Strategies to maximise the returns on first-phase 5G deployment

10 August 2020 | Research

Strategy report | PPTX and PDF (27 slides) | Operator Investment Strategies

This report provides an assessment of 5G progress to date and reviews the key decisions that will affect its commercial success in the early 2020s for many players in the value chain. The report is designed to showcase the wealth of 5G-related research that Analysys Mason has carried out already, and to provide a taster of our thinking about how 5G will evolve in future. Each section distils key messages from a body of reports and provides links to the in-depth documents, as well as a full bibliography.

The report summarises the surveys, interviews and case studies that have been conducted across many of Analysys Mason’s research programmes to dissect the wide diversity of business opportunities provided by 5G for vendors and operators, as well as the key risks.

It is based on:

- our findings from over 60 5G-related AM reports, which are based on a wide variety of research, including annual regional consumer surveys, capex and opex forecasts, vendor market share and revenue forecasts in 5G technologies, enterprise requirements surveys, and case studies and interviews with a wide variety of stakeholders

- discussions with analysts in many Analysys Mason practices to achieve a consensus view on key aspects of the 5G business case.

Key questions answered in this report

- What have been the main commercial successes and failures of 5G so far?

- How is 5G affecting operator capex and opex?

- To what extent is 5G driving adoption of digital platforms, or vice versa?

- Is 5G a catalyst for significant disruption for established vendors and/or operators?

- Which are the most important consumer use cases in the 5G model for the early 2020s?

- What needs to be done to unlock enterprise and IoT potential for 5G?

Who should read this report

- Senior executives in operator, vendor and investment companies, who need a high level view of the wider 5G picture to support decision making.

- Strategy and business planning teams that need a one-stop overview of the key issues, with the ability to link easily to more-detailed information on each element.

Contents

- Executive summary

- Challenge: 5G’s many promises are not yet proven and operators and vendors must avert a loss of confidence at a critical moment for investment

- Solution: operators can score quick wins by playing to their strengths, but they must also decide which emerging 5G opportunities best align with their capabilities

- Recommendations

- There are immediate opportunities to monetise 5G’s network performance – by offering more and richer mobile services, while also reducing costs to deliver data

- Beyond the monetisation of improved connectivity, 5G business models are diverse, and operators must select those which align with their strengths

- For many operators, content and VAS partnerships will be necessary to improve the continuity mobile case and to attract consumers to 5G

- Fixed-wireless access is an example of a new 5G consumer service that can be monetised at an early stage by operators in certain scenarios

- Operators can leverage new enablers such as edge compute to expand their 5G consumer services, but they will also require new ecosystem partnerships

- An operator’s options will depend how far and fast it adopts the cornerstones of the ‘full 5G’ platform: cloud-native core, vRAN, automation and a service platform

- The cloud-native 5G core and, eventually, the vRAN will define full 5G, but these are challenging migrations; most will move step-by-step to achieve incremental ROI

- Growing levels of automation will be essential to support the 5G business case and to maximise the benefits of the migration to cloud-native networks

- The culmination of the migration to cloud-native, automated networks is a dynamic, sliceable platform that allows operators to support vast numbers of services

- Cloud-native, automated platforms can support a diversity of use cases, and enable operators to capture up to 50% of the available revenue in many value chains

- New, digital operators will set the pace for a cloud-based, asset-light approach to deploying 5G; established operators will need to emulate that agility

- To achieve a broad, cross-industry position, operators will take a phased approach commercially as well as technically

- Technology and platforms are not just about performance; they must support agility so that operators can adjust easily to multiple enterprise ecosystems

- Participation in, and collaboration with, a strong ecosystem of partners will be critical to building successful industrial IoT solutions

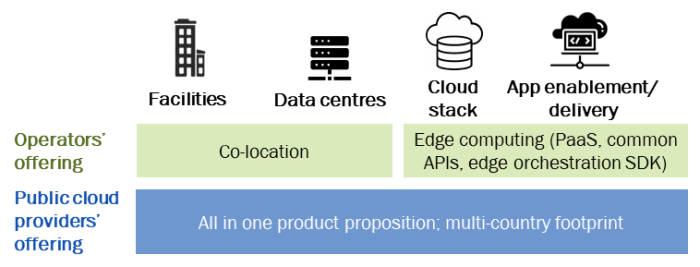

- Edge computing will be an important way to enhance an operator’s B2B and B2B2C role, and the right choice of partners will be critical in this market too

Executive summary

5G is now at an important juncture. After a year of commercial deployments, we have some ability to assess its impact on the telecoms market. Multiple pressures, exacerbated by COVID-19, risk a loss of confidence throughout the value chain if operators are unable to deliver quickly on 5G’s promises in four key areas: cost, consumer, enterprise and digital transformation.

Analysys Mason has published over 60 5G-related reports in the past year, which provide deep insights into the impact of 5G so far, and the commercial and architectural decisions that lay ahead in the 2020s. This report draws on this body of evidence to demonstrate the gains so far, but also the shortcomings of the first-stage 5G model. The next phase must build on foundations laid in the consumer markets and leverage the migration to cloud-native platforms to expand the business model (with reasonable cost and risk mitigation) to create new opportunities in enterprise.

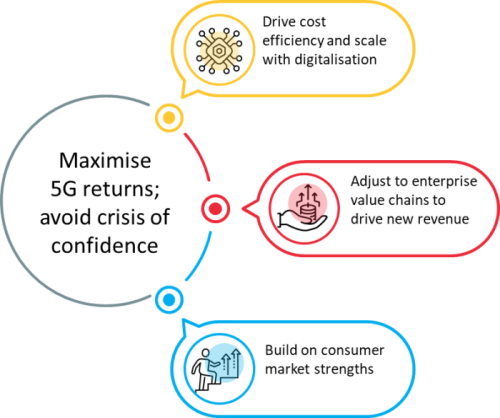

Figure 1: Three steps in a successful 5G migration

Source: Analysys Mason, 2021

Challenge: 5G’s many promises are not yet proven and operators and vendors must avert a loss of confidence at a critical moment for investment

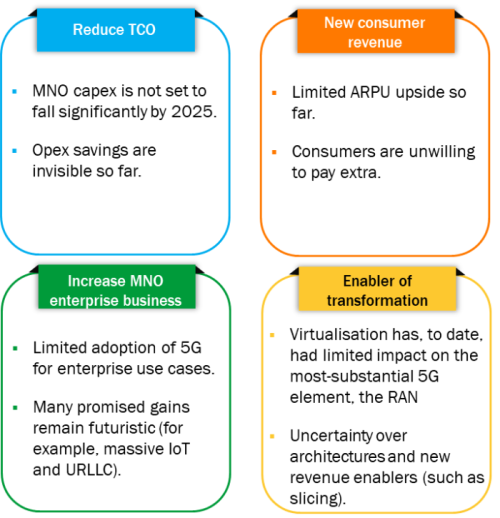

Many promises have been made for 5G and its potential to transform the operator’s business case in the 2020s. The more-realistic of these promises fall into four main categories:

- significant reduction in mobile total cost of ownership (TCO)

- new user experiences that can be monetised directly

- support for significantly improved mobile enterprise revenue based on new IoT and ultra-reliable low latency communications (URLLC) use cases

- 5G as an essential element of a digital transformation strategy, for operators and their enterprise customers.

Not all operators will target all goals at once. In particular, some will see transformation or enterprise expansion as too risky, especially amid the economic uncertainty created by COVID-19. However, each one will need to see results in at least some categories.

The first wave of commercial 5G deployments were carried out in a conservative way that was closer to 4G+, so measurable commercial results have, so far, been modest. While that was to be expected in the first phase, 5G is now approaching an important juncture where investors, governments, enterprises and consumers are looking for more-dramatic impact. Amid economic and geopolitical uncertainty, MNOs may be tempted to stay on a conservative deployment track. However, this would risk a blow to confidence in 5G’s ability to deliver its grander visions, which would affect investment and adoption during 2020 and 2021.

Figure 2: 5G promises benefits in four key areas, but these are not proven based on first phase results

Source: Analysys Mason, 2021

Solution: operators can score quick wins by playing to their strengths, but they must also decide which emerging 5G opportunities best align with their capabilities

While it may seem counter-intuitive to take bold commercial or architectural steps during an economic crisis, it is essential for operators to work with their supply chains and their partners to move to the next phase of 5G deployment.

It is important to establish some immediate gains from the first phase of 5G deployment, whether in improved cost efficiency or an enhanced offering for certain familiar user bases. For some operators, adding fixed-wireless to their mobile service is an example of expanding the proposition for the existing base.

However, while early-stage 5G deployments have largely addressed conventional KPIs, a more-radical business plan is required to deliver all the promises of 5G – not just for MNOs but for other stakeholders such as enterprises. Unlike 4G, there is no common formula for 5G success. It enables a wide range of opportunities to reach new markets, enhance value propositions, and support new cost and pricing models.

5G roll-outs, together with broader digital transformation and cloud migration, enable operators to address a wider variety of these opportunities from a common platform. However, they must also prioritise the 5G-enabled goals that best align with their current strengths in markets, services and partnerships. No operator will be able to address all of the 5G opportunities at once. Instead, they must identify the most-promising areas of expansion and transformation, and plan their next phase of network build-out and service launches accordingly.

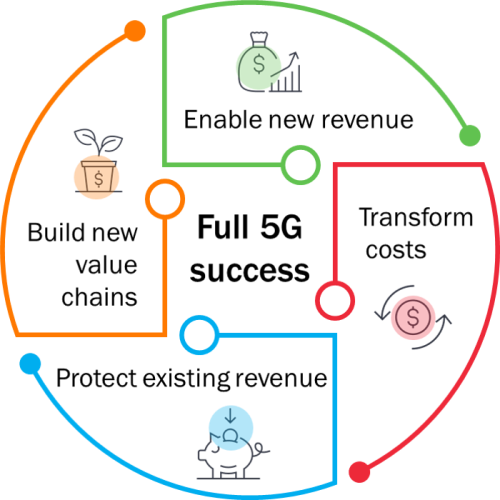

Figure 3: A holistic approach to 5G will deliver maximum benefits but some operators can succeed by focusing on just one area

Source: Analysys Mason, 2021

Recommendations

The ‘continuity mobile’ model has ROI limitations. Operators need to assess how much focus to put on cost savings versus investing in new revenue opportunities.

Operators can use 5G to monetise demand for better user experiences of existing services, such as video streaming. Returns for ‘continuity mobile’, however, will be limited, which will put pressure on 5G to deliver cost savings. New types of content and services are needed to stimulate demand for increased network performance, but the enabling ecosystems are currently immature. Operators must decide which partnership strategy to adopt.

Cloud-native platforms offer the greatest potential for revenue growth, but migration must be aligned to commercial priorities with ROI at each stage.

Vendors must work closely with operators to ensure that the challenging migrations to virtualised or cloud-native RAN and core are well-managed, with clear, step-by-step roadmaps that deliver incremental returns at each stage, while also enabling a fully agile service platform as the end goal. This platform, including network slicing, will deliver the greatest returns by enabling operators to target a wide range of industries and use cases.

The ecosystem must adapt to new platforms and partnerships to lower the barriers to adoption of 5G for enterprise and IoT services.

Targeting 5G opportunities in the enterprise market (especially when they involve emerging platforms such as industrial IoT (IIoT) and edge computing) requires significant change in ecosystem relationships, not just technology. Vendors, operators and enterprises need to co-operate by agreeing the best way to ensure that 5G networks –initially built for generic mobile broadband – can be optimised for the specific needs of many industries.

There are immediate opportunities to monetise 5G’s network performance – by offering more and richer mobile services, while also reducing costs to deliver data

As of June 2020, 78 operators had launched commercial mobile 5G services. Some of these are just augmenting capacity for 4G services in areas of heavy usage, while others (notably, the major operators in China, South Korea and the USA) are rolling out broad 5G coverage at a rapid rate.

To date, only three operators have a 5G standalone network (which works with a 5G core) in commercial use. The most-common pattern is to deploy 5G in areas of high data usage to increase average speeds, improve quality of experience and so support some new or enhanced applications. For most operators, this provides a pragmatic way to start the complex migration to full 5G platforms and service models, but it carries the risk of a limited commercial result.

The key, in this first phase, is to be able to leverage the improved network performance in order to improve some KPIs, which might be to increase revenue, to reduce the cost of delivery, or to reverse ARPU decline and gain market share. 5G also has the potential to support a range of emerging services that can benefit from high-performance mobile networks. These include cloud gaming, advanced video experiences, and augmented/mixed reality experiences.

5G fixed-wireless access (FWA) offers an opportunity for many MNOs to better address the home broadband market, potentially opening up a new revenue stream.

Figure 4: Revenue opportunities for operators in the consumer 5G space

Source: Analysys Mason, 2021

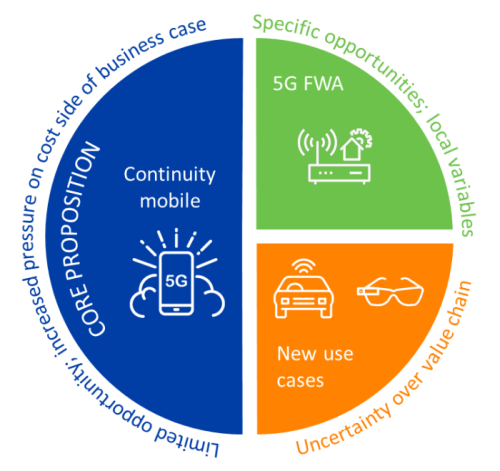

Beyond the monetisation of improved connectivity, 5G business models are diverse, and operators must select those which align with their strengths

Central to Analysys Mason’s research is a collection of case studies of individual operators, combined with broad-based surveys of consumers. These are conducted annually in all major regions, and provide insights into the diversity of 5G strategies. These case studies show that most MNOs are adopting a combination of three main strategies (outlined below) in consumer markets, with each placing more or less weight on each one.

- Enhancing familiar connectivity models with new approaches to pricing such as speed tiering or low latency. This will often be necessary just to maintain current ARPU levels as consumers expect more for their money, so cost efficiency will also be key.

- Bundling content and value-added services (VAS) with connectivity. This will be important to build on 5G connectivity to generate new usage and revenue, rather than just keeping ARPU stable.

- Starting to enhance existing propositions by harnessing 5G capabilities such as improved support for AR/VR, and then extending these services to new user bases, including B2B services within the value chains.

The last two strategies span a diversity of services including video streaming, broadcasting, AR-enhanced navigation, cloud gaming and many others. Each comes with different demands and different value chains, and MNOs should initially focus on those areas where they have existing presence.

Figure 5: Advantages and disadvantages of various (not mutually exclusive) 5G pricing approaches

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Speed tiering |

|

|

| Content and VAS bundling |

|

|

| Price premium |

|

|

| Multi-device approach |

|

|

Source: Analysys Mason, 2021

For many operators, content and VAS partnerships will be necessary to improve the continuity mobile case and to attract consumers to 5G

Skilful 5G pricing strategies will deliver some early returns, and some operators will continue to focus mainly on simple connectivity propositions. Even large players such as Vodafone are pulling back from being content providers and focusing on enhanced connectivity. Others, especially in competitive markets, will quickly add bundled content/VAS, and/or new use cases to ensure that they meet ROI and KPI targets.

The first mobile 5G services that are being launched are emphasising the following.

- Video streaming capabilities. This is an established but growing use case. 5G is often marketed as offering a superior video experience and rapid download times (‘movies in seconds’). Customers do not want to wait. Some operators are also enhancing the video experience with multiple simultaneous streams (common for eSports viewing) and multiple viewpoint options.

- Improved social experiences. 5G can provide faster video uploads to social apps, virtual chatrooms (such as SK Telecom’s Social VR) and video calling (such as KT’s ‘narle’).

- Mobile gaming. Several operators see 5G as opening up the gaming experience on mobile handsets to move beyond simple single-player games (such as Angry Birds) to more demanding and/or multi-player games.

Figure 6: Examples of unique or new content/VAS launched in 2019 with 5G, selected operators, worldwide

| Operator | Type of content or VAS |

|---|---|

| China Mobile (China) | Migu video (video streaming with 4K content); Migu VR (concerts and sports); AR concerts; 24-bit music streaming; HD cloud games (cloud gaming) and VR gaming. |

| EE (UK) | BT Sport HDR |

| LG U+ (South Korea) | U+ VR (movies, travel and games); U+ AR (Dancing with the Stars and AR yoga) and Nvidia GeForce Now (cloud gaming). |

| SK Telecom (South Korea) | VR content (movies and shows); VR games; Project xCloud (cloud gaming) and social room VR (social app). |

| Vodafone (UK) | Hatch (cloud gaming) |

Source: Analysys Mason, 2021

Figure 7: Selected longer-term consumer 5G use cases and their technical requirements

| Use case | Bandwidth | Latency |

|---|---|---|

| Streaming video | 4K: >15Mbit/s; 6DoF: >200Mbit/s; Hologram: >1Gbit/s | 50–100ms |

| Social broadcasts | 4k: >15Mbit/s; 360º: 20–50Mbit/s; more for extra FoV and overlay | 50–100ms |

| Mobile cloud AR/MR | Full cloud: >100Mbit/s | <5s |

| Cloud gaming | Heavily device-dependent: 10Mbit/s to >100Mbit/s | <10ms |

Source: Analysys Mason, 2021

Fixed-wireless access is an example of a new 5G consumer service that can be monetised at an early stage by operators in certain scenarios

Fixed-wireless access (FWA) provides an opportunity for some operators to establish a brand new revenue stream in the first phase of 5G roll-out. The size of the opportunity depends on the level of competition in the existing fixed broadband market, as well as local cost structures for various technology options.

Some FWA services have been based on 4G, but the performance has been too low to be attractive to the mass market, except in areas with absent, or very expensive, wireline connectivity. With 5G, a wider variety of service models can be enabled, either to complement or challenge FTTP services. 5G also offers mobile-only operators a way to address the home broadband market without having to pay wholesale fees to fixed players.

Our case studies clearly indicate that 5G FWA providers need to avoid competing head-to-head with FTTP, and instead focus on VDSL services, which fall into a lower price bracket. The attraction to consumers can be improved with VAS. Meanwhile, wireline telecoms operators can use 5G to extend coverage into areas where FTTP roll-out would be uneconomical.

There is a risk that competition from FWA drives down average home broadband prices and therefore reduces the total revenue available to telecoms operators, but FWA does provide the opportunity for a larger number of operators to compete in this market, and for pure-play MNOs to diversify their revenue streams.

Figure 8: Different types of 5G FWA operator and their strategies

Source: Analysys Mason, 2021

Operators can leverage new enablers such as edge compute to expand their 5G consumer services, but they will also require new ecosystem partnerships

A partnership model between network operators and content providers/platforms is likely to be required in the long term for the development of more-demanding applications. Many of these applications can be enhanced by a combination of 5G and edge computing to enable very low latency responses. However, this introduces more complexity to the value chain.

Cloud gaming is a good example of how operators, content providers and edge cloud providers can work together to extend the 5G business case by supporting high bandwidth, low latency and mobile capabilities to enable new experiences. For instance, the concomitance of 5G and cloud-gaming maturity provides an opportunity for operators and gaming companies to unite their marketing efforts.

Operators should proactively choose which role in the cloud-gaming value chain is the best fit for them before the ecosystem reaches full maturity. The potential reward is a larger share of the revenue growth once cloud gaming is able to compete with traditional gaming channels.

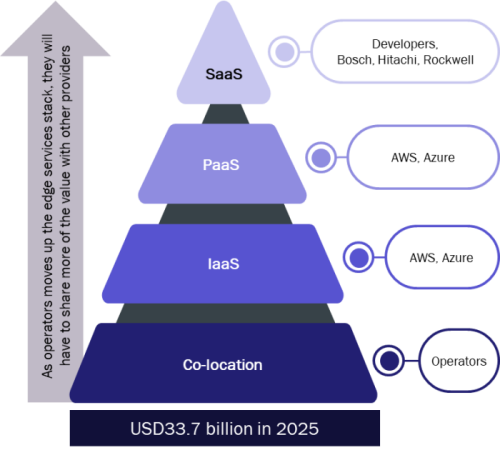

Operators should also identify their role in the edge cloud, taking a realistic view of their assets and capabilities. Some are well-positioned to act as edge location providers, but that role alone risks being commoditised and many will want to move up the stack into services. However, the value of those new services remains unclear, as does how this value will be distributed.

Figure 9: Selected operator 5G cloud-gaming partnerships

| Operator (country) | Partner | Games | Price per month |

|---|---|---|---|

| Sprint (USA) and Vodafone (Germany, Italy, Spain and UK) | Hatch | >100 | USD6.99–10; first 3 months free |

| Sunrise (Switzerland) | Gamestream | >50 | USD10; first month free |

| LG U+ (South Korea) | NVIDIA GeForce Now | >200 games available, but not included | Free for basic version; USD5 for Premium (promo price) |

| SK Telecom (South Korea), T-Mobile (USA) and Vodafone (UK) | Microsoft xCloud | 85 | Free trial version |

Source: Analysys Mason, 2021

Figure 10: Components of the edge cloud value chain for gaming streaming services

Source: Analysys Mason, 2021

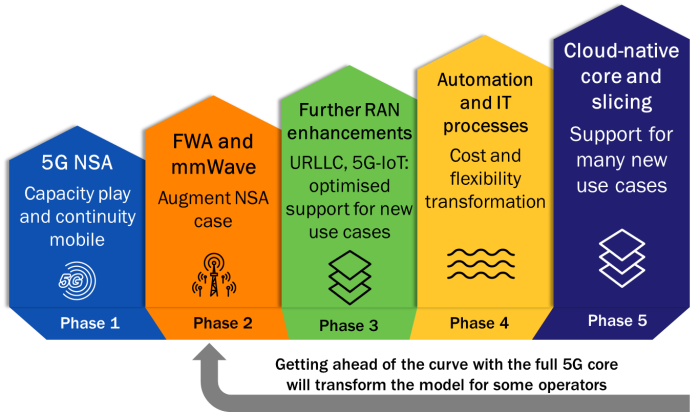

An operator’s options will depend how far and fast it adopts the cornerstones of the ‘full 5G’ platform: cloud-native core, vRAN, automation and a service platform

Figure 11: Typical stages in the deployment of successive waves of 5G and related technology

Source: Analysys Mason, 2021

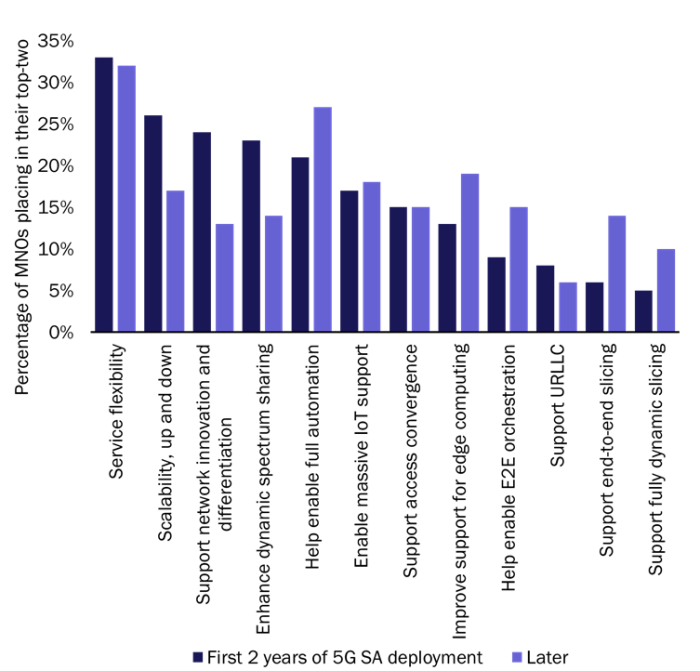

The cloud-native 5G core and, eventually, the vRAN will define full 5G, but these are challenging migrations; most will move step-by-step to achieve incremental ROI

MNOs can make some immediate revenue gains and develop their expertise and confidence by deploying 5G core functions in limited scenarios from the start. However, the solutions that are currently available are too immature for most operators to use in their primary businesses.

A ‘big bang’ deployment of a cloud-native 5G core to handle the primary customer bases and applications would be foolhardy for most operators until solutions are proven for large-scale roll-outs. However, devising a step-by-step deployment plan with tangible gains at each stage is a good way to build knowledge, test solutions and vendors in real-world environments, and start to generate some incremental revenue.

For instance, some operators will initially deploy cloud-native technology for secondary cores, which are often implemented to support a new, discrete revenue stream such as an IoT service. 32% of operators questioned in our survey said that they would start deploying cloud-native 5G core by the end of 2023, but this figure rose to over 50% when referring to secondary cores.1

The key drivers for the first 2 years of a 5G standalone deployment relate to flexibility and scalability because the precise business models are not fully understood. Later, the focus shifts to end-to-end orchestration and slicing to support a wide range of revenue streams. At this point, some operators will embark on the even more challenging migration to a macro vRAN, having often deployed first in secondary, localised networks.

Figure 12: Top commercial drivers for deploying deploy cloud-native 5G core, in the first 2 years of 5G standalone, and later1

Source: Analysys Mason, 2021

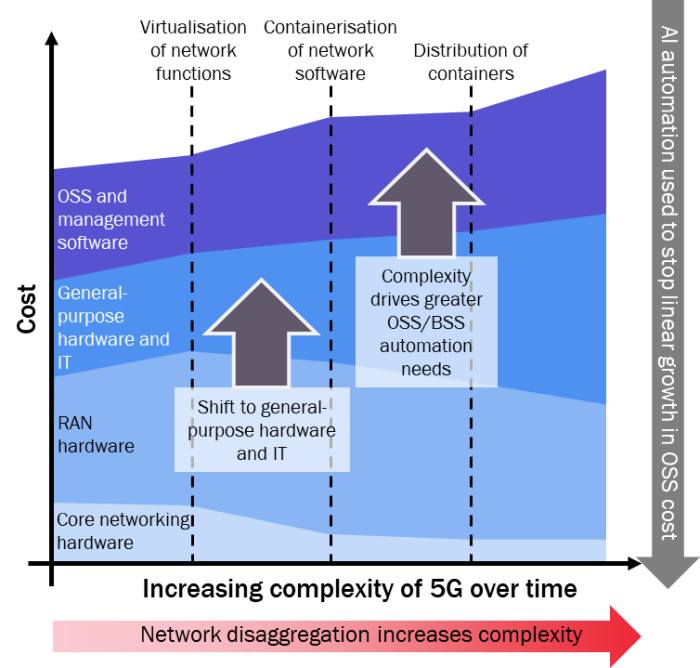

Growing levels of automation will be essential to support the 5G business case and to maximise the benefits of the migration to cloud-native networks

There is a clear consensus that 5G will require greater levels of automation than previous network generations due to its increased scale, the complexity of managing a disaggregated network running on shared and distributed general purpose IT solutions and a need to support more-dynamic services at potentially very low costs.

The disaggregation of the 5G core and RAN will use virtualisation and containerisation, thereby enabling the dynamic scaling of resources, the addition of new functionality and the optimisation of compute locations. AI-based rules will be needed to achieve the complex tasks of allocating resources and decisioning to understand what is required.

It will be important to the operator’s ROI case and confidence that the rewards of the investment in AI-enabled automation are clearly outlined at the start. Some of these relate to the significant potential impact on opex. Between 2018 and 2026, we estimate that operators will save a total of USD130 billion in opex, compared to a scenario with no increase in automation.

The significant resources and costs associated with 5G and the related deployment of AI-based tools need to be viewed as part of a greater transformation for operators. Operators that are developing AI-based automations to support 5G services must also ensure that these automations can be applied to previous generations of wireless and wireline networks and in other business areas.

Figure 13: The relationship between cost and complexity in 5G roll-outs

Source: Analysys Mason, 2021

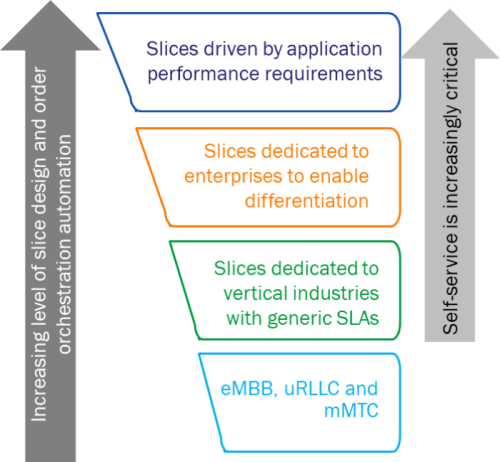

The culmination of the migration to cloud-native, automated networks is a dynamic, sliceable platform that allows operators to support vast numbers of services

An automated, cloud-native network that supports an agile service platform provides operators with the maximum flexibility to support a huge number of applications and services for different industries, without the cost and risk of developing specific expertise and ecosystems for each one. The culmination of this vision of 5G is dynamic network slicing.

Generic, capacity-based network slices for eMBB, uRLLC and mMTC can be created with minimal automation, but operators will want to offer on-demand, differentiated network slices for enterprise- and application-specific SLAs.

Network slicing technology offers operators the ability to provide differentiated service-based slices to enterprises through granular partitioning and resource allocation. Applications that automatically request slices based on the expected availability and performance requirements will take network slicing technology to a new level.

With a cloud-native 5G core and dynamic slicing, operators will be able to target a larger share of 5G enterprise and consumer value chains, compared with focusing on connectivity alone, or building a set of services and partnerships that is specific to a particular industry. The platform approach enables operators to play in every link of the value chain and, on average, to target as much as 50% of the total 5G revenue available to that chain.

Figure 14: The level of design and order orchestration automation varies by slice

Source: Analysys Mason, 2021

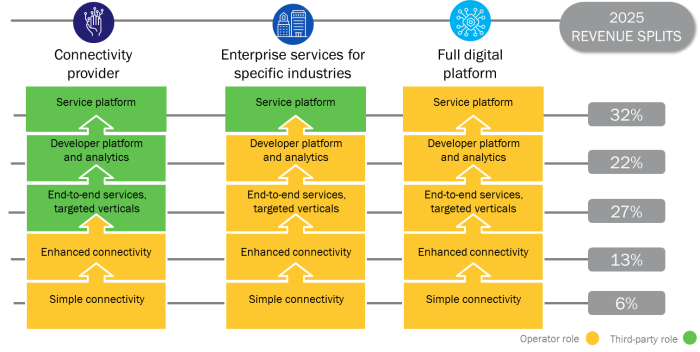

Cloud-native, automated platforms can support a diversity of use cases, and enable operators to capture up to 50% of the available revenue in many value chains

Figure 15: Areas of the 5G value chain that operators can address with a full platform, compared to connectivity or single-industry strategies

Source: Analysys Mason, 2021

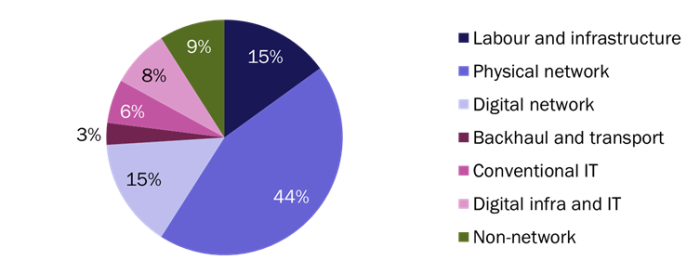

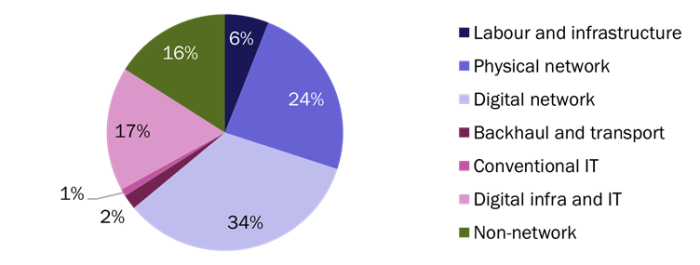

New, digital operators will set the pace for a cloud-based, asset-light approach to deploying 5G; established operators will need to emulate that agility

Unlike the early days of 4G, the dawn of 5G is seeing many types of operators deploying the new networks. New entrants from the cloud or content worlds (such as Rakuten Mobile), as well as private or industrial operators, will introduce new assumptions about the architecture and cost of a 5G network. Rakuten’s commitment to a cloud-native, low-capex network has, for all its challenges, put pressure on more-conventional operators to chase similar targets in terms of service agility and low total cost of ownership.

The emerging digital 5G operators are choosing a cost-efficient model that relies heavily on outsourcing in order to minimise investment in physical assets (by deploying networks in third-party cloud, for instance). These players are targeting a low cost base and high level of service differentiation with open and cloud-based architecture. They are not wedded to asset ownership, and typically only 30% of their capex spending, and 21% of their opex, goes on their physical networks, compared to 59% and 36% in the case of conventional operators. The lower cost base and cloud-native platforms that the digital players achieve will give them high levels of agility, which the incumbents may struggle to emulate.

We expect that OTT players such as AWS will invest more in network build-outs from 2021. They will harness their own cloud platforms and shared spectrum. Some operators (such as Orange) will also establish separate digital divisions to make investments in expanding services such as financial applications.

Figure 16: Breakdown of capex for a conventional MNO, 2021

Source: Analysys Mason, 2021

Figure 17: Breakdown of capex for a digital MNO, 2021

Source: Analysys Mason, 2021

To achieve a broad, cross-industry position, operators will take a phased approach commercially as well as technically

We previously outlined the importance of a migration to automated cloud-native networks and a service platform approach to give the operator maximum flexibility to expand its business into many new sectors and applications. For most operators, that migration will be best planned on a step-by-step basis to avoid unacceptable cost and risk. The same is true of planning the 5G services roadmap, especially for enterprise and IoT use cases, where many operators have limited experience.

It takes more than a 5G upgrade to turn an operator into an enterprise provider. Successful operators will plan each step of their technical migration in parallel with their service expansion, ensuring that each new 5G capability can enable new services with immediate revenue upside, and that each new application is optimised by the right technology enhancements. Just as importantly, they must ensure that they are aligned with ecosystems that surround the services and industries they decide to prioritise.

One option is to harness new 5G capabilities, such as improved AR/VR, and extend them from consumer into enterprise use cases (such as AR/VR for quality control on a factory floor), or they can expand into B2B opportunities within the ecosystems that surround their consumer services (such as enabling services for broadcasters). However, the key unique selling point of 5G for enterprises (especially for industrial networks) is often high speed mobility, coupled with high reliability, to enable use cases such as unmanned aerial vehicles (UAVs), robots.

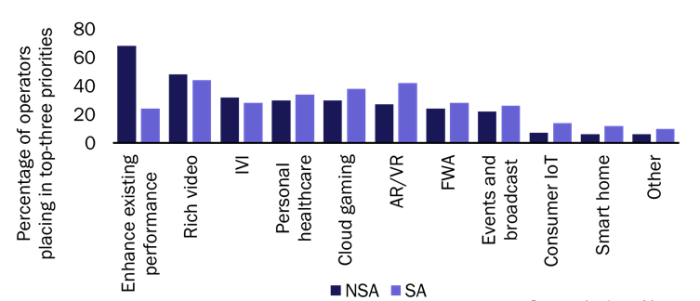

Figure 18: Top three commercial 5G use case priorities for phase one, and impact of 5G core on those priorities2

Source: Analysys Mason, 2021

Figure 19: Percentage of operators intending to deploy 10-most cited 5G use cases, and required technology

Source: Analysys Mason, 2021

Technology and platforms are not just about performance; they must support agility so that operators can adjust easily to multiple enterprise ecosystems

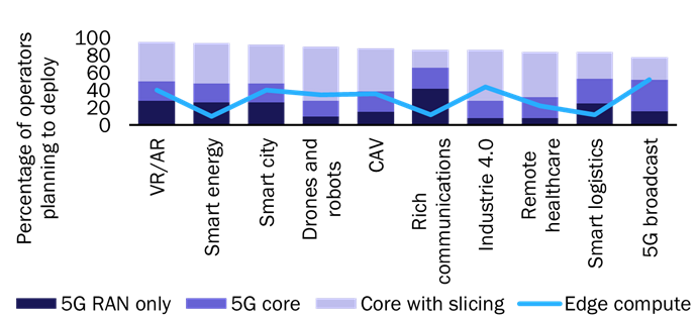

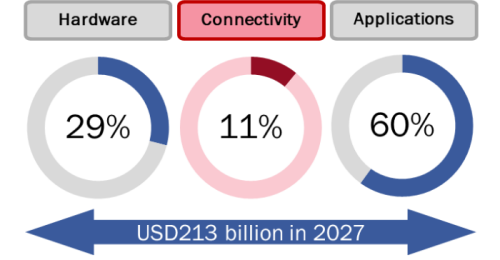

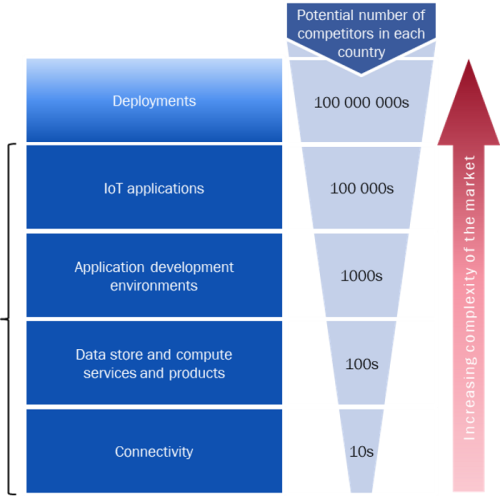

Industrial IoT and edge computing are both seen as strong opportunities for operators to launch new 5G-enabled enterprise applications. However, in both cases, operators only access a limited part of the value chain, and even in connectivity, there is rising competition from MVNOs, private network operators and others. In the IoT sector, revenue is increasing, but represents a small revenue stream for operators. To access a larger share of the value, operators need to move beyond connectivity, but the large number of vendors makes it a highly competitive market and the new transactional sales models make it complex. Similar challenges apply in enterprise edge markets.

Figure 20: Percentage of IoT revenue derived from connectivity, 2027

Source: Analysys Mason, 2021

Figure 21: Number of competitors or partners in each layer of the IoT stack

Source: Analysys Mason, 2021

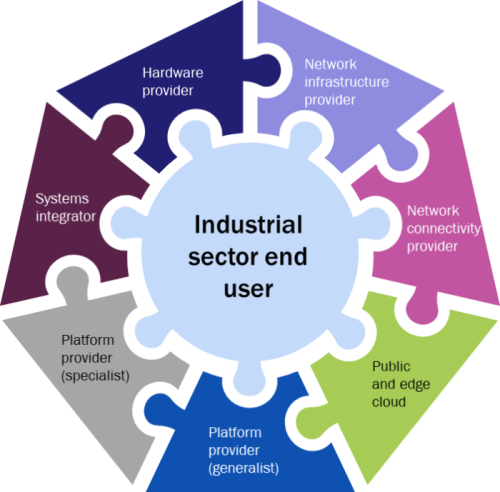

Participation in, and collaboration with, a strong ecosystem of partners will be critical to building successful industrial IoT solutions

Operators are building early IIoT propositions based on private wireless networks to support their 5G business cases. Ecosystem collaboration should be central to IIoT strategies, and is a good example of the importance of partnerships and ecosystem development in most enterprise 5G markets.

Operators with ambitions to use private LTE, 5G networks and IoT solutions to target the industrial sector will need to understand the IIoT value chain. They will need a clear understanding of where they currently fit and where they wish to be in the future. To achieve their vision for IIoT, operators will need to forge relevant partnerships across the ecosystem to:

- create awareness and demand for cellular-based networking solutions for IIoT

- ensure that device and hardware manufacturers embed or enable support for cellular technologies in their propositions

- develop solutions to deliver the required outcome and ensure integration of existing and new systems.

Industrial IoT propositions are complex and most suppliers will struggle to deliver components outside of their core competencies. Operators will need to select influential partners and compare their readiness for IIoT and 5G, as well as their existing industrial customer base and ecosystem presence.

Figure 22: Roles in the industrial IoT value chain

Source: Analysys Mason, 2021

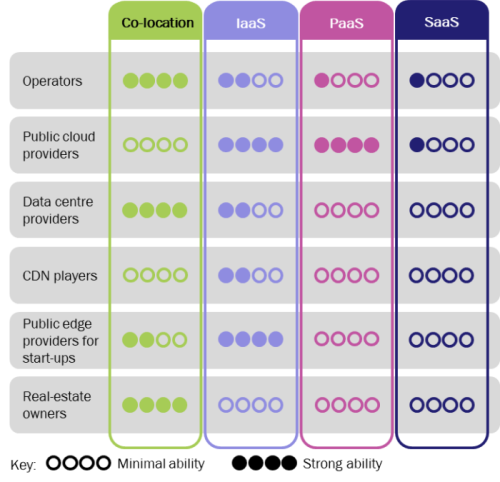

Edge computing will be an important way to enhance an operator’s B2B and B2B2C role, and the right choice of partners will be critical in this market too

Figure 23: Services in the public edge cloud value chain and example providers

Source: Analysys Mason, 2021

Figure 24: Key players’ ability to provide services in the public edge cloud value chain, Analysys Mason assessment 2020

Source: Analysys Mason, 2021

1 These results are based on Analysys Mason’s survey of 78 MNOs, conducted in November 2019. Respondents were asked to name all the factors driving them to deploy the 5G core. They were then asked to select their top 2 from a list of the 12 most-cited. For more information, see Analysys Mason’s MNO and vendor strategies for deploying the cloud-native 5G core.

2 5G use case priorities and technology enablers, based on April 2020 survey of 76 tier one operators conducted by Analysys Mason.

Authors