Telecoms software and services: worldwide market shares 2019

17 September 2020 | Research

Justin van der Lande | Michela Venturelli | Gorkem Yigit

Market share report | PPTX and PDF (111 slides); Excel | Telecoms Software Market Shares

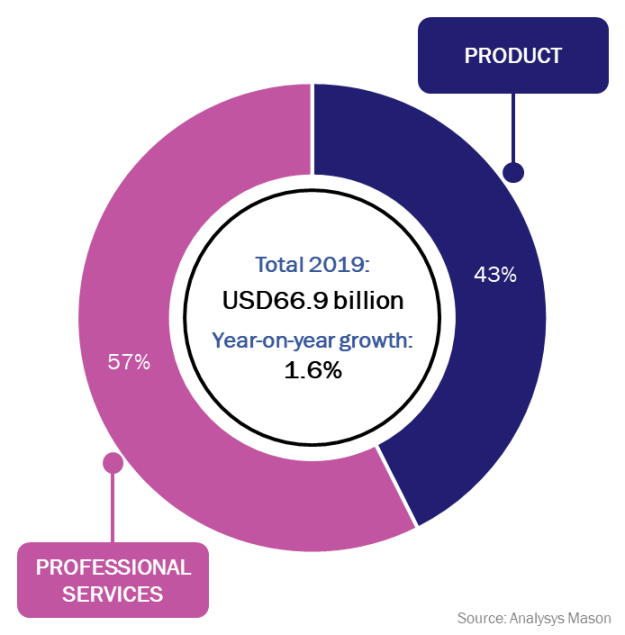

This report provides market share data for communications service provider (CSP) spending on telecoms-specific software systems and related services for 2019 across seven different segments. It provides details of how spending varied by delivery model, service type, vendor and region. It analyses which vendors led the USD66.9 billion telecoms software and related services market in 2019 overall, and in each of the seven segments and their sub-segments. It assesses how the market leaders rose to the top, and which vendors in the market are doing best at capturing revenue growth opportunities to improve their share.

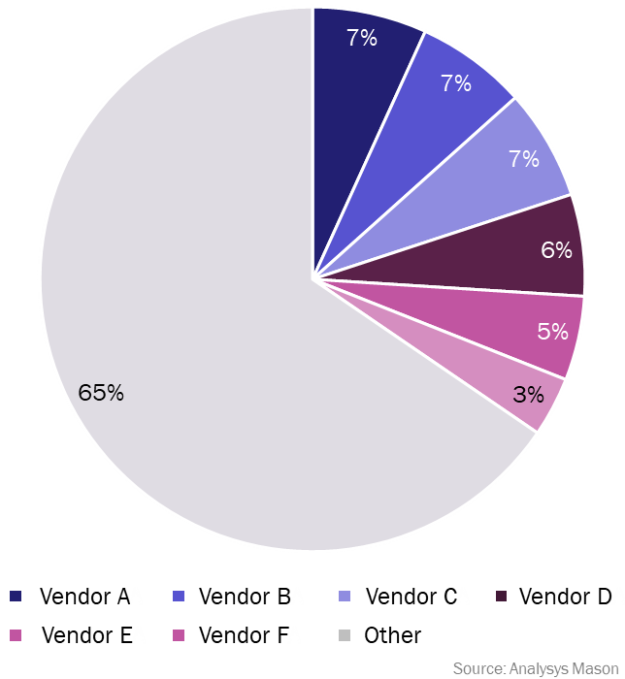

Telecoms software and services total revenue by vendor, worldwide, 2019

Key developments in the telecoms software and services market in 2019

- Telecoms software revenue in 2019 grew 1% from 2018; there were only small changes in the relative size of the segments between 2018 and 2019.

- The roll-out of 5G NR has had a small but noticeable, positive effect on spending in most telecoms software segments, but 5G standalone will have a greater impact.

- CSPs’ shift to cloud technologies was another significant driver of change in 2019.

- Digital transformation continues to be an important driver of CSP software spend.

- Professional services account for more than half of CSPs’ overall spend.

Key questions answered in the telecoms software and services market share report

| What was the overall size of the the telecoms-specific software and services market and what drove this spending among CSPs? |

| How did the spending vary across seven different market segments and their sub-segments? |

| Who are the major vendors, what is their share of revenue in the market, and which vendors are growing or shrinking and why? |

| What are the different drivers and growth rates of CSP spending on products and professional services? |

Telecoms software and services total revenue by type, worldwide, 2019

Who should read this report

- Vendor and systems integrator strategy teams that need to understand where growth is slowing and where it is increasing across different market segments and sub-segments.

- Product management teams that are responsible for feature functionality, geographical focus or professional service offerings, and product marketing teams that are responsible for market-share growth.

- Market intelligence teams at vendors that want to understand how their competitors compare to each other.

- CSPs that are planning transformation projects and want to ensure that their current vendors are staying up to date.

This report provides:

- detailed market share data for the telecoms software and services market overall, as well as seven segments:

- AI and analytics

- Customer engagement

- Monetisation platforms

- Automated assurance

- Service design and orchestration

- Network automation and orchestration

- Video and identity platforms

- a summary of key developments in the market overall and in each segment

- an Excel data spreadsheet of revenue and share for the top-six vendors in each segment, split by type and by region