The small and medium-sized business (SMB) market offers significant opportunities for vendors and telecoms operators.

There are 150 million SMBs worldwide and they will spend USD1.45 trillion on IT solutions in 2023.

However, there are significant challenges to understanding the fragmented, regional and highly complex market and pinpointing where your product opportunities are.

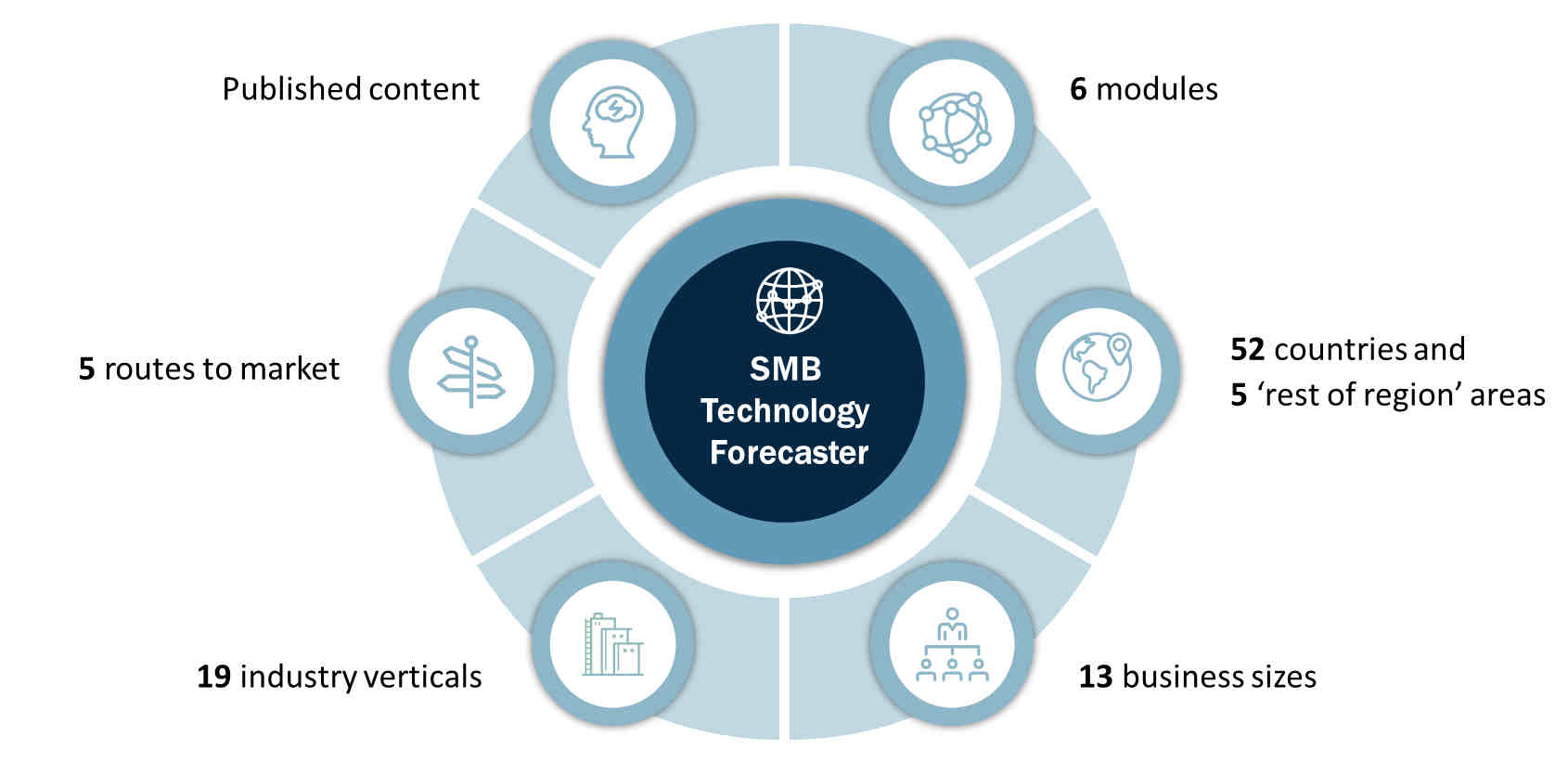

Analysys Mason's SMB Technology Forecaster is an essential tool that helps clients to forecast, inform and validate their marketing and channel strategies with precision and confidence. Underpinned by extensive primary research, granular demand insights and macroeconomic data, the SMB Technology Forecaster is stress-tested to ensure accuracy and predictability, providing granular forecast data to enable our clients to answer business-critical questions such as the following.

Strategic questions to answer to unlock SMB IT spending opportunity

- Economic: what impact are events having on SMB IT spending and my opportunity to sell to SMBs?

- Channels: which sales channels are the most effective for my product?

- Business segment: what are SMBs’ top IT priorities by segment?

- Region: which geographical regions should I focus on?

- Behaviour: which IT solutions do SMBs prefer to purchase?

- My opportunity: what is the overall opportunity for my IT solutions within the SMB ecosystem?

SMB IT research modules

Other modules are available on request:

- USA 50 states IT spending

- USA public sector IT spending

- USA 50 states channel partner counts

- Global channel partner counts