Business survey 2023: telecoms operators are gaining share in the SME ICT services market in the USA

29 June 2023 | Research

Article | PDF (4 pages) | SME Services| Business Applications| Cyber Security| Devices and Peripherals| IT and Managed Services| IT Infrastructure| UC and Digital Services

Analysys Mason recently surveyed 274 small and medium-sized enterprises (SMEs) in the USA, asking them about their IT-related needs, supplier selection criteria and propensity to churn. The survey also asked SMEs about their relationships with IT and connectivity service providers. 14% of SMEs reported changing service providers in the previous 6 months and almost twice as many switched to telecoms operators as switched away from operators. SMEs reported that they are looking for innovation, a wider range of offerings and more value from service providers. Overall, SMEs are tending to switch to providers that can deliver a managed services wrap. This points to an opportunity for operators – those that can provide cost-effective, managed solutions with business-level service and support should be in a good position to win SMEs over from other channels.

SMEs are switching ICT providers to obtain more innovative partners, a wider range of tailored solutions and better value

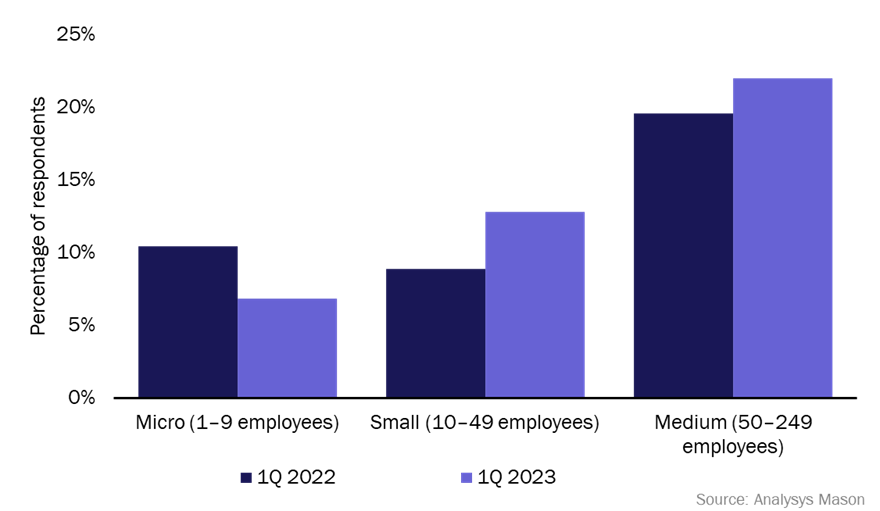

Figure 1: Percentage of SMEs that switched service provider during the previous 6 months, by business size, 1Q 2022 and 1Q 20231

14% of SMEs surveyed reported switching a service provider in the last 6 months. This is relatively unchanged from the SME survey in 2022 (13%), although the incidence among small businesses and medium-sized businesses was higher year-on-year, and higher than among micro businesses. We have seen that the incidence of changing providers has stabilised somewhat over the last 2 years as SMEs’ business operations have levelled out.

SMEs report they are looking for innovative, strategic partners that can provide advice, support and a wide range of tailored solutions that will grow with their evolving business needs:

- 69% of SMEs that reported switching a service provider during the previous 6 months said they did so because they felt their old provider’s product/service options were too limited or no longer tailored to their needs, or the provider demonstrated a lack of vision and strategy

- 54% reported changing providers because of pricing or value-for-money issues

- 51% reported a variety of customer care reasons for switching, such as poor response times, account management, communications, customer service or customer experience.2

Providers have been improving some metrics among SMEs. For example, only 38% of SMEs switched because of the IT service provider’s lack of vision and strategy, (a decrease from 44% in 1Q 2022). 10% of SMEs switched specifically because of poor communications on the part of the service provider, down from 28% of respondents in 1Q 2022.

Telecoms operators and MSPs/SIs are gaining customers from vendor direct and VAR/reseller channels

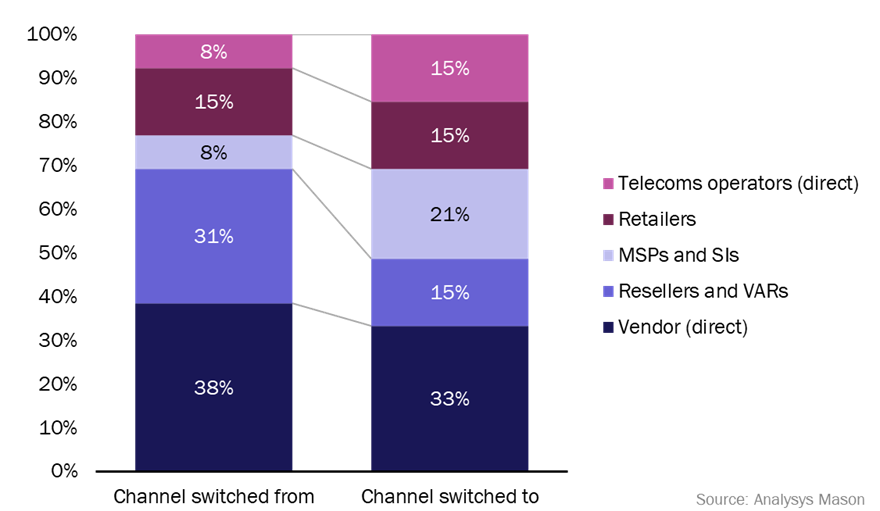

Telecoms operators and managed service providers (MSPs)/systems integrators (Sis) are gaining customers from vendor direct and value-added reseller (VAR)/reseller channels. As SMEs’ demand for cloud solutions and managed services increases, it is not surprising that their channel usage is changing over to MSPs, SIs and telecoms operators, which can provide managed IT solutions as part of connectivity contracts (that is, they are switching to channels that provide managed services support).

Figure 2: SME switching activity in the last 6 months, by channel, 1Q 20233

Telecoms operators have an opportunity to gain SMEs’ business if they can provide a range of customisable IT and connectivity solutions that are packaged with a comprehensive service and support wrap, and are offered at cost-effective prices. Some US-based telecoms operators, such as Comcast and Verizon, have been adding to their IT service portfolios to expand their range of offerings for SMEs. Telecoms operators are upselling IT services, including Microsoft 365, managed cybersecurity solutions and cloud services as part of their SME bundles and SMEs are responding favourably.

Operators that can provide SMEs with more individual attention and support will be in a good position to win SMEs’ business

Operators will continue to face increasing competition from MSPs, but several aspects of the SME–operator relationship are probably helping to increase operators’ share of SME spend. SMEs appreciate the ‘one-stop-shop’ aspect of purchasing everything from one vendor with one monthly bill and take comfort from partnering with a well-known provider with whom they have an existing relationship. Operators also have the advantage of scale, which can help them to price services competitively, and well-established sales and customer service processes to provide tailored customer care for small businesses.

Many operators are focusing on smaller businesses – targeting them with education, training and digital transformation support to help build a more advisory relationship; for example, Verizon’s Small Business Digital Ready programme provides small businesses with free online courses, tools, coaching, peer networking and grants. In addition, operator sales teams should provide SMEs with individualised attention, an assessment of needs and education about the benefits of various IT solutions. Operators that can provide SMEs with services such as assessments, advice, design/planning services and business-level service and support should be in a good position to win SMEs over from other channels.

1 Question: “Please tell us if your company has switched to a new channel partner (such as MSPs/SIs, Resellers/VARs, retailers, telecom operators, vendors) in the last 6 months.”; n = 274 (2023), n = 273 (2022).

2 Question: “Why did your company switch to a new channel partner in the last 6 months?”; n = 39 (2023), n = 36 (2022).

3 Question: “Please indicate the channel type you switch from and channel type you switched to in the below.”; n = 39 (2023).

Article (PDF)

Download