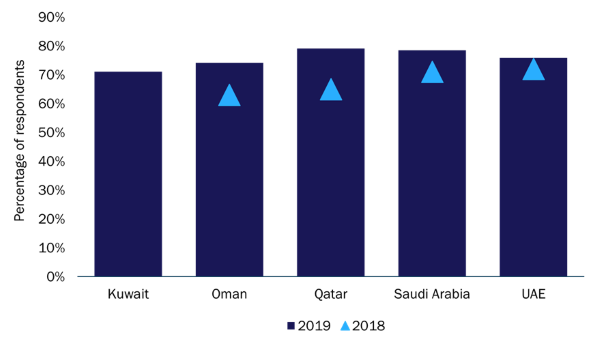

We asked respondents whether they subscribed to paid-for online video (over-the-top (OTT)) services and compared the results to those from 2018 (Figure 1).1 The take-up of OTT video services is high compared to that in other regions and it increased between 2018 and 2019, especially in Oman and Qatar. We expect that traditional pay-TV services, received via IPTV or satellite, are not sufficient to address the growing needs for content quality and choice.

Figure 1: Penetration of paid-for online video services, by country, Middle East, 2018 and 2019

Source: Analysys Mason, 2020

Most respondents have access to traditional pay-TV services, but there is a risk that consumer preference will shift towards OTT

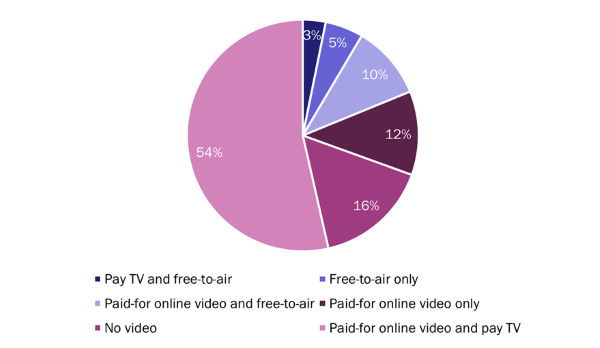

More than half of the respondents reported using paid-for online video and pay-TV services side-by-side (Figure 2). Most have access to online video either through a free app provided by their pay-TV provider or by signing up to a third-party streaming service such as Netflix. Only 12% of respondents indicated that they only had paid-for OTT services.

Figure 2: Proportion of respondents using different video services in the Middle East, 2019

Source: Analysys Mason, 2020

We forecast that traditional pay-TV and OTT video services will largely co-exist over the next 5 years in the Middle East and North Africa.2 OTT video services will thrive in countries where consumers have large disposable incomes and where the broadband penetration is high (such as Qatar and the UAE). We do not anticipate that there will be significant cord-cutting in the region, but operators’ share of the paid-for video services market could be at risk of cannibalisation from OTT players.

The high penetration of Netflix in the region puts pressure on the mobile video propositions from operators and pay-TV providers

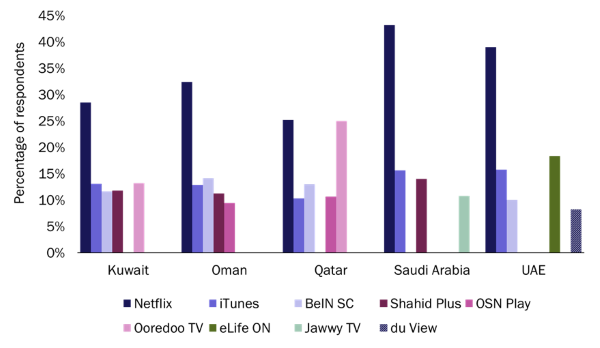

The demand for richer, on-demand video services from consumers in the region has attracted the interests of traditional pay-TV providers, telecoms operators and global OTT players, and has enabled local OTT players to emerge. Figure 3 shows the penetration of the top online video services that mobile consumers reported using.

Figure 3: Most popular paid-for online video services reported by respondents in the Middle East, by country, 2019

Source: Analysys Mason, 2020

Netflix was most popular in all five countries, and several operator OTT services were found among the most popular services. Ooredoo TV was used by a quarter of mobile respondents in Qatar and eLife ON was used by 18% of Etisalat’s customers in the UAE. Jawwy TV, the multi-screen proposition from STC that was launched in 2018, was used by 7% of respondents in Saudi Arabia. STC ultimately aims to use Jawwy TV to increase its share of the video market across the whole of the Middle East, not just in Saudi Arabia. The success of OTT providers puts pressure on local pay-TV providers and operators with IPTV services to remain competitive, not only regarding prices,3 but also in terms of content diversity.

Operators should expand their partnerships with OTT players to strengthen their multi-screen and pay-TV propositions

Operators should form commercial partnerships with OTT video providers to enhance their pay-TV propositions. The alternative is to accept greater competition and, ultimately, an erosion of either price or take-up. Operators have so far been more successful in forming such partnerships with local OTT video providers such as Starz Play and OSN WAVO than with international players such as Netflix.

In the Middle East, these commercial partnerships are often based on offering new customers a time-limited free trial to an OTT service. Elsewhere in the world, OTT players are beginning to bundle their video services alongside pay TV at a discounted price (for example, Sky offers a 29% discount on its Netflix bundle in the UK) and new OTT providers are signing ‘wholesale exclusivity’ contracts (for example, Zain was offering free access to iflix for 6 months to its customers in Bahrain, Iraq, Jordan, Kuwait and Sudan in 2018 and Disney+ has signed similar contracts in Europe in 2020). Operators can act as gateways to large OTT players’ content, even if they cannot secure preferential rates, and can thus benefit from co-branding and an enriched content portfolio.

Partnering with operators offers OTT players an opportunity to expand their addressable markets. Operators are more likely to negotiate favourable terms with niche OTT players (for example, those that offer language-specific content) than with global OTT players due to reduced bargaining power with the latter. Operators can therefore offer niche OTT bundles at a discount. However, this may change as competition intensifies and the local markets saturate.

Ultimately, operators cannot attempt to operate independently of the OTT video revolution; they should aim to establish relationships with different OTT players to integrate their services and content propositions. This will enable them to capitalise on the growing demand for OTT video services.

1 Note that Morocco was replaced with Kuwait in the 2019 survey.

2 For more information, see Analysys Mason’s Pay TV and OTT video in the Middle East and North Africa: trends and forecasts 2019–2024.

3 For example, a subscription to Amazon Prime Video in the UAE costs only AED16 (USD4.4) per month.

Download

Article (PDF)Related items

Pay TV and streaming video in Switzerland: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in the Netherlands: trends and forecasts 2023–2028

Forecast report

Pay TV and streaming video in Finland: trends and forecasts 2023–2028